Are you looking for $500 Down On A Car No Credit Check? Yes, you can get a car on $500 Down no credit check.

In this article, we have shared all the information about how you can Get $500 Down On A Car No Credit Check.

I recently graduated from college with no credit history. I needed a car to get to my new job, but I didn’t have any money saved up. I started to research my options and found out that a few dealerships offered $500 Down on a Car with no Credit Check.

This blog has all the information about $500 Down On A Car No Credit Check that I experienced during my research.

When getting a new set of wheels or even a used one, you’ll need both good credit and good money. Having bad credit and no money makes it hard to get car financing; it is a fixed note in our brains. When you have bad credit and no money, you assume you aren’t able to buy a car. That’s true, isn’t it? Buying a car for only $500 is possible if you do a little research and know what you are doing.

You can get a car loan even if you have bad credit and little money in your bank account. If you plan to buy a car and are struggling with bad credit, this article is for you.

$500 Down on a Car no Credit Check

Contents

- 1 $500 Down on a Car no Credit Check

- 1.1 Understanding No Credit Check Car Financing

- 1.2 How Can I Apply For $500 Down On A Car No Credit Check?

- 1.3 Other Financing Options for Buying a Car

- 1.4 The Pros and Cons of $500 Down on a Car No Credit Check

- 1.5 Identifying Red Flags and Scams of $500 Down On A Car No Credit Check

- 1.6 FAQs

- 1.7 Conclusion

A car has become an essential feature of modern life, allowing many people to commute, run errands, and enjoy greater convenience. It can be challenging to acquire a car when you have limited funds or a poor credit score, especially if you don’t have perfect credit.

A $500 down payment on a car without a credit check might seem appealing to those with credit challenges because it provides an accessible solution. This article explores the benefits, risks, and viability of no-credit-check car financing.

It is also possible to get Credit Cards with $500 Limit Guaranteed Approval if you do not have sufficient funds or have bad credit. It can help you improve your credit score and increase your chances of getting a car loan. Many credit cards offer No Credit Check Credit Cards Instant Approval No Deposit, even to people with poor credit histories.

Understanding No Credit Check Car Financing

The term no credit check car financing refers to a loan that does not require a credit check before approval. A no-credit-check dealership does not rely heavily on credit scores to determine the borrower’s creditworthiness but rather on factors such as income, employment stability, and down payment.

According to their website, this allows people with poor or no credit history to purchase a car with a minimum down payment, often as low as $500.

How Can I Apply For $500 Down On A Car No Credit Check?

Here are the steps to apply for $500 Down On A Car No Credit Check –

- Receiving car financing through a lender with no credit check is still possible, even if no credit check is not an option.

- The finance structures used by lenders specializing in bad credit car loans are often called finance structures. Designed for those with bad or no credit scores, they allow everyone to drive the car they choose.

- It is important to determine how much you can afford before applying for bad credit car financing. By being realistic and reasonable, you will give yourself the best chance of keeping up payments and building your credit score.

- You’re ready to start your application once you’ve determined a comfortable and manageable amount within your budget using our finance calculator. Through the bad credit car finance approval system, you will receive a quick decision once you begin your application. It will let you know if you’ve been successful.

- If your application is successful, you will have good funding requirements. The loan repayments can be approved after you’ve found the perfect car.

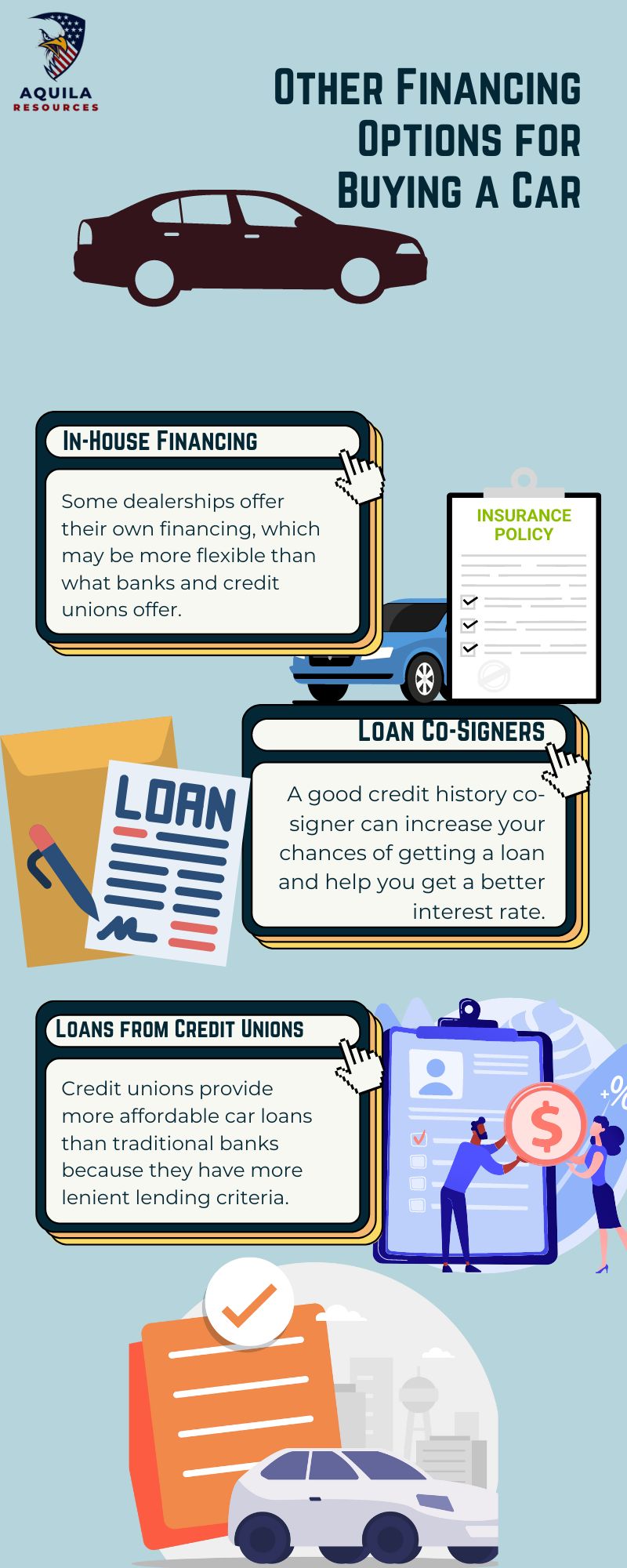

Other Financing Options for Buying a Car

Owning a car without a credit check is possible, but there are other options. Several alternative financing options are available for people with poor credit scores looking to obtain a car loan at a more reasonable rate.

The Pros and Cons of $500 Down on a Car No Credit Check

Here are the pros and cons of $500 Down On A Car No Credit Check –

| Pros | Cons |

| Easy Access: A major advantage of no-credit check car deals is that they make it easier for individuals with low credit scores to own a car. | Higher Interest Rates: Dealerships with no credit checks often compensate for their higher risk by charging much higher interest rates, resulting in a longer-term loan that is more expensive. |

| Fast Approval: Dealerships that don’t conduct credit checks typically approve purchases faster, so buyers can drive away with their new car faster. | Limited Car Selection: Dealerships with limited vehicle selection may limit buyers’ options, resulting in them buying an older or less desirable vehicle. |

| Opportunity for Credit Building: Borrowers can use these opportunities to gradually rebuild their credit scores by responsibly making loan payments. |

Potential Predatory Practices: Unscrupulous dealers may conceal unfavorable loan terms, resulting in financial hardships and even repossessions in the worst cases. |

Identifying Red Flags and Scams of $500 Down On A Car No Credit Check

Several scams and fraudulent practices are associated with no credit check car financing. It is important for buyers to remain vigilant and watch out for red flags such as:

Here are some of the red flags and scams of $500 Down On A Car No Credit Check –

| Red flag | Description |

| Low down payment |

A low down payment can be a sign of a predatory loan. Be wary of dealerships that offer extremely low down payments, as they may be hiding hidden fees or other charges.

|

| Dealership pressure |

You should feel free to make decisions at your own pace without feeling pressured by the dealership. If a salesperson is pressuring you to make a decision quickly, it’s a good sign that you should walk away.

|

| Insufficient transparency |

A legitimate dealership will be transparent about the loan’s terms, interest rates, and any additional charges. If you’re not sure about anything, ask the salesperson to explain it to you in detail.

|

FAQs

Is Getting a Car with a 500 Credit Score Possible without Putting Money Down?

There were 21 % of auto loans to people with poor or unsecured low to moderate credit scores (Read: Unsecured Credit Cards for 500 Credit Score). If you have good credit, it should be possible to get a good car with this rating.

What is the Point of Buying a Car with a $500 Down Payment?

The larger the down payment, the lower the monthly loan payment will be. Still, the $500 down on a Car lot can help if you’re in a hurry and need your next vehicle for less.

Is $500 a Good Down Payment for a Car?

A good credit score should make the down payment on a car around $500. If you have credit problems, you can end up with more debt. It is difficult for the lender to estimate the down payment you need.

Conclusion

Putting only $500 down on a car without a credit check may seem like a dream for those with poor credit, but such deals should be cautiously approached. Although obtaining no-credit-check auto financing can be beneficial for some, it has its share of risks and potential pitfalls. Buyers who are informed and cautious and find a deal that fits their needs and budget can navigate the car financing landscape more confidently.

Add Comment