Are you looking for the Best Credit Cards for Groceries and Gas? If Yes, then you are at the right place.

In this article, we are sharing all the information about Best Credit Cards for Groceries and Gas.

A credit card that rewards you for every dollar you spend at the grocery store is the best for shopping. Credit cards with grocery shopping benefits can be useful for those with large families, who work in the food industry, or who like to cook and bake. The majority of people, however, could benefit from credit cards with bonus rewards at grocery stores since nearly everyone buys groceries.

The benefits and costs of each credit card such as Best Cash Back Credit Cards should be carefully considered when selecting one for groceries. The cost of an annual charge may be more beneficial in the long run if you spend a lot of money on groceries. The best grocery rewards credit cards are discussed here.

If you are looking for Best Credit Cards for Groceries and Gas, these are the best options:

| Best Credit Cards for Groceries and Gas | Detailes |

|---|---|

| Blue Cash Preferred Card from American Express Credit Card | Learn More |

| American Express Gold Card | Learn More |

| Citi Premier Card | Learn More |

| Blue Cash Everyday Card from American Express | Learn More |

| Bank of America Customized Cash Rewards Credit Card | Learn More |

What Is Credit Cards for Groceries and Gas?

Contents

- 1 What Is Credit Cards for Groceries and Gas?

- 2 Top 5 Best Credit Cards for Groceries and Gas

- 3 Video Guide for Best Credit Cards for Groceries and Gas

- 4 Who should apply for a Groceries and Gas Credit Card?

- 5 How to Choose Best Credit Cards for Groceries and Gas?

- 6 How to Make the Most of Your Best Credit Cards for Groceries and Gas?

- 7 What should I Look for in Best Credit Cards for Groceries and Gas?

- 8 FAQs

The biggest benefit of a gas and grocery credit card is that it offers bonus rewards for these two types of purchases. It is important to note that the cards discussed above offer a high return rate on both purchases, not just on one or the other.

Some cards feature rotating quarterly bonus programs, allowing you to earn rewards on purchases from various merchant categories. For example, a bonus reward may be earned when you make grocery purchases during the first quarter and when you fill up at a gas station during the third quarter.

You can earn more money back on gas and grocery purchases with a gas and grocery card than the standard 1%. It is determined by the card which merchant categories will be rotated, so the rotation order or merchant categories may vary from year to year. The issuer usually limits the amount of eligible purchases you can make each quarter to reward you with bonus rewards.

Top 5 Best Credit Cards for Groceries and Gas

When it comes to gas and groceries, credit cards are a great way to earn cash back. This type of credit card could be very beneficial to consumers who spend a lot in those areas. Gas and grocery credit cards usually offer rewards rates of 2% to 3%, although some offer rewards rates as high as 5% and 6%. Credit cards for gas and groceries are available with various features, including no annual fees, big welcome bonuses, and 0% introductory APRs.

Here is the list of Top 5 Best Credit Cards for Groceries and Gas –

Blue Cash Preferred Card from American Express Credit Card

Blue Cash Preferred Card from American Express credit card is suitable for households that spend a lot on groceries, gas, transit, and streaming services. These categories, especially at supermarkets in the United States and on select streaming services, are among its richest rewards. A nice welcome offer awaits new cardholders and a 0% APR introductory period. This cashback card charges an annual fee, unlike most cashback cards.

Pros & Cons of Blue Cash Preferred Card from American Express Credit Card

Pros

- Bonus offer of $250 statement credit

- Balance transfers and purchases are offered at low intro APRs

- The rate of rewards is high

Cons

- The annual fee begins with the second year

- APR above average for regular loans

- The foreign transaction fee is 2.7%

American Express Gold Card

American Express Gold Card rewards consumers with high-end perks while earning a competitive rewards rate. A member can earn four times the Membership Rewards points at U.S. supermarkets and restaurants. All other purchases earn 1X Membership Rewards points.

Travel booked through Amex.com or directly with the airline earns 3X Membership Rewards points. When Americans shop at qualifying supermarkets, they can earn $207 in cash back yearly. There are terms and conditions.

Pros & Cons of American Express Gold Card

Pros

- A high potential for rewards and earnings

- Many partners accept points for transfer

- No additional annual fee for up to 5 authorized users

- There is a regular and rose gold version available

Con

- There are no lounge benefits

- The ability to carry a balance is limited

- The pay over time feature has a high APR

- APR for pay over time penalties is high

Citi Premier Card

You will receive 60,000 points after spending $4,000 in your first three months with the Citi Premier Card. Additionally, Citi Travel credit cardholders can earn 10 points for every $1 they spend on hotels, car rentals, and attractions booked through June 30, 2024, 3 points for every $1 they spend at restaurants, supermarkets, and gas stations, 3 points for every $1 spent on hotels and air travel, and 1 point per $1 spent on all other purchases.

Pros & Cons of Citi Premier Card

Pros

- The initial bonus is 60,000 points

- Every dollar spent on travel, gas, dining, and groceries earns you 3 points (1 point for every dollar spent elsewhere).

- Fee-free foreign transactions

Cons

- The annual fee is $95

- There is no 0% introductory rate

- Regular APR is high

Blue Cash Everyday Card from American Express

The Blue Cash Everyday Card from American Express rewards you for retail purchases at U.S. supermarkets, gas stations, and online retailers. Although the rewards aren’t as good as those on the American Express Blue Cash Preferred Card, this card has no annual fee. Those who sign up for a new card get a decent welcome offer and an introductory rate of 0%.

Pros & Cons of Blue Cash Everyday Card from American Express

Pros

- Up to $6,000 in cash back at U.S. supermarkets (then 1%)

- A 3% cash back program at U.S. gas station up to $6,000 per year, then 1%.

- You can earn more rewards at select merchants with Amex Offers, which provide statement credits.

Cons

- Fees for purchases made abroad are 2.7%

- It’s not ideal for people who don’t regularly shop for groceries

Bank of America Customized Cash Rewards Credit Card

With the Bank of America Customized Cash Rewards Credit Card, you can decide which category earns the highest cashback rate, from gas stations, restaurants, travel, home improvement, and more. Additionally, grocery stores and supermarkets offer a great new cardholder bonus.

Pros & Cons of Bank of America Customized Cash Rewards Credit Card

Pros

- A 25% to 75% increase in cashback is available to Bank of America Preferred Rewards clients

- Earning potential for rewards is decent

- Monthly option to change 3% bonus category

Cons

- There is a quarterly cap on bonus rewards

- Fees for balance transfers are high

- A fee for foreign transactions

A gas credit card or grocery credit card or Best Credit Cards for Online Shopping makes sense if you want to maximize your credit card rewards. Cash back or points can be earned when you fill up at the pump or shop for groceries with your credit card. The best gas and grocery cards can help boost your finances since those are big expenses.

There are many different kinds of credit cards available, including this type. Be sure to choose a credit card with a high reward rate and other benefits appropriate for your gas and groceries needs.

Discover the top 5 guaranteed approval gas credit cards for effortless fuel savings, regardless of your credit score. Enjoy perks like cashback rewards and exclusive discounts at gas stations. These cards are perfect for budget-conscious individuals, providing a hassle-free way to save money whenever you fill your tank.

Video Guide for Best Credit Cards for Groceries and Gas

Who should apply for a Groceries and Gas Credit Card?

Credit cards that reward you for supermarket purchases are the perfect addition to just about anyone’s wallet, considering Americans spend over $5,000 annually on food (Read – Credit Cards with $5000 Limit Guaranteed Approval). It’s typically necessary to have good or excellent credit to qualify for the best cards.

The major credit card issuers, such as American Express, offer online prequalification checks. You can check your chances of getting approved for one of these credit cards by completing a prequalification application through the card issuer’s website, which is easy, convenient, and free. A new credit card search should also include checking your credit score.

How to Choose Best Credit Cards for Groceries and Gas?

It’s a good idea to compare credit cards before making a decision to ensure you’ve found the best fit. The following questions should be asked before you choose a grocery rewards card.

Shopping Preference

Your shopping habits will largely determine the type of grocery rewards card that works for you. You can shop at a broad range of grocery stores and supermarkets with a general-purpose credit card that offers grocery rewards. You may get better value from a credit card with a co-branded brand or a flat-rate rewards card if you are loyal to a particular wholesale club, superstore, online grocery retailer, or delivery service.

Spending Amount

You need to consider your spending habits when selecting a grocery rewards card. Several of the best grocery reward cards don’t charge an annual fee, making them a great choice for budget-conscious shoppers who need to spend more at the grocery store to justify an annual fee.

There is, however, the possibility of higher reward rates with grocery rewards cards with an annual fee. Therefore, if you make heavy grocery store purchases and earn many rewards, you can also use Online Stores With Payment Plans to buy grocery, you can easily offset an annual fee and even get a better deal than you would with a no-fee card. Annual fee cards have many advantages, such as bonus categories and savings.

Travel credit cards with solid rewards rates on grocery purchases may be a better option than cash-back cards for travelers who enjoy travel and are okay with spending extra time to use transfer travel partners.

Rewards Approach

The rewards you can earn from a grocery rewards card can be quite high, but earning them may take some effort. If you want to earn more than 1 percent cash back on your purchases, keep track of spending categories, be aware of spending caps, and keep multiple credit cards in your wallet.

The extra benefits may not be worth the hassle if you value simplicity. If you want an easier way to earn rewards, grocery rewards cards with a simple rewards structure or flat-rate credit cards make good choices. As a result, you are likely to earn fewer rewards, but you will not have to jump through as many hoops as you would with grocery cards with multiple high-earning bonus categories.

Card Benefits

Earning more than cash back or points with the right grocery rewards card is possible. Check for card perks that can boost your card’s short-term and long-term value. There may be a generous sign-up bonus, an introductory APR offer, purchase protections, no foreign transaction fees, an annual credit, or a free subscription to a grocery delivery service.

How to Make the Most of Your Best Credit Cards for Groceries and Gas?

- If you want to maximize the benefits of your grocery credit card, you need to identify what type of shopper you are and choose the type of card that is right for you.

- You should then use the card whenever you go grocery shopping. You can save money on groceries if you select a credit card that gives you rewards or a sign-up bonus.

- Keep your credit card balance low by paying off your balance on time and in full every month. You will only have enough money to feed yourself or your family if you pay the interest charges on time.

What should I Look for in Best Credit Cards for Groceries and Gas?

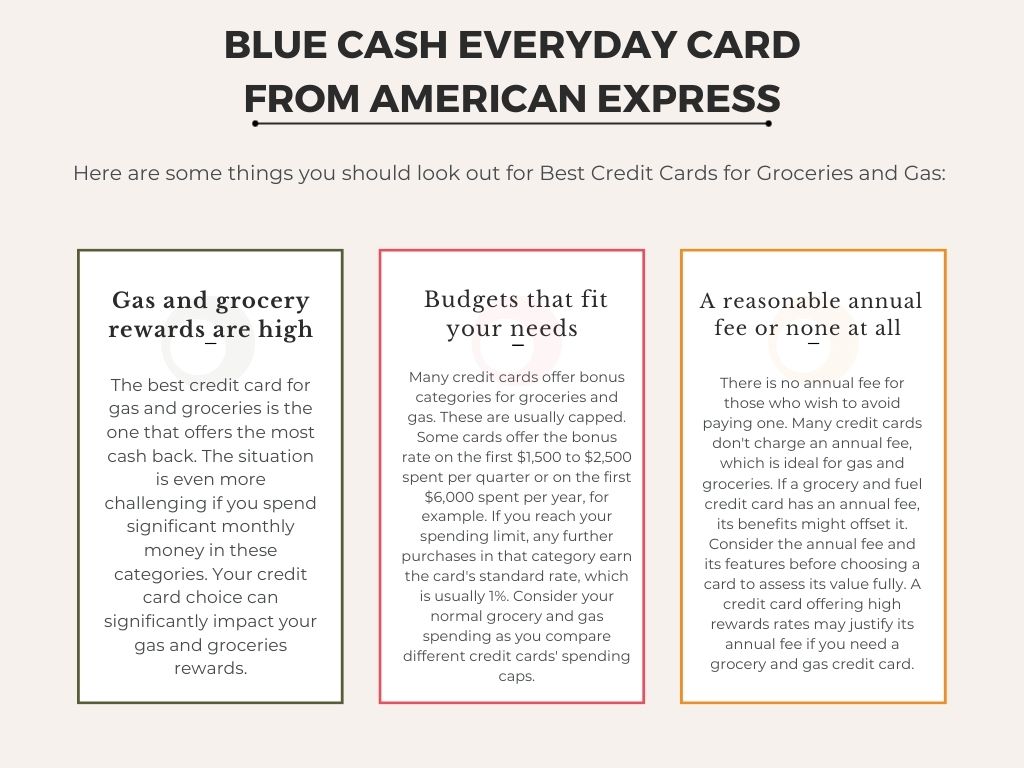

Here are some things you should look out for Best Credit Cards for Groceries and Gas:

FAQs

What is a Grocery and Gas Credit Card?

Credit cards that earn bonus rewards on fuel and groceries are called gas and grocery credit cards. Generally, these cards give you 2% back on gas purchases and groceries and 1% back on all other purchases. It is important to note that bonus rates differ from card to card. For example, some credit cards offer rewards of 5% to 6% in bonus categories, while others offer fewer rewards.

When is Best Credit Cards for Groceries and Gas a Good Idea?

A gas credit card and a grocery credit card are good ideas when you have these two expenses as your two largest monthly expenses. Reviewing your spending for the last couple of months can determine if you should consider the best credit cards for food and gas. Grocery and gas cards can help you save much money if gas and groceries rank among your top three or four expenses.

How do Credit Cards for Groceries Work?

There is no difference in how rewards credit cards work for groceries compared to other types of credit cards. One main difference between them is that they offer higher reward rates on grocery purchases, whether online or in-store.

What Cards Give You Cash Back on Groceries?

It is possible to earn cash back on groceries with many cards, especially if the card offers a flat rewards rate that applies to all spending categories. Some cards offer specific grocery rewards, while others offer rewards based on your highest spending category. One of these cards could earn you a higher rate on groceries if groceries are consistently your highest spending category.

What Should I Look for in Credit Cards for Groceries and Gas?

Find a credit card that offers the best rewards rates in these two categories when looking for the best gas and grocery credit card. A reasonable annual fee should be charged for the benefits offered by the card. Many credit cards also do not require an annual fee for gas and groceries.

You can even get gas cards with bad credit if you have a low credit score. You should also look for bonus rewards spending caps beyond rewards rates and fees. Most of these cards limit your ability to earn bonus rewards quarterly or annually, including the best gas and grocery credit cards.

Add Comment