Are you looking for Balance Transfer Cards For Bad Credit? If Yes, you have stumbled at the right place.

In this article, we are sharing all the information about Balance Transfer Cards For Bad Credit.

Balance Transfer Cards For Bad Credit

Contents

- 1 Balance Transfer Cards For Bad Credit

- 1.1 What Is a Balance Transfer?

- 1.2 How does Balance Transfer Work?

- 1.3 Are There Balance Transfer Cards for Bad Credit?

- 1.4 How To Apply for a Balance Transfer Card for Bad Credit?

- 1.5 5 Best Balance Transfer Cards For Bad Credit

- 1.6 Pros and cons of Balance Transfer Cards For Bad Credit

- 1.7 What to Consider When selecting Balance Transfer Cards For Bad Credit?

- 1.8 Should You do Balance Transfer with Balance Transfer Cards For Bad Credit?

- 1.9 How should I compare Balance Transfer Cards For Bad Credit?

- 1.10 Does Balance Transfer Cards For Bad Credit Affect Your Credit Score?

- 1.11 FAQs Related to Balance Transfer Cards For Bad Credit

Balance transfers are a great option if you have a high-interest credit card balance. You only need to determine whether this option is right for you based on your financial circumstances. There may be a challenging win for people with bad credit with balance transfers.

The balance transfer credit card is an excellent tool for consolidating debt. Some even offer a 0% introductory APR, so you can save money and pay off your debt faster. You need to check your credit score before transferring a balance and understand the potential downsides and alternatives. If you are struggling to get a credit card because of a low credit score see our list of Credit Cards for 500 Credit Score.

What Is a Balance Transfer?

You can save money on high-interest debt by transferring your balance to a lower-interest-rate card. Even better, you can transfer your balance to one that offers a 0% APR introductory offer. It is common to pay a balance transfer fee when moving debt from one card to another, usually between 3% and 5%.

If you transfer your debt to another card, you will be charged a fee, so you should consider the cost before deciding. A balance transfer will probably not be a good money move if you pay more in fees than you save on interest.

How does Balance Transfer Work?

Individuals can transfer all or part of their existing credit card balance to a new account. Some credit cards advertise low or even 0% interest rates on balance transfers for a set period, such as 12 months or 18 months. However, it’s important to note that these credit cards often charge fees when you transfer balances, usually 3% to 5%.

Are There Balance Transfer Cards for Bad Credit?

Credit cards that offer balance transfers to those with bad credit are currently out of stock. The fair credit market does, however, offer a few loans.

The annual percentage rate on balance transfers can be low or 0% for a limited period on some credit cards. This benefit is that it makes them a good option for people who want to consolidate debt or pay off existing credit card debt. A strong credit history is typically required to apply for these cards, which limits the lender’s exposure. Issuers often impose a credit limit of less than $1,000 on cardholders with bad credit.

A bad credit score is often the result of missed payments, high credit utilization, or other negative factors such as bankruptcy, which make borrowers look riskier to credit card companies. This makes it difficult for people with bad credit to qualify for the most competitive credit card offers, including those with balance transfer incentives.

A few instant approval credit cards offer cash advances that you can get instead of Balance Transfer Cards for Bad Credit, but they typically have high-interest rates and fees.

How To Apply for a Balance Transfer Card for Bad Credit?

Balance Transfer Cards For Bad Credit require the same application process as other credit cards.

- Choose the right card based on your goals.

- If you want to increase your chances of approval, make sure your credit report is error-free.

- Generally, you can apply online or in person at your bank’s branch.

- The application requires your name, U.S. address, and Social Security number or ITIN.

- It is also possible that you will be asked for your income and housing costs. Your credit limit on a new card will depend on this information and a hard credit pull.

- Fill out the application and submit it. You may have to wait for a card issuer to respond, but many may approve you immediately. You are entitled to receive a written explanation of why the card issuer denied your application.

5 Best Balance Transfer Cards For Bad Credit

Balance Transfer Cards For Bad Credit options for people with bad credit. Before applying, you can find out how much you can save by using Bankrate’s balance transfer calculator. There are pros and cons to each card, however.

Here are the best cards for people with Balance Transfer Cards For Bad Credit –

Capital One Platinum Secured Credit Card

A Capital One Platinum Secured Credit Card is another option for people with bad credit. You’ll also have to deposit money as collateral on this card to secure your line of credit. You can secure a $200 line of credit by paying a security deposit of only $49, $99, or $200. There is a $1,000 maximum deposit limit, but you can deposit up to $1,000.

The main advantage of this card is that you can see if you are prequalified without a hard inquiry on your credit report. Additionally, there are no annual fees. There is no balance transfer fee when you transfer a balance at the Transfer APR. The variable APR of 30.49 percent applies to balance transfers.

Feature of Capital One Platinum Secured Credit Card –

| Feature | Details |

| Line of Credit | $200 |

| Security Deposit | $49, $99, or $200 |

| Maximum Deposit | $1,000 |

| Prequalification | Yes, without a hard inquiry |

| Annual Fee | $0 |

| Balance Transfer Fee | None when you transfer a balance at the Transfer APR |

| Transfer APR | 30.49% variable |

Milestone Mastercard

A Milestone Credit Card can be a good option for people with below-average credit scores who want to avoid paying a deposit. Milestone Card offers a $700 credit limit and no security deposit requirement, making it a good choice.

It could help you handle some emergency expenses more easily, although you’ll be charged a high APR if you carry a balance from month to month. A high annual fee is also associated with the Milestone Card, so keep it short.

Features of Milestone Mastercard –

| Feature | Details |

| Credit score requirement | Below-average |

| Security deposit | No |

| Credit limit | Up to $700 |

| APR | 26.99% |

| Annual fee | $75 |

| Late payment fee | $35 |

| Foreign transaction fee | 3% |

| Balance transfer fee | 3% |

| Grace period | 21 days |

Discover it Secured Credit Card

Discover it Secured Credit Cards offer an introductory APR of 10.99 percent for six months, followed by a variable APR of 29.24 percent. With this card, you won’t have to pay a membership fee, and you’ll earn rewards for your purchases: 2 percent back at gas stations and restaurants up to $1,000 each quarter, then 1 percent back and 1 percent back everywhere else. Discover will also match you at the end of the first year for the cash-back rewards you earn.

You must make a security deposit, but it will be refunded if you close your account by the due date. A minimum deposit of $200 and a maximum deposit of $2,500 will determine the credit line you are approved for. Fees will also apply to future balance transfers. An introductory fee of 3 percent and a fee of up to 5 percent will apply to your first balance transfer.

Features of Discover it Secured Credit Card –

| Feature | Details |

| Introductory APR | 10.99% for 6 months, then 29.24% variable |

| Annual fee | $0 |

| Rewards | 2% back at gas stations and restaurants up to $1,000 each quarter, then 1% back and 1% back everywhere else |

| Cash back match | Discover will match you at the end of the first year for the cash-back rewards you earn |

| Security deposit | Required, minimum of $200 and maximum of $2,500 |

| Balance transfer fee | Introductory fee of 3% and a fee of up to 5% will apply to your first balance transfer |

Aspire Cash Back Reward Card

Aspire Cash Back Reward Card is an expensive, unsecured credit card. No security deposit is required on the Aspire Card, but there is an annual fee of $49 – $175 the first year, plus monthly fees after that. A monthly fee of $5 – $12.50 is added to the mix after the first year, and the annual Fee drops to $0 – $49 afterward.

Feature of Aspire Cash Back Reward Card –

| Feature | Details |

| Annual fee (first year) | $49 – $175 |

| Annual fee (after first year) | $0 – $49 |

| Monthly fee | $5 – $12.50 |

| Rewards | 1% cash back on all purchases |

| Welcome bonus | None |

| Foreign transaction fee | 3% |

| Balance transfer fee | 3% |

| Late payment fee | Up to $35 |

| Grace period | 21 days |

BankAmericard Secured Credit Card

A BankAmericard Secured Credit Card may be a good option if you wish to transfer higher amounts of balance. The card has a $200 minimum deposit and a $5,000 maximum deposit. The issuer can refund your deposit if you practice good credit habits. This card offers no rewards, but it’s a great way to build a credit history without spending any money.

Feature of BankAmericard Secured Credit Card –

| Feature | Details |

| Credit score requirement | Fair or poor |

| Security deposit | Required, minimum of $200 and maximum of $5,000 |

| Credit limit | Equal to the amount of your security deposit |

| APR | 26.24% variable |

| Annual fee | $0 |

| Late payment fee | Up to $35 |

| Foreign transaction fee | 3% |

| Balance transfer fee | 3% of each transaction (minimum $0) |

| Grace period | 21 days |

Pros and cons of Balance Transfer Cards For Bad Credit

There are few Balance Transfer Cards For Bad Credit cards for people that offer preferential interest rates on new purchases. A balance transfer fee will also likely add to your debt immediately in addition to the transfer fee.

You should also have a solid repayment plan before taking out a loan.

Transferring balances will only help you achieve something other than moving debt from one place to another if you’re very serious about debt repayment. You might even end up with more debt if you transfer balances to new cards with more available credit and continue to spend as normal.

The other option is to obtain a credit card with a lower interest rate than you currently pay. In this case, even after paying a balance transfer fee, it may help you lower your debt faster. Your card usage will be disciplined if you are disciplined.

What to Consider When selecting Balance Transfer Cards For Bad Credit?

Here are some factors to consider when selecting a Balance Transfer Cards For Bad Credit –

- Consider transferring credit card debt from a high-interest credit card to a balance transfer credit card with a lower interest rate. You can save money on interest and pay down your debt faster with these cards, which offer 0% or low-interest rates on transferred balances.

- There are, however, a few things to consider before choosing a balance transfer card. Ensure the card’s balance transfer fee doesn’t cancel out any potential interest savings. These fees are typically a percentage of the transferred amount.

- You should also consider the length of the 0% intro APR period and the regular APR that kicks in afterward. Last, only apply for one credit card at a time since the process can temporarily affect your credit score.

- A balance transfer card with all the features you need can help you get closer to financial freedom if you conduct thorough research and take some time to consider what you need.

Should You do Balance Transfer with Balance Transfer Cards For Bad Credit?

If you have a poor credit score, you might still be approved for a balance transfer credit card, but it’s not necessarily worth it. The best unsecured credit card for bad credit might be something other than an unsecured credit card with balance transfer terms, even if you can get approved.

A secured credit card might be an option for people with poor credit, but they could be better for balance transfers. The credit limit on secured credit cards is typically equal to or close to the deposit amount because collateral is used to secure the card. A secured credit card is optional if you have the cash to use as collateral, but paying off your debt instead would be a better option.

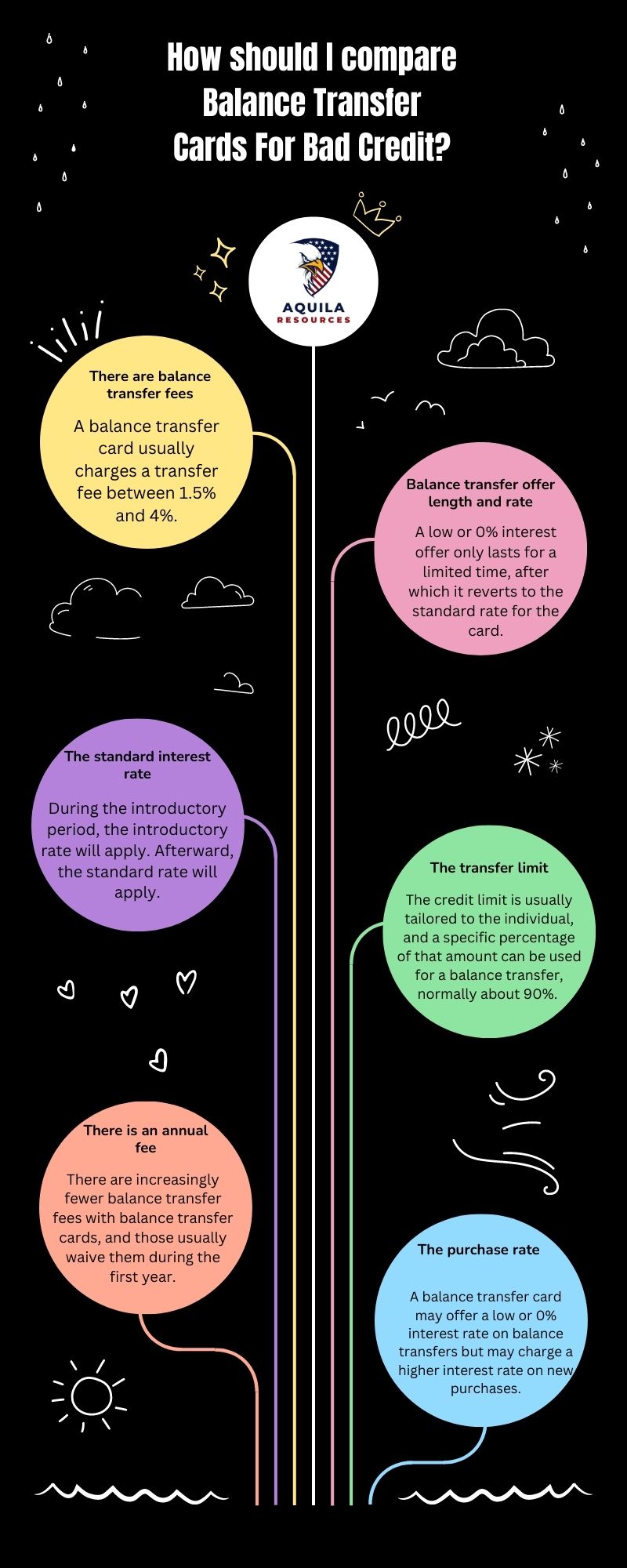

How should I compare Balance Transfer Cards For Bad Credit?

After checking your eligibility, you’ll be able to find out which balance transfer deals are available to you. If you are fortunate enough to have a lot of options, you can compare offers based on the following factors.

Here are some Factors that you can compare while choosing Balance Transfer Cards For Bad Credit –

Does Balance Transfer Cards For Bad Credit Affect Your Credit Score?

Your credit score can take a hit with a new line of credit inquiry, but if you lower your credit utilization, you may find that your score rises. Your credit score can be impacted by applying for a new balance transfer card, but you can’t predict exactly how it will affect your score.

If you transfer a balance to a new card and the new card’s credit limit is close or at or above your old card’s total limit, your score may also be affected. Your debt-to-available credit ratio determines a significant part of your credit score.

The balance transfer will help you reduce your debt load more quickly, which will positively impact your credit score in the long run due to a lower overall loan balance.

FAQs Related to Balance Transfer Cards For Bad Credit

Is It Possible to Obtain a Balance Transfer Card with Bad Credit?

A balance transfer card may technically be available to those with bad credit, but the lenders want to avoid taking on the risk. Credit card companies often resist the issue of credit cards with low credit scores.

Can I Get a 0% Balance Transfer Card for Bad Credit?

A low credit score will likely prevent you from qualifying for the longest 0% balance transfer cards. Alternatively, apply for a balance transfer card with a low interest rate instead of a 0% deal to help you pay off your debt.

What Credit Score Do You Need to Get a Balance Transfer Credit Card?

The Experian credit bureau, one of the three main credit bureaus, suggests a credit score of 670 or more to be eligible for a balance transfer card. The higher your score, the larger your credit line and other benefits you can get. Credit Cards for 650 Credit Score are also available, but they may have higher interest rates and fees.

Add Comment