Are you looking for Allotment Loans For Federal Employees With Bad Credit? If Yes, You are at the right place.

This article shares all the information about Allotment Loans For Federal Employees With Bad Credit.

Regarding loans, federal employees want simplicity and reliability in a world that is often difficult to understand. Federal employees have numerous options, including Kashable, BMG, and Oneblinc, which have tailored their services to meet their needs.

Throughout this guide, we will take a closer look at the features of each of these lenders, aiming to help you make a decision that is right for you. This informative exploration is the first step to securing the most suitable allotment loans.

The allotment loan program offers federal employees with bad credit the opportunity to get a low-rate loan with favorable terms. Allotment loans come in two types, and government employees can generally apply for them easily. Government employees and military personnel, particularly those in active service, are often targeted by unscrupulous lenders using allotment loans.

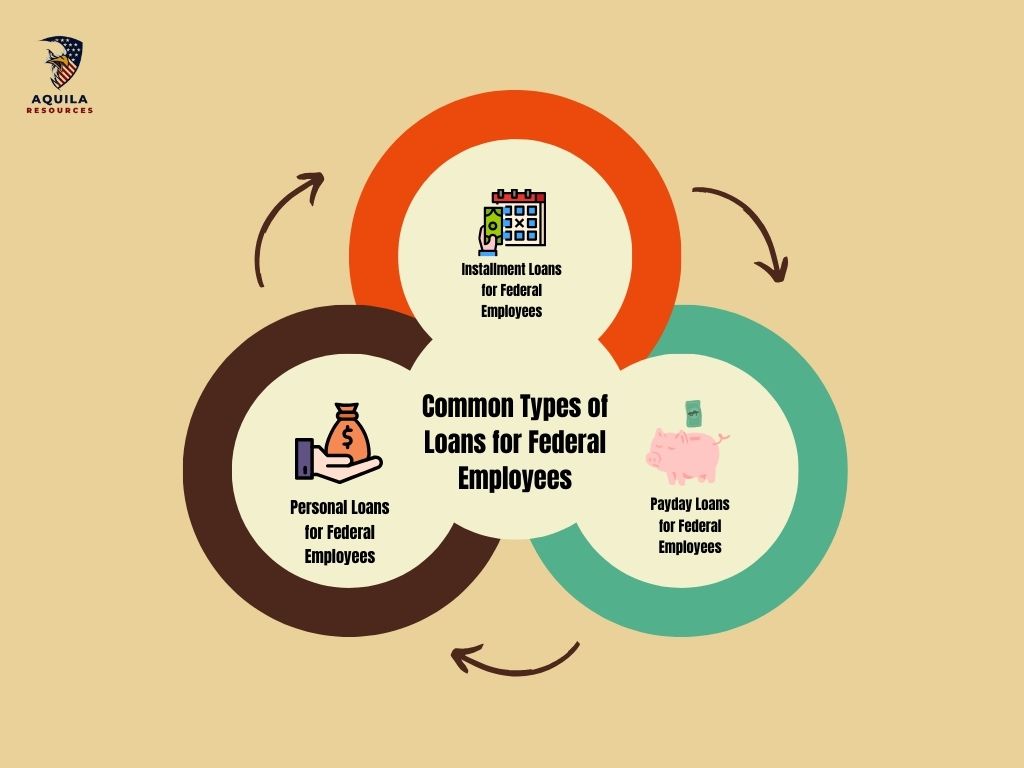

Common Types of Loans for Federal Employees

Contents

- 1 Common Types of Loans for Federal Employees

- 2 What is an Allotment Loan?

- 3 What are Allotment Loans for Federal Employees?

- 4 Allotment Loans for Federal Employees with Bad Credit

- 5 5 Best Allotment Loans for Federal Employees with Bad Credit

- 6 Eligibility Criteria for Allotment Loans

- 7 What Are the Benefits of Federal Employee Loans?

- 8 What Are the Disadvantages of Allotment Loans for Federal Employees?

- 9 Pros and Cons of Allotment Loans for Government Workers

- 10 Common Uses of Allotment Loans

- 11 Tips for Managing an Allotment Loan Responsibly

- 12 FAQs

Installment Loans for Federal Employees

Installment loans are available to government employees who can repay them over a long period. Borrowers can make monthly fixed payments on this type of loan. You can repay the loan over months or years, depending on how much you borrowed. Direct lenders are more likely to offer quick funding to federal employees since they have a stable source of income.

Personal Loans for Federal Employees

Government jobs provide job security, which allows you to obtain personal loans more easily than in the private sector. If you need a loan for personal reasons, you can take out an allocation loan. Federal employees have the advantage of being able to use loans for other urgent needs without getting a loan approval. This type of loan does not require any collateral.

Payday Loans for Federal Employees

Obtaining a payday loan to cover your daily expenses is also possible with Same Day Installment Loans No Credit Check Online. Payday loans can come in handy if you are unable to pay your bills or are facing another financial emergency. A deduction will be made from your next paycheck for the amount borrowed.

What is an Allotment Loan?

The allotment loan is a type of loan that is specifically made for federal employees. No collateral is required, and low, fixed interest rates and manageable payment terms for federal employees. Those who bring out allocation loans pay off their loans by allocating monthly funds from their salaries. A deduction is made from the employee’s salary.

A federal employee can apply for two types of allotment loans. The following are listed:

- The Discretionary Allotment Loan: Allotment loans enable borrowers to designate a specific amount of money to be automatically deducted from their paychecks. You can use them for various purposes, such as paying your monthly bills. Allotment loans are flexible and can be started and ended whenever they wish.

- Non-Discretionary Loans: Allotment loans are similar to discretionary loans in that you can designate a certain portion of your paycheck for a specific purpose. However, the allotment cannot be terminated or started at will.

An allotment loan is a loan that is arranged between a borrower and a lender. Federal government employees with poor credit records can easily qualify for this type of loan. Since repayment is guaranteed for as long as the federal government employs the borrower, all loans are guaranteed. A borrower’s allotment payments are divided between their paychecks to facilitate repayment.

What are Allotment Loans for Federal Employees?

An allocation loan installment loan for federal employees facilitates easier financial management same as Allotment Loans For Healthcare Workers. The government enables federal workers to borrow money and pay it back over a predetermined period by deducting it from their paychecks. By using this scheme, repayments are streamlined, and missed payments and late fees are avoided. If federal employees understand how these loans work, they can use them to maintain financial stability and achieve their financial goals.

Allotment Loans for Federal Employees with Bad Credit

Many options are available for these loans, where credit scores are only one deciding factor. Many lenders in this space, such as Kashable and BMG Money, have crafted their products to take into account more than a person’s credit score. Thanks to this change in focus, federal employees can navigate their financial journeys with less stress resulting from past financial mistakes.

5 Best Allotment Loans for Federal Employees with Bad Credit

Kashable

Kashable is a New York-based online lending company founded in 2013. All states except West Virginia offer workers a socially responsible wellness solution, including postal employees.

Kashable offers loans ranging from $250 to $20,000 at 6% APR for terms ranging from six months to 24 months. An application for Kashable can be completed within a couple of minutes. They may delay if additional information needs to be verified.

Kashable calculates offers and assigns interest rates based on your employment and credit data, and they report payments to all three credit bureaus to improve your credit score. Payments are automatically deducted from your paycheck each month. If you quit your job or are terminated early, a Kashable representative will work with you to arrange an alternative repayment method, such as ACH payments, checks, or money orders.

Eligibility Requirements for Kashable

- Taking part in their program is a requirement for qualifying. Their website makes it easy for you to check your eligibility.

- If you don’t live in West Virginia, you can apply, and the application process takes only a few minutes.

- The Kashable application will perform a soft credit check that will not affect your credit rating.

- A hard credit inquiry may temporarily lower your credit score if you choose to proceed with your loan.

- Kashable may only accept your application if you have an active and in good standing checking account before applying.

- The employee ID must be submitted along with the employee’s email address and mobile phone number. You may even be asked for a copy of your pay stub to verify your income and employment.

Pros and Cons of Kashable

Pros

- Good credit score and low rates

- There are no penalties for prepayment

- The companies report your payments to Equifax, Experian, and Transunion.

- Enhance your credit score by following these steps.

Cons

- Low credit scores result in higher interest rates.

- West Virginia does not offer this service

- Provided only by select employers

- A credit check is performed on you.

BmgMoney

BmgMoney is an online lending company founded in Miami, Florida, in 2009. The company’s website has a specific landing page for postal employees that lists allotments. BmgMoney offers loans between $500 and $10,000 with interest rates ranging from 16.99% to 35.99% APR and terms ranging from 6 to 36 months.

The application fee may range from $0 – $49 after approval, but no hidden fees exist. Visit their website and search for your employer to determine if you are eligible. The BMG Money application does not run a FICO score or credit report. Their underwriting is solely based on alternative and employment data. You will receive your money within 1 – 2 days after your application has been approved.

Eligibility Requirements for BmgMoney

- Ensure they are legally allowed to operate in their state.

- Have a company they work for as their employer

- A minimum of one year’s experience is required.

- At least 18 years of age is required.

- A military member cannot be active

- There are no open bankruptcies

Pros and Cons of BmgMoney

Pros

- There needs to be a credit check or credit history. A BMG money allotment loan could save a lot if you have a low credit score.

- The requirements for eligibility are less restrictive than those of most traditional lenders.

- The acceptance rate of their loans is higher than that of other traditional lenders.

- When approved, funding is available immediately.

Cons

- When your credit score is good or excellent, you may find lower interest rates elsewhere.

- You must only apply if your employer offers the loans as an employee benefit.

- There may be a fee of $0 – $499 to apply.

- You must submit verification documents.

OneBlinc

OneBlinc was founded in 2018 and is headquartered in Miami, Florida. The postal service employees and the federal government working in many industries can apply for allotment loans. A OneBlinc loan can range from $500 to $3,000, with interest rates ranging from 23% to 32.9% APR and payments of as little as 12 biweekly and as much as 84 biweekly.

OneBlinc accepts more applications regardless of your credit score. The company needs to pull your credit report. Depending on the terms of your loan, one-time fees could range between $0 – 88.90. If you apply, you might be required to submit additional documents as part of the loan application process.

OneBlinc will respond within 24 hours after uploading and marking the documents as “in review.” Your application decision may be delayed if you provide incorrect information.

Eligibility Requirements for OneBlinc

- You can qualify even with a low credit score since no minimum credit requirements exist.

- There is no credit check. Credit decisions are made, and loan prices are determined using their risk assessment algorithm.

- They must be offered as an employee benefit by a company. The application is open to any company that is a partner.

- There are no open bankruptcies. Your application may be disqualified immediately if you have an open bankruptcy record.

Pros and Cons of OneBlinc

Pros

- A credit score is not a requirement

- A lightning-fast approval process

- A simple payment plan

- You build your credit through it.

Cons

- There is a one-time application fee.

- Your credit score might qualify you for a lower rate elsewhere.

- You can only apply if your employer is part of their network.

Workplace Credit

WorkplaceCredit is a Florida-based online consumer lending company that was founded in 2016. The company specializes in providing financial services to private sector employees, federal employees, USPS employees, and individuals with a steady job history.

The WorkplaceCredit program offers flexible and affordable personal loans that can be repaid through payroll deductions. The loan amount can range from $25,000 to $250,000, with repayment terms ranging from 6 to 36 months. The origination fee can also be as high as 4%. WorkplaceCredit has the advantage of being accessible to almost everyone, regardless of credit history. Once approved, you could receive the funds within one or two days.

Eligibility Requirements for Workplace Credit

- Eligibility requirements for WorkplaceCredit are minimal

- The minimum age requirement for using their service is 18 years old.

- You qualify if you have a valid address

- It is a requirement that you are a current U.S. resident.

- A minimum of 12 months of employment is required

- A US bank account is required for disbursement of loans.

Pros and Cons of Workplace Credit

Pros

- A very small set of requirements makes it possible for almost anyone to qualify.

- A high approval rate

- Specially designed loans for USPS employees and postal workers

- You could get as much as $25,000

- Low-interest rates for people with poor or average credit scores

Cons

- Your credit score may allow you to qualify for a loan at a lower interest rate

- Rates and fees should be more transparent.

Access Loans

AccessLoans is an online lending company based in Aventura, Florida. The company offers convenient loans to employees of the public and private sectors, including postal workers. Their goal is to improve lending access and transparency while inspiring financially healthier communities.

Various loan amounts are available through Access Loans, ranging from $850 to $6,000, with interest rates and terms ranging from 8 to 26 months. During the application process, the employer may ask you for documents such as a driver’s license, proof of address, a pay stub, and a selfie. The approval process can take up to two days to complete.

Eligibility Requirements for Access Loans

- A minimum of one year of employment is required before applying

- Do not have a bankruptcy filing on their record

- A minimum age of 18 is required

Pros and Cons of Access Loans

Pros

- Manually submitting your documents means you qualify even if your employer does not work directly with the organization.

- Funding is available on the same day.

- There is no prepayment fee.

Cons

- The higher your credit score, the lower your interest rate may be elsewhere.

- There may be an origination fee charged

- Process of manual document submission

- The approval process takes longer

Eligibility Criteria for Allotment Loans

Allotment loans are typically granted only to applicants who meet certain eligibility requirements. Allotment Loans for Postal Employees with Bad Credit or Federal Employees may be required to meet different eligibility requirements based on the lending institution they are applying to:

Employment Status

A federal or postal employee must be employed to be eligible for an allotment loan. Before applying for a loan, some lenders may require you to work a certain number of months or go through a probationary period.

Age Requirement

The minimum age for applying for an allotment loan is typically 18.

Credit Score

Employees with low credit scores may be able to get allocation loans from some lenders, but better loan terms and lower interest rates are often the result of higher credit scores.

Income Level

It may also be deemed necessary by lenders to take a look at your income level when determining your ability to repay the loan. The income you earn must cover both your loan payments and your other living costs comfortably.

Allotment Availability

There must be enough allotments available. Therefore, you must allow enough deduction from your paycheck to repay the loan that you’re willing to have automatically deducted.

Debt-to-Income Ratio

Your debt-to-income ratio is a calculation that compares your monthly debt payments with your gross monthly income. You can use this to help them determine whether you can manage the payments.

What Are the Benefits of Federal Employee Loans?

Fast Approval Process

With allocation loans, a fast approval process is possible since providers consider other factors. The loan is approved based on your income and debt-to-income ratio instead of performing the usual credit check. Consequently, the approval process can be simplified, which enables borrowers to get funded quickly.

Simple Requirements

Furthermore, lenders require borrowers to satisfy simple everyday requirements to get funding. The minimum requirements for obtaining a job in the federal government are that you must be over 18 years old and have worked for the government for at least one year.

Friendly Repayment Conditions

Loan providers offer convenient repayment conditions. There will be no pressure on you when it comes to repaying your loan. Only when you are comfortable with the loan terms will you take the loan?

Flexibility

Allotment loans can be used for other pressing needs once they are approved. You can pay your bills, renovate your home, or repair your car.

Instant Funding for Emergencies

You can receive the funds in your bank account within one or two business days. You will be able to access the funds in case of an emergency.

What Are the Disadvantages of Allotment Loans for Federal Employees?

The federal employee loan may be useful during an emergency but has disadvantages.

Collection Issues

You will still be required to repay the loan even after you have been fired from a government position. A change in employment status will also need to be communicated to them.

Cycle of Debt

An employee of the federal government might fall into a cycle of debt at some point. Allotment loans are typically taken in multiples by workers. Employees with so many loans will need help paying for their daily necessities.

A Lot of Allotments

A federal employee loan might not be advantageous for employees with other debts. The situation only gets worse as workers accumulate more debt. The debt trap eventually becomes harder to escape.

Worsening Ability to Repay

Those already in debt may be at risk of significant financial hardship since there are no limitations on borrowing amounts.

Pros and Cons of Allotment Loans for Government Workers

Several options are available to government workers regarding financing, but allotment loans remain the most popular choice. The advantages and disadvantages of these loans are the same as those of any financial instrument. Individuals must understand these factors to make an informed financial decision tailored to their unique situation.

Pros

- Easily Accessible: The documentation for these loans is usually minimal, so government workers have relatively easy access to them.

- Repayment Flexibility: The loan is repaid conveniently, with installments deducted from the borrower’s paycheck directly, which minimizes missed payments.

- Approval is Quick: The approval process for allotment loans is typically faster than traditional loans so that you can receive your funds more quickly.

- Acceptance of Bad Credit: If you have bad credit, you can rebuild your credit rating by repaying a bad credit loan with a good credit score.

Cons

- Interest Rates are Higher: The interest rates charged by allotment loans are often higher than those of other loans.

- The Risk of Debt Cycle: A lack of responsible debt management can sometimes lead individuals into a cycle of debt due to the ease of accessibility of credit.

The allotment loan process for government workers is a mixed bag regarding the pros and cons. One advantage of this type of loan is the ease of access, flexibility of repayment options, and the possibility of being approved even if your credit score is low. It is also important to consider the risk of entering a debt cycle and the possibility of higher interest rates.

It is, therefore, important for potential borrowers to consider these factors carefully. The key to making a beneficial financial decision is to conduct thorough research and holistically consider one’s financial situation.

Common Uses of Allotment Loans

Allotment loans can serve a lot of different purposes. One of their main advantages is flexibility, which lets them cover unexpected expenses or financial needs. Allotment loans are commonly used for the following purposes:

Emergency Expenses

The allotment loan can cover the cost of unexpected medical bills, car repairs, or home repairs. It is possible to access funds quickly with these loans in an emergency.

Debt Consolidation

Allotment loans can consolidate multiple high-interest debts into one lower-interest loan. This could save you money and simplify your payments.

Educational Expenses

Education-related expenses such as tuition, books, and other tuition expenses can be paid with allocation loans. Do this for your education or a member of your family.

Major Purchases

An allotment loan can give you the necessary funds to purchase major appliances or furniture.

Travel Expenses

The allotment loan program can help you cover the costs of flight tickets, hotel rooms, and other travel-related needs, regardless of whether it’s a much-needed vacation or an unexpected travel need.

Personal Events

Personal events, such as weddings and funerals, are often associated with significant costs. These expenses can be managed with the help of an allotment loan.

Home Improvement Projects

The funds you need are available through an allotment loan if you plan to renovate your home.

Tips for Managing an Allotment Loan Responsibly

Maintaining good financial health requires careful management of an allotment loan, just like any form of credit. Managing your allotment loan can be easy if you follow these tips:

- Budget Accordingly: Allotment loans are automatically deducted from your paycheck, so adjust your budget accordingly.

- Borrow Only What You Need. It would help if you only borrowed what you needed. Borrowing more than necessary may result in unnecessary financial burdens since you must repay the loan with interest.

- Repayments on Time: If you want to avoid overdraft fees or penalties, ensure you have sufficient funds to cover allotment loans automatically taken from your salary.

- Please read the Terms: Understand the loan agreement carefully before signing it, including the interest rate, repayment terms, and any fees or penalties.

- Contact Your Lender. Contact your lender if you’re experiencing difficulty making payments as soon as possible. Your payment plan may be adjusted, or you may be offered assistance in other ways.

- Check Your Credit Reports: Monitor your credit reports regularly to ensure that your loan repayments are reflected accurately and that your credit score is improving.

FAQs

What Do Loans for Federal Employees Mean?

A federal employee loan is intended for federal employees and government workers. It is beneficial for these individuals to take advantage of the favorable terms lenders offer. Allotment loans are still accessible to government employees with poor credit.

Can I Get Allotment Loans for Federal Employees With Bad Credit?

Yes. Allotment loans are available to people with bad credit. The only drawback is that these loans may come with higher interest rates. It is possible to have an APR as high as 400% on allotment loans for bad credit. The amount can even be higher depending on how the lender assesses your eligibility.

These funding options are expensive due to the high interest rates associated with bad credit allotment loans. Due to this, most people need help repaying the loan. If you are seeking small loans, take out these loans. A comparison of lenders can ensure you get the best terms and conditions that meet your financial needs.

Where Can I Find Allotment Loans for Low-Credit Federal Employees?

Allotment loans for federal employees are available at the following places.

Some credit providers, such as the postal service, hire workers in certain federally regulated occupations.

- Army emergency aid

- BMGMoney

- Federal Workers Education Assistance Fund

- Redeemable

- P2P military loans

Add Comment