Are you looking for Guaranteed Credit Card Approval With No Deposit? if yes then you are at the right place.

In this article, we provide a list of the 5 best Guaranteed Credit Card Approval With No Deposit and explain how to get one.

During my college days, I had no credit history. I wanted to get a credit card to build my credit, but I was worried that I wouldn’t be approved because I had no credit. I did some research for Guaranteed Credit Card Approval With No Deposit and found that a few cards offer Guaranteed Credit Card Approval With No Deposit.

Following these tips will increase your chances of getting Guaranteed Credit Card Approval With No Deposit.

Guaranteed Credit Card Approval With No Deposit

Contents

- 1 Guaranteed Credit Card Approval With No Deposit

- 1.1 What Is a Credit Card Security Deposit?

- 1.2 What is No Deposit Credit Card?

- 1.3 Best Guaranteed Credit Card Approval With No Deposit

- 1.4 How to Apply for Guaranteed Credit Card Approval With No Deposit

- 1.5 Benefits and Drawbacks of Guaranteed Credit Card Approval With No Deposit

- 1.6 Tips for Responsible Guaranteed Credit Card Approval With No Deposit Use

- 1.7 What Credit Score Do I Need to Credit Card Approval With No Deposit?

- 1.8 Video Guide for Guaranteed Credit Card Approval With No Deposit

- 1.9 FAQs

Getting approved for a credit card can be challenging if you have a low credit score. In this case, the best option is a credit card with guaranteed approval. They provide the convenience and benefits of a credit card while helping individuals establish or rebuild their credit scores.

When you have a good or excellent credit score and an established credit history, getting a credit card without a deposit may be easy. However, applying for a credit card without a deposit can be more challenging if you are beginning your credit history or trying to rebuild your credit score.

In this case, consider applying for a No Credit Check Credit Cards Instant Approval No Deposit. These credit cards are designed for people with low or no credit history and typically offer lower interest rates and fees than other types of credit cards.

If you are looking for Guaranteed Credit Card Approval With No Deposit, these are the best options

| Credit Cards | Details |

|---|---|

| Surge Platinum Mastercard | Know More |

| Reflex Platinum Mastercard | Know More |

| Fortiva Mastercard Credit Card | Know More |

| Milestone Mastercard | Know More |

| Revvi Card | Know More |

What Is a Credit Card Security Deposit?

Credit cards can be opened with no money down for borrowers with established credit histories and decent credit scores. Credit cards such as this are unsecured. It’s possible, however, that you’ll only be offered a secured credit card if you have no credit history or a low credit score. There is usually a refundable security deposit associated with each credit card. An average deposit amount is $50 to $300.

Although you can’t use a debit card to cover unexpected expenses since you can only spend money you already have, this is a good method for building credit. It is better to know that your credit card issue report to the credit bureaus or not. On-time payments are one of the cardinal rules of credit cards, and eventually, you can graduate with an unsecured card.

What is No Deposit Credit Card?

These unsecured cards do not require a security deposit, so they offer greater flexibility from the beginning. Opening a credit card is important and should not be taken lightly. A credit card can have many negative effects, and it’s important to understand how much it costs. You might end up drowning in debt if you max out a high-interest credit card.

You should consider alternative ways of establishing credit, such as credit-builder or even small personal loans, before applying for a no-deposit credit card or any other credit card. Credit cards offer some perks and protections, such as chargeback protection, that aren’t available with these options. Start your research online if a credit card is your next step.

Best Guaranteed Credit Card Approval With No Deposit

These credit cards have many benefits, including low credit requirements and the ability to help build your credit score. Now, let’s get started.

Here are some of the best Guaranteed Credit Card Approval With No Deposit –

Surge Platinum Mastercard

You can get a Surge Platinum Mastercard with no deposit and a bad credit score. There is an APR of 29.99% on this card. Celtic Bank provides this card.

Initially, the card’s credit limit is 300 to 1,000 dollars, but it can be raised to 2,000 dollars by making your first six minimum monthly payments on time. This card will help you to improve your credit score by using since it sends monthly report to three major credit bureaus.

Reflex Platinum Mastercard

Reflex Platinum Mastercard is an unsecured credit card that offers a credit limit of $300 to $1,000. You can increase this limit to 2,000 dollars by making your first six minimum monthly payments on time. It can help you improve your credit score since it reports to three major credit bureaus monthly.

The card has an APR of 29.99% and a zero-dollar fraud liability. No deposit is required for approval.

Fortiva Mastercard Credit Card

A 3% cash back reward makes this credit card one of the best instant guaranteed approval credit cards with no deposits, given that it offers a 3% cash back reward. This card allows you to make contactless payments using your mobile wallet. An annual credit increase review is conducted with this credit card.

This card may charge an APR of 29.99% or 36%. For this card, you only need a fair credit score. There is an annual fee of 85 dollars for this card. It is an instant approval credit card with instant use.

Milestone Mastercard

You can get a credit limit of 700 dollars with this credit card. You can improve your credit score by using this card since your account history is reported to three major credit bureaus in the US.

The card has a zero-dollar liability if it is used unauthorized. The Bank of Missouri offers this unsecured credit card, which is rated as good. There is also no monthly maintenance fee associated with this credit card.

Revvi Card

You can apply for this card quickly and easily. There is a credit limit of 300 dollars on the card. You receive 1% cash back when you make a payment towards this card. You can build your credit score by using this card. It costs 75 dollars for the first year and 48 dollars from then on. There is a 34.99% APR on this card. This credit card is guaranteed to be approved with no deposit required.

Here is the table of Best Guaranteed Credit Card Approval With No Deposit –

| Credit Card | APR | Annual Fee | Credit Limit | Other Features |

| Surge Platinum Mastercard | 29.99% | $0 | $300-$1,000 |

Reports to 3 credit bureaus monthly

|

| Reflex Platinum Mastercard | 29.99% | $0 | $300-$1,000 |

Reports to 3 credit bureaus monthly

|

| Fortiva Mastercard Credit Card | 29.99% or 36% | $85 | $300-$1,000 |

3% cash back rewards, contactless payments, annual credit increase review

|

| Milestone Mastercard | 26.99% | $0 | $700 |

Reports to 3 credit bureaus monthly, zero-dollar liability

|

| Revvi Card | 34.99% | $75 for the first year, $48 from then on | $300 |

1% cash back rewards, guaranteed approval, no deposit required

|

How to Apply for Guaranteed Credit Card Approval With No Deposit

Getting Guaranteed Credit Card Approval With No Deposit is a straightforward process, but it’s important to follow the right steps to increase your chances of approval.

Here’s the guide on how to apply for Guaranteed Credit Card Approval With No Deposit:

- Research and Compare: Start by researching different no deposit credit cards available in the market. Compare their fees, interest rates, and benefits to find the best suits your needs.

- Check your Eligibility: Review the eligibility criteria for each card. While these cards are designed for people with less-than-perfect credit, specific requirements such as minimum income or age may still exist.

- Gather Necessary Information: Collect the documents and information you’ll need for the application, including your personal identification, employment and income details, and any other required documentation.

- Apply Online: Most credit card applications can be completed online through the issuer’s website. Complete and correct the application form.

- Wait for Approval: After submitting your application, the card issuer will review your information. With guaranteed approval cards, you should receive a quick decision, often within minutes.

- Activate Your Card: Once approved, you’ll receive your new card in the mail. Follow the instructions provided to activate it.

- Use Responsibly: After activation, start using your card responsibly. Make regular payments on time and try to keep your credit usage low to improve your credit.

Benefits and Drawbacks of Guaranteed Credit Card Approval With No Deposit

Benefits:

Here are the Benefits of Guaranteed Credit Card Approval With No Deposit

| Benefits | Description |

| No Upfront Deposit | The most significant advantage is that you don’t need to provide a security deposit to open an account. |

| Credit Building Opportunity | These cards offer a chance to rebuild or establish credit when traditional credit cards may be out of reach. |

| Guaranteed Approval | As the name suggests, you’re guaranteed approval, making these cards accessible to a broader range of applicants. |

| Convenient Payment Method | Guaranteed Credit Card Approval With No Deposit can be used for everyday purchases, online shopping, and emergencies, providing a convenient payment option. |

Drawbacks:

Here are the Drawbacks of Guaranteed Credit Card Approval With No Deposit

| Drawbacks | Description |

| Higher Fees | No deposit credit cards often come with higher annual fees, interest rates, and other fees than traditional cards. |

| Lower Credit Limits | Initial credit limits may be relatively low, which can limit your purchasing power. |

| Limited Rewards | Without a security deposit, managing your spending and payments responsibly is essential to avoid debt. |

| Potential for Debt | Without a security deposit, managing your spending and payments responsibly is essential to avoid falling into debt. |

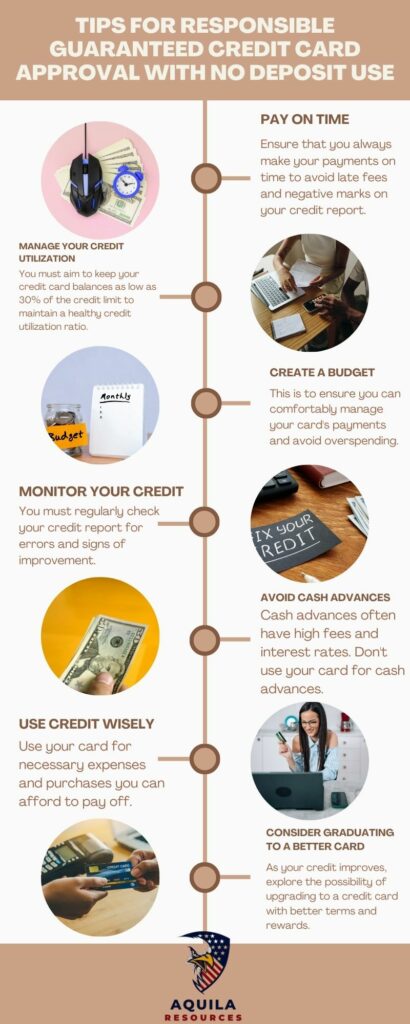

Tips for Responsible Guaranteed Credit Card Approval With No Deposit Use

To make the most of your no deposit credit card and improve your credit score, follow these tips:

- Pay On Time: Always make your payments on time to avoid late fees and negative marks on your credit report.

- Manage Your Credit Utilization: To maintain a healthy credit utilization ratio, you must aim to keep your credit card balances as low as 30% of the credit limit.

- Create a Budget: This is to ensure you can comfortably manage your card’s payments and avoid overspending.

- Monitor Your Credit: You must regularly check your credit report for errors and signs of improvement.

- Avoid Cash Advances: Cash advances often have high fees and interest rates. Don’t use your card for cash advances.

- Use Credit Wisely: Use your card for necessary expenses and purchases you can afford to pay off.

- Consider Graduating to a Better Card: As your credit improves, explore the possibility of upgrading to a credit card with better terms and rewards.

What Credit Score Do I Need to Credit Card Approval With No Deposit?

If you have a FICO credit score of 750 or higher, you will be approved for almost any credit card available. You may also qualify for some cards with a fair credit score of 620 or higher, but your credit limit may be lower, and your interest rates may be higher.

If your credit score is below 580, you should get a secured credit card. You may be required to provide collateral whenever you fail to make payments on these cards.

There are some credit cards companies that offers Credit Cards with $500 Limit Guaranteed Approval even if you have bad credit. You can build your credit history over time by using these credit cards, which have low credit limits.

Customized credit cards are designed to meet specific spending needs. Those who enjoy online shopping can benefit from exclusive discounts offered by the best credit cards for online shopping.

You can save money with the best cash back credit cards if you prefer cash back. Families benefit from the best credit cards for groceries and gas since they offer rewards at the lowest cost. A specialized credit card streamlines choices and helps you spend more smartly with every purchase.

Video Guide for Guaranteed Credit Card Approval With No Deposit

FAQs

What Are Instant Approval Credit Cards?

Credit cards that have instant approval are those that evaluate applications immediately. These applications usually require applicants to answer basic questions about their identity and income status. A decision is made immediately on an application once it has been submitted.

Do All Credit Cards Require a Deposit?

Secured credit cards are the only credit cards that require a security deposit. Those with no credit history or low credit scores may only be eligible for secured credit cards. Credit cards can be obtained without a deposit if you have a good credit score.

How Long Does It Take to Approve a Credit Card?

A credit card application may be approved instantly, but most companies take a week or two to do so. During this period, the credit card company will examine your borrowing history to determine your creditworthiness.

Is It Possible to Get a Credit Card with No Credit History?

Yes. You can get a credit card without a credit history. Since a security deposit is required, it is easier for borrowers without credit histories to get approved with a secured credit card. Students can apply for credit cards generally issued to borrowers without a credit history.

Add Comment