Are you looking for Alabama First-Time Homebuyer Assistance Programs? If Yes, You are at the right place.

In this article, we are sharing all the information about Alabama First-Time Homebuyer Assistance Programs.

It is difficult for first-time buyers to find their dream home in Alabama because of rising prices early in the year, but they can find one with assistance near the middle of the year.

According to a Report, the median home sale price increased by 15.7% between May 2021 and 2022 to $301,000. That’s a $40k increase from last year.

First-time homebuyers in Alabama might find those numbers discouraging, but tax credit programs and help with down payments or closing costs are available.

Alabama is known for its Beaches along the Gulf of Mexico, scenic mountains, and historic towns, as well as NASA’s research center. A report said that the median sale price of homes in this southern state in January 2023 was $254,600.

The government offers programs to help first-time home buyers become homeowners, like lower mortgage rates, fewer lending requirements, down payment assistance, and tax breaks. The Alabama Housing Finance Authority is responsible for overseeing these programs.

It’s a great time to be a first-time home buyer in Alabama, even if it’s your second home. Several national programs can help you afford your first home. The Alabama Housing Finance Authority has helped thousands of families afford homes since 1980, including many first-time homebuyers.

Who is a First-Time Homebuyer in Alabama?

Contents

- 1 Who is a First-Time Homebuyer in Alabama?

- 2 What are Alabama First-Time Homebuyer Assistance Programs?

- 3 4 Alabama First-Time Homebuyer Assistance Programs

- 4 State Wide Alabama First-Time Homebuyer Assistance Programs

- 5 City-Wide Alabama First-Time Homebuyer Assistance Programs

- 6 Alabama First-Time Homebuyer Assistance Programs Qualifications

- 7 How Do I Apply for Alabama First-Time Homebuyer Down Payment Assistance?

- 8 What to Know About Buying a House in Alabama

- 9 Federal First-Time Homebuyer Loan Programs

- 10 FAQs

First-time homebuyers are those who have never owned a home before within the last three to 10 years, depending on the region. Several programs, for instance, suggest that Alabamians may qualify if they haven’t owned a home in the last three years, while another program raises that threshold to 10 years.

If you’re interested in this offer, we recommend reading the fine print and any limitations listed below. It is important to note that some programs can only be used once, so if you have previously claimed this benefit, it will not be available again.

The good news is that some of these programs are for more than just first-time homebuyers! It is instead the focus of the program to assist Alabamans who are in low-income households in becoming homeowners.

What are Alabama First-Time Homebuyer Assistance Programs?

There are numerous Alabama first-time homebuyer assistance programs in like Florida First Time Home Buyer Programs and Illinois First Time Home Buyer Programs designed to assist residents in achieving their dream of becoming homeowners, including low-interest loans, grants for down payments, and tax credits. A first-time home buyer program is designed to ease the process of becoming a homeowner but to qualify, and you may need a credit score of 640 or higher to meet certain income requirements.

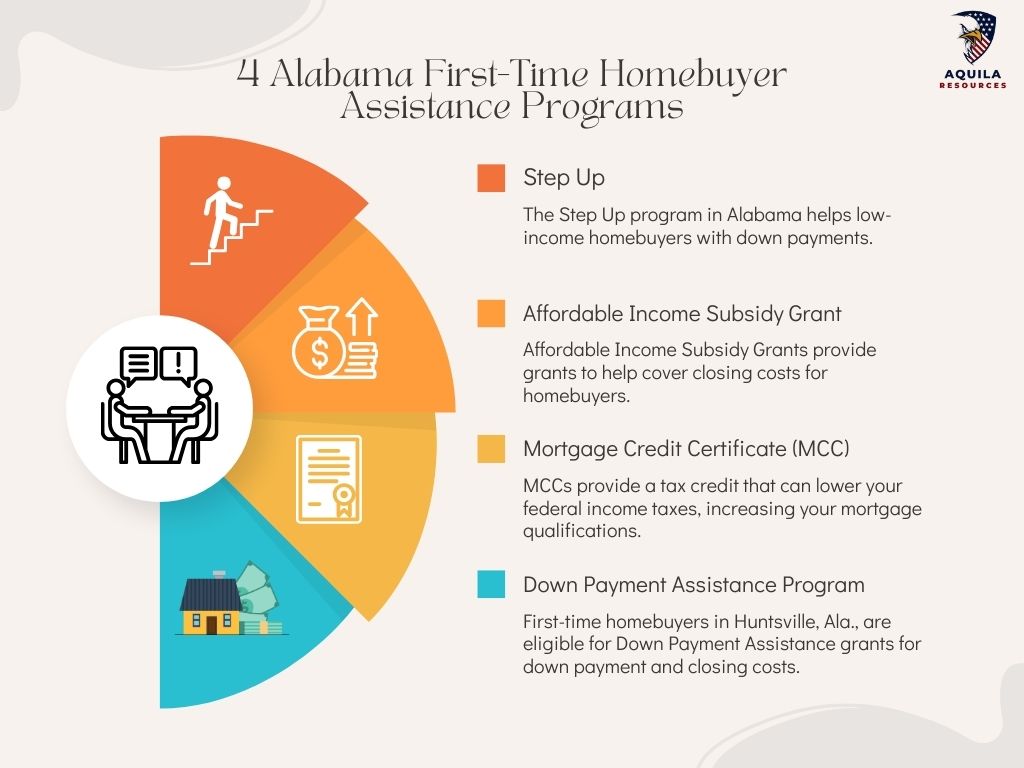

4 Alabama First-Time Homebuyer Assistance Programs

The Alabama Housing Finance Authority (AHFA), created by the Alabama state legislature, offers down payment assistance, closing cost assistance, and tax credits to first-time homebuyers. The Alabama Department of Housing and Urban Development (HUD) offers additional information about first-time homebuyer programs.

Here are the Alabama First-Time Homebuyer Assistance Programs –

Step Up

The Step Up program in Alabama helps low-income homebuyers with down payments. The program offers 4% of the sales price up to $10,000 to assist with the down payment. As well as a 30-year, fixed-rate mortgage, there is a 10-year second mortgage to secure the funds. Due to the ServiSolutions division of AHFA servicing both loans, monthly payments can be combined into one check, so you feel like you are paying only one mortgage.

Requirements of Step Up Program

- A borrower’s income must be less than $130,600, regardless of household size

- The credit score must be at least 640

- 45% or lower debt-to-income ratio

- A homeownership education course must be completed

Pros and Cons of Step Up Program

| Pros | Cons |

| Up to $10,000 in down payment assistance | The program is not available to homebuyers with poor credit |

| Payments for the first and second mortgages combined | There are income limits |

Affordable Income Subsidy Grant

Affordable Income Subsidy Grants provide grants to help cover closing costs for homebuyers. It is required that you earn at most 80% of the Area Median Income (AMI) for the property’s location to qualify. Furthermore, the grant amount varies depending on how much you earn: homebuyers earning 50% or less of the AMI can apply for a grant of 1%, while those earning 51% to 80% are eligible for 0.5%.

Requirements of Affordable Income Subsidy Grant

- Have an income of 80% or less of the Area Median Income (AMI) for the area of the property

- The credit score must be at least 640

- The ratio of debt to income of less than 45%

- Complete a course on homeownership education

Pros and Cons of Affordable Income Subsidy Grant

| Pros | Cons |

| Grants up to 1% of the loan amount | Limits on income |

| Mortgage Credit Certificates can be combined with this product | The amount of the grant depends on your income |

| A credit check and a DTI are required | |

| A participating lender must be used to apply |

Mortgage Credit Certificate (MCC)

MCCs provide a tax credit that can lower your federal income taxes, increasing your mortgage qualifications. You can save money by receiving a larger tax break or refund, or you can update your W-4 form to increase your withholdings. A MCC may be combined with a conventional fixed-rate mortgage, an FHA, VA, Rural Development loan or a privately insured mortgage. The amount of the loan determines mortgage credit rates.

Requirements of Mortgage Credit Certificate (MCC)

- Ensure that you meet the federal income limits.

- The federal government requires sellers to meet sales price limits, currently $381,308 in target areas and $311,980 elsewhere.

- You must update your employer’s W-4 withholding form.

Pros and Cons of Mortgage Credit Certificate (MCC)

| Pros | Cons |

| Tax credit of up to $2,000 per year for up to 50% of mortgage interest | Limits on income |

| Reduction of federal taxes dollar-for-dollar | Limits on sales prices |

| Combined with the Step Up program and other mortgages | |

| Withholding adjustments for immediate savings |

Down Payment Assistance Program

First-time homebuyers in Huntsville, Ala., are eligible for Down Payment Assistance grants for down payment and closing costs. Different maximum amounts are depending on the type of home: $7,500 for an existing home or $10,000 for a new home. The assistance operates as a 0% interest second mortgage with no monthly payments, forgiven over five years at 20% per year. To receive full forgiveness, you must live in the home for five years.

Requirements of Down Payment Assistance Program

- A first-time homebuyer or someone who has not owned a home in the past three years

- The home must be located within the city limits of Huntsville

- A household income of 80% or less of the AMI, based on the size of the family

- The lender must meet credit requirements

- The home must be your primary residence, not a business, commercial, or rental property

- Take a homebuyer’s education course

Pros and Cons of Down Payment Assistance Program

| Pros | Cons |

| Down payment assistance up to $10,000 | The home must be occupied for five years for the loan to be fully forgiven. |

| A loan with 0% interest and full forgiveness | The processing time is six weeks |

| Qualifying homes must be located within Huntsville’s city limits | |

| The transaction must involve a minimum contribution of $500 |

State Wide Alabama First-Time Homebuyer Assistance Programs

| Program | Assistance Offered | Who Should Apply | Assistance Type |

| Step Up Program | Up to 3.5% of home loan that can be used for down payment assistance | Any homebuyer that can meet income and credit score requirements | Second mortgage |

| Affordable Income Subsidy Grant | Up to 1% of home loan that can be used for closing costs | Any homebuyer that can meet income and credit score requirements | Grant |

| Mortgage Credit Certificate | Reduces up to $2,000 in mortgage interest that you pay into federal taxes for the life of your loan | Any homebuyer that can meet income and home sale price requirements | Tax credit |

| Down Payment Assistance Program | $7,500 on an existing home or $10,000 on a new home | Any homebuyer that can meet income and home sale price requirements and has not owned a home in the past three years | Grant |

City-Wide Alabama First-Time Homebuyer Assistance Programs

| City | Program | Assistance Offered | Who Should Apply | Assistance Type |

| Huntsville | Home Ownership Program | Up to $7,500 in down payment assistance | First time homebuyers that can meet income requirements | Grant |

| Mobile | Down Payment Assistance Program | Up to $10,000 in down payment assistance and closing costs | First time homebuyers that can meet income requirements | Forgivable second mortgage |

| Tuscaloosa | Homeownership Program | Up to $22,500 towards home purchase | First time homebuyers that can meet income requirements | Forgivable second mortgage |

| Prichard | Affordable Homes Program | Down payment assistance – amount not specified | First time homebuyers that can meet income requirements | Not specified |

| Opelika | Homeownership Loan Program | Up to $6,000 in down payment assistance | First time homebuyers that can meet income requirements and buying within the city limits of Opelika | Grant |

| Decatur | H.O.M.E. Program | Up to 50% of down payment or up to 100% of closing costs | First time homebuyers that can meet income requirements | Grant |

| Montgomery | Homeownership Program | Monthly mortgage assistance | First time homebuyers that can meet income requirements | Subsidy |

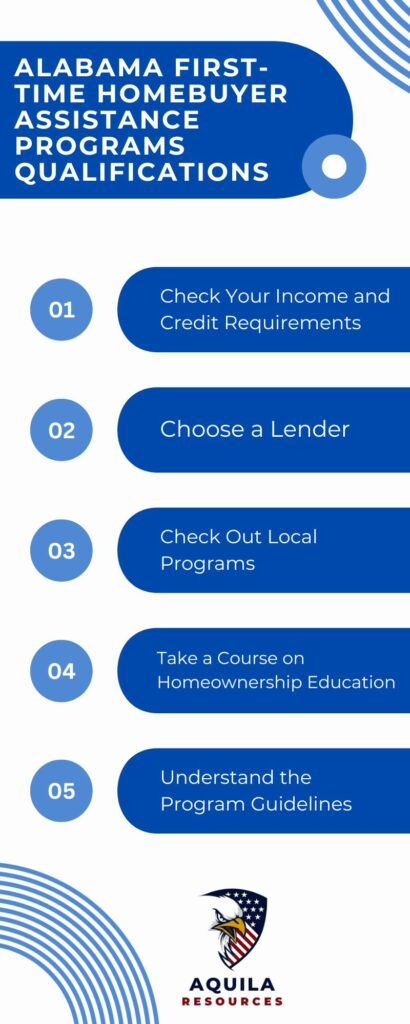

Alabama First-Time Homebuyer Assistance Programs Qualifications

First-time homebuyer programs in Alabama have different eligibility criteria, but here’s what you should expect from the process.

1. Check Your Income and Credit Requirements: If you’re interested in a program, ensure you meet the income and credit requirements before applying. Applicants for Mortgage Credit Certificates (MCCs) must also ensure that the sales price of the target home is within the federal limits.

2. Choose a Lender: The AHFA does not directly lend to borrowers. A participating lender will guide you through the application process if you’re interested in one of their programs.

3. Check Out Local Programs: There are different types of assistance, and the application process varies for each type. The program will provide down payment assistance only for first-time homebuyers, for example. If you combine aid with a loan, you will apply through the lending consortium that is part of the program.

4. Take a Course on Homeownership Education: If you are interested in receiving a down payment or closing cost assistance, you must take a homeownership education course approved by your local government.

5. Understand the Program Guidelines: Some programs have requirements after you close on a house. The Down Payment Assistance program, for instance, requires that you live in the home for five years to receive full loan forgiveness.

How Do I Apply for Alabama First-Time Homebuyer Down Payment Assistance?

First-time homebuyers in Alabama must find a participating lender since AFHA does not lend directly to borrowers. You will be guided through the application process by your lender for the specific assistance program you are seeking.

What to Know About Buying a House in Alabama

There has been a steep increase in the price of homes in Alabama and across the country in recent years. First-time homebuyers can benefit from special homeownership programs to make the process easier.

A few Alabama loan programs can provide you with the down payment help you need if you qualify. Furthermore, there are special mortgages, income tax breaks that are worthwhile, and education courses for new homebuyers. Are you ready to get started?

Federal First-Time Homebuyer Loan Programs

First-time buyers in Alabama can also use government-backed loans, such as FHA, VA and USDA mortgages, to get more favorable terms and rates. It may also be possible to get assistance and other home loan options through your mortgage lender. Detailed information on first-time homebuyer loans can be found on the homebuyer loans and programs page.

Conventional Loans

There are conventional loans and mortgages, but they are not guaranteed by the government or insured by it. Because of this, their qualification standards can be stricter. In contrast, conventional loan programs like those offered by Fannie Mae HomeReady® and Freddie Mac Home Possible have flexible qualification standards and low down payment requirements.

FHA Loans

A Federal Housing Administration (FHA) loan is a government-backed mortgage. The FHA loan program is popular with first-time homebuyers due to its more lenient credit and low down payment requirements. The FHA permits you to qualify for an FHA loan with a down payment of 3.5% if your credit score is 580 or higher. FHA loans are also available for those with lower credit scores, but a 10% down payment is required.

VA Loans

A VA loan is a government-backed mortgage guaranteed by the Veterans Affairs Department (VA). Veterans and active-duty service members are the only recipients of these loans. Their 100% financing means there is no down payment required, and there is no loan limit or credit requirement. It is important to note that borrowers will be charged a funding fee even without mortgage insurance.

USDA Loans

A USDA loan is a government-backed mortgage guaranteed by the United States Department of Agriculture. You must own a home in a designated rural area to qualify, but these loans are available to low- and moderate-income homebuyers without a down payment.

FAQs

How Much of a Down Payment Do I Need to Buy a House in Alabama?

Those who qualify for USDA or VA loans can buy a home in Alabama without any down payment. Additionally, homebuyers can find programs that assist them with low down payments, like Alabama Step Up, which grants assistance of up to 3% of the purchase price of a 10-year second mortgage.

Is There a First-Time Homebuyer Tax Credit in Alabama?

Yes. First-time homebuyers and buyers in targeted areas in Alabama can apply for a mortgage credit certificate from the Alabama Housing Finance Authority. An annual mortgage interest tax credit of up to $2,000 can be claimed for a dollar-for-dollar refund of interest paid by the certificate.

Who Can Help Me with My Down Payment on a House in Alabama?

Through the Step Up program, the Alabama Housing Finance Authority funds down payments for middle-income borrowers.

Add Comment