Are you looking for Best Cash Back Credit Cards? If Yes, Then you are at the right place.

In this article, we are sharing all the information about Best Cash Back Credit Cards.

You’ve come to the right place if you’ve wondered how to save on everyday expenses. There are plenty of ways to earn cashback rewards using cashback cards, including shopping online, gas, and streaming services. A cashback card can meet your needs in a variety of ways. Cards with flat cashback rates, rotating bonus categories, or tiered rewards are available.

Cash Back Credit Cards is one of the best you can get, giving you 1% to 10% cash back – often for no annual fee. Cashback credit cards are a good choice for those just starting to use them since they don’t require much effort.

Credit cards that offer Cashback are the best gift ever. Cashback cards offer you a percentage back each time you spend with them, just like automatic coupons. Cashback cards aren’t as universal as they seem, and choosing the one that best fits your needs is not simple.

Cash Back Credit Cards that is right for you will typically depend on where you spend the most money, how much you spend on credit cards, and what other benefits you seek. We found the Best Cash Back Credit Cards based on our analysis of hundreds of cards from different issuers. The following is our ranking of the best Cash Back Credit Cards across several categories.

If you are looking for Best Cash Back Credit Cards, these are the best options:

| Credit Cards | Details |

|---|---|

| Wells Fargo Active Cash Card | Read Details |

| Citi Double Cash Card | Read Details |

| Discover it Cash Back | Read Details |

| Capital One Savor Cash Rewards Credit Card | Read Details |

| Chase Freedom Unlimited | Read Details |

What are Cash Back Credit Cards?

Contents

- 1 What are Cash Back Credit Cards?

- 2 How Cash Back Credit Cards Work

- 3 What Are the Different Types of Cash Back Credit Cards?

- 4 How to Choose a Cash Back Credit Card?

- 5 Top 5 Best cash back credit cards

- 6 How to Apply for Cash Back Credit Cards?

- 7 Video Guide For Best Cash Back Credit Cards

- 8 Who Should Get Cash Back Credit Cards?

- 9 Different Ways to Maximize Cash Back Credit Cards

- 10 What Are the Pros and Cons of Cash Back Credit Cards?

- 11 Can I Get Cash Back Credit Cards With Bad Credit?

- 12 FAQs

Credit cards that offer Cashback allow you to earn rewards on your card spending and redeem them for checks, bank deposits, or statement credits. Cash Back Credit Cards could give you Cashback on every purchase. Suppose you earn 1% cash back on every purchase with your card. You get $10 back on just spending $1,000 with this card. It might not seem like a lot, but it adds up over time. Spend $1,000, and you’ll get $10 back.

There are some best credit cards for online shopping offer high cash back rewards on purchases. This is because online shopping is often more convenient and affordable than shopping in-store, so it makes sense to use a credit card that can help you save money on your purchases.

How Cash Back Credit Cards Work

Understanding how Cash Back Credit Cards work is important before looking at the best cards. Basic cash back credit cards work the same way as travel rewards cards. Some cashback cards offer sign-up bonuses, but those are typically smaller. There are some exceptions to this, but traditional travel cards tend to offer high-point bonuses.

Cashback rewards are available on everyday purchases beyond the sign-up bonus. Earn Cashback every time you make a purchase using your credit or debit card. Some cards offer up to 6% cash back, but most offer 1% to 2% cash back. There is a difference between cash back cards and travel rewards cards when redeeming the Cash back.

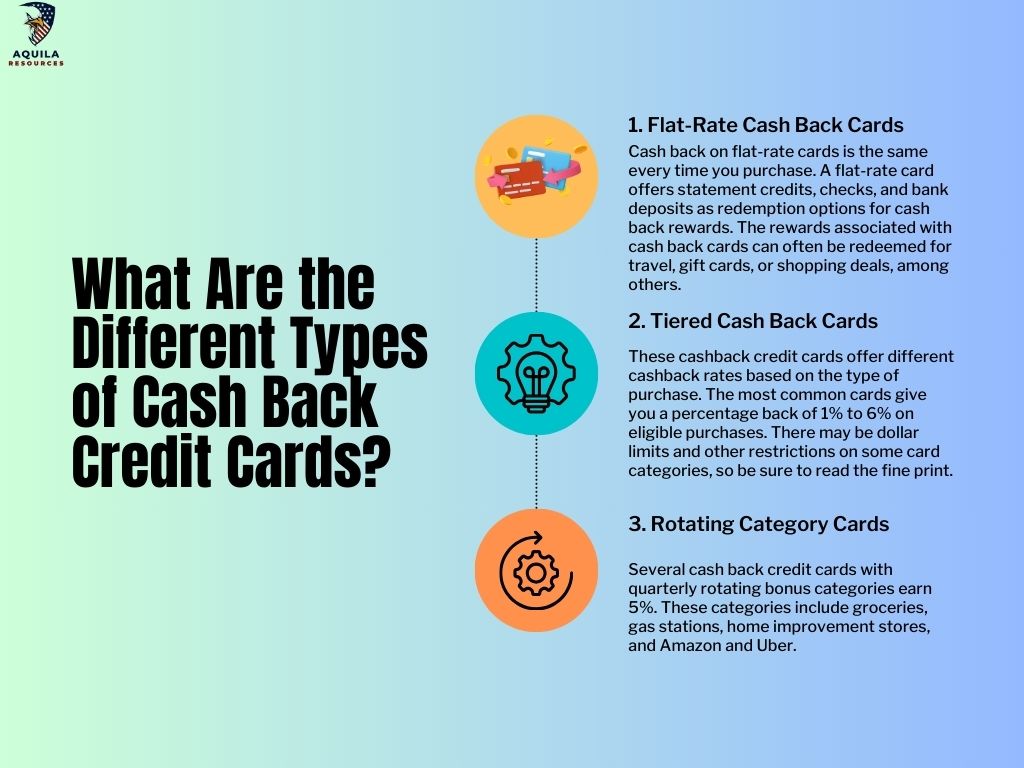

What Are the Different Types of Cash Back Credit Cards?

Cash Back Credit Cards can be categorized into flat rate, tiered Cash back, and rotating category cards. These are the different types of cash back credit cards you need to know:

Flat-Rate Cash Back Cards: Cash back on flat-rate cards is the same every time you purchase. A flat-rate card offers statement credits, checks, and bank deposits as redemption options for cash back rewards. The rewards associated with cash back cards can often be redeemed for travel, gift cards, or shopping deals, among others.

Tiered Cash Back Cards: These cashback credit cards offer different cashback rates based on the type of purchase. The most common cards give you a percentage back of 1% to 6% on eligible purchases. There may be dollar limits and other restrictions on some card categories, so be sure to read the fine print.

Rotating Category Cards: Several cash back credit cards with quarterly rotating bonus categories earn 5%. These categories include groceries, gas stations, home improvement stores, and Amazon and Uber.

To earn rewards, the bonus categories must be activated online every quarter. Additionally, you will have to track your spending since there is a limit of $500 for each 5% bonus category.

How to Choose a Cash Back Credit Card?

Cash Back Credit Cards are primarily designed to reward you with points, categories, and an annual fee. The rewards and the annual fee go hand in hand since you want to make sure you can cover the fee but still earn a profit from the program.

You can select a rewards card that rewards you no matter what you purchase or gives you perks no matter what you buy. If you choose a credit card specializing in essential purchases such as gas and groceries, you can further maximize your rewards.

It is also important to consider any additional card perks. It is possible to temporarily avoid interest charges on new purchases with Cash Back Credit Cards, for example, by offering a 0% APR on the first purchase. A purchase protection plan or extended warranty will also protect your purchases against damage or theft.

Top 5 Best cash back credit cards

It is easy to earn and use Cashback. Every time you use your credit card, you will receive rewards as a percentage of the purchase. For instance, your card would give money back if you used it to pay for gas. You can put money back in your pocket by getting back money you would have spent regularly.

Cash Back Credit Cards can serve many purposes. Cardholders can choose flat-rate cards, which earn the same amount no matter their purchase, tiered cards, which have a higher rate on specific purchases, or cashback cards with bonus categories updated every quarter. The following are some of the best.

Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card ranks highly in our list of best cash back credit cards the best 2% cash back credit cards. There are no bonus categories to manage because it earns flat reward rates on all purchases – 2% cash rewards on purchases. You can use your Wells Fargo Rewards to earn cash rewards in various ways in our guide to earning and redeeming Wells Fargo Rewards.

A bonus of $200 cash rewards is offered as part of the no-annual-fee card’s welcome offer after purchasing $500 in purchases within three months of account opening. The card also offers new account holders an introductory APR of 0% on purchases and qualifying balance transfers for 15 months (followed by an APR of 20.24 percent, 25.24 percent, or 29.99 %). You can use this if you must pay off a large expense over time.

Wells Fargo Active Cash Card offers a good array of benefits that include cell phone coverage, roadside assistance, travel emergency assistance, and Visa Signature Concierge services. If traveling outside the US, you’ll want to pack a different card, as it charges foreign transaction fees.

Citi Double Cash Card

Citi Double Cash Cards once ranked as the best flat-rate cash back cards on the market, offering more benefits and the same effective cash rewards rate.

The Citi Double Cash Card still offers decent flat-rate rewards on all purchases without an annual fee. The card earns 1 point for every dollar you spend and 1 point for every dollar you pay your bill. (This is worth 2% back in cash back). Citi Double Cash Card is a good choice for those who want straightforward rewards when they spend.

In addition, the Citi Double Cash Card offers an advantage if you’re interested in opening a balance transfer credit card. The intro APR on balance transfers is 0% for 18 months (followed by a variable APR of 19.24% – 29.24%) for new cardholders.

Note: Citi Double Cash Cards have few other benefits, so you should choose it if you want a balance transfer offer specifically.

Discover it Cash Back

A Discover it Cash Back card could be a great fit if you prefer Cash back over points and like rotating bonus categories. You can earn 5% cash back on up to $1,500 combined spending in popular rotating quarterly bonus categories (then 1%) when you activate. The combined 5% cash back at Amazon.com and Target on up to $1,500 purchases after enrollment, followed by 1% everywhere else.

Discover offers new cardholders a different kind of welcome bonus. Instead of the traditional welcome bonus, you will receive a $100 reward every time you earn rewards with the Discover Cashback Match card after your first 12 months of using it. If you’re a big spender, earning up to 10% back in your first year can be quite rewarding.

Capital One Savor Cash Rewards Credit Card

This Capital One Savor Cash Rewards Card is very good if you have a credit score of 700 or higher and enjoy dining and entertainment a lot. Capital One Savor offers 4% cash back on dining, entertainment, and popular streaming services. Also, it gives back 3% on grocery purchases and 1% on everything else. The Capital One Savor Card offers a $300 cash back bonus for spending $3,000 within three months, which is more than an appetizer.

The card offers 3% cash back on dining, grocery store purchases (excluding superstores such as Walmart and Target), entertainment, popular streaming services, and 1% on all other purchases. Using the Capital One Travel website, you can earn 5% cash back on hotels and car rentals.

Chase Freedom Unlimited

The Chase Freedom Unlimited offers 1.5 – 5% cash back on purchases and does not have an annual fee. You will also receive a matching cash back reward for your first year as an anniversary present from Chase. There’s more to the Chase Freedom Unlimited card than meets the eye. Additionally, purchases and balance transfers are eligible for an introductory APR of 0% for 15 months.

The Chase Freedom Unlimited card could be right if you want a card with good bonus categories and decent rewards on nonbonus spending. Travel purchases made through Chase Ultimate Rewards earn 5% cash back (5x points), dining and drugstore purchases earn 3% cash back (3x points), and everything else earns 1.5% cash back (1.5x points).

Chase Freedom Unlimited has no annual fee, and you can get a 0% intro APR for 15 months on purchases and balance transfers. There is a variable after that, which ranges from 20.49% to 29.24%. You can take advantage of that introductory offer if you make a major purchase soon.

How to Apply for Cash Back Credit Cards?

Here are the steps to getting a Cash Back Credit Cards:

- Choose a Card that Fits Your Budget: Spend a few minutes analyzing your spending habits to determine which categories you spend the most on each month, such as groceries, dining out, and gasoline. You can then find cards with high reward rates in those categories.

- Visit the Credit card Issuer’s Website to Apply Securely: The fastest and easiest way to get a card is to apply online, although you can also apply in a bank branch or over the phone.

- Provide all of the Required Financial Information to the Issuer: Issuers generally require name, Social Security number, employment and income information, and personal identifying information. A hard credit pull will also be required so that the issuer can check your credit score.

- Reward Yourself Responsibly with the Card: Pay off your debts on time and in full each month by spending only what you can afford. Credit card debt and credit score damage could result if you do not pay interest charges and late fees.

Video Guide For Best Cash Back Credit Cards

Who Should Get Cash Back Credit Cards?

Nearly everyone can benefit from getting a small portion of their purchase back. Cash back is unlike travel points and miles in that you can use it however you want. The experts at our company believe that credit card rewards can be useful in helping you cope with today’s high prices and interest rates.

- Commuters: The gas price has reached record highs, making a cash-back credit card a great way to reduce the pain at the pump. Most credit cards allow you to earn up to 3 percent back at gas stations, but some offer up to 5 percent back. A card offering elevated cashback rates on transit may be helpful if you use public transportation or ridesharing instead.

- Those who Love Food: Cards with restaurant categories allow you to earn rewards when eating at fast-food restaurants and fine-dining establishments. Some include food delivery services. Also, if you earn rewards on your grocery card, you may get bonus categories such as bakeries or butcher shops.

- A Minimalist: Cashback cards appeal to even the most simple people – we’re talking longtime debit users. Cashback cards with flat rates and no annual fees are great for people who want to earn rewards without hassle. Some cards let you set up automatic bill payments and rewards redemptions so you can set it and forget it whenever you want.

- Students or Those New to Credit: A student card can help students establish their credit history faster. A cash back credit card can also help people new to credit, such as immigrants, build credit by the time they graduate and need a home or auto loan. Cashback cards are harder to obtain without a credit history, but some options exist.

- A Savvy Spender: Rewarding yourself with Cash back on a card that matches your spending habits is possible. Ensure you carry a card that rewards you well for your large and most frequent purchases and another card that gives you a flat rate for all other purchases.

- The Infrequent Traveler: Cashback cards are great for travelers who need to travel more to justify a premium travel card but still want to enjoy discounted travel. Cashback can be redeemed for plane tickets or hotel stays because you have more flexibility.

The Spender Type Tool at Bankrate can provide suggestions based on your spending habits. Get card recommendations tailored to your spending habits based on the spender type you most closely identify with.

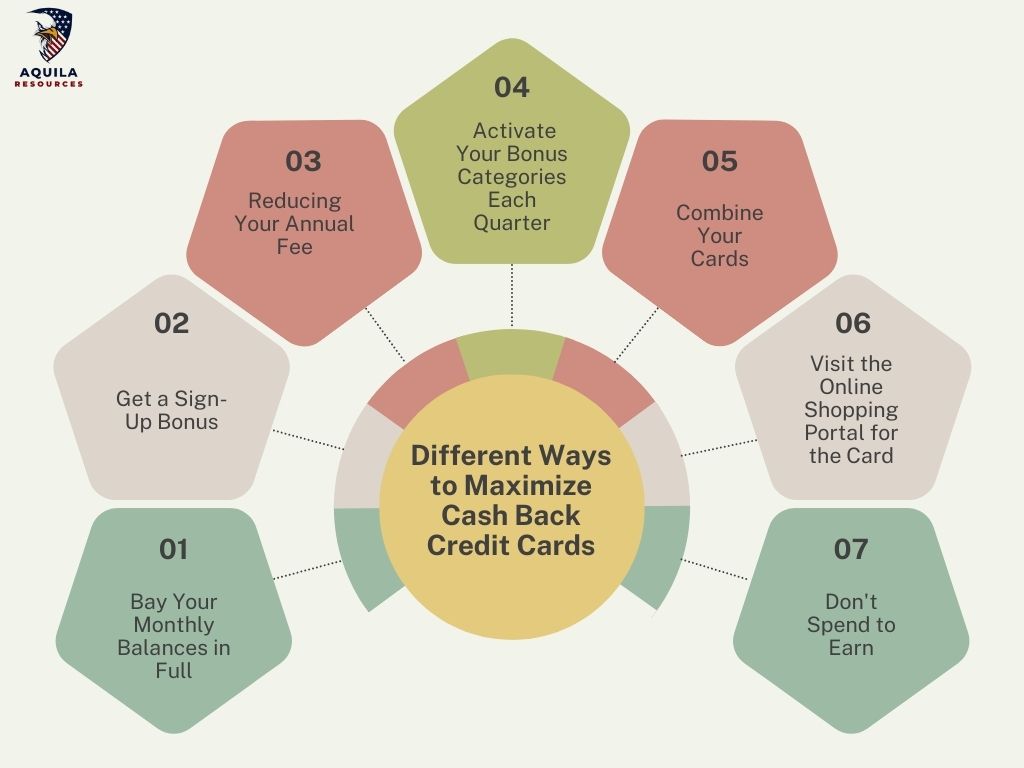

Different Ways to Maximize Cash Back Credit Cards

The following tips ensure you get as much cashback as possible from your Cash back credit cards.

- Bay Your Monthly Balances in Full: If you don’t, you’ll lose your cashback (plus interest). The best practice is to pay your monthly balance in full, regardless of your credit card type.

- Get a Sign-Up Bonus: As a new cardholder, spend a certain amount on a cash back credit card within a prescribed period to earn bonus rewards. To meet the spending requirements, only spend what you can afford, or you might carry a balance and lose rewards.

- Reducing Your Annual Fee: It’s important that your cashback rewards exceed the annual fee of your credit card, if it has one. An annual fee may make the card’s value difficult to justify.

- Activate Your Bonus Categories Each Quarter: A rotating category card typically requires you to enroll or activate the bonus cash back categories for the upcoming quarter to earn the higher bonus rate. Your earnings will be standard if you don’t.

- Combine Your Cards: It is best to use a combination of cards. Make sure you cover all of your major spending categories to earn the maximum amount of rewards.

- Visit the Online Shopping Portal for the Card: Several card issuers provide rewards or discounts for online shopping through their shopping portals. You can maximize the benefits of a flat-rate card in this way.

- Don’t Spend to Earn: A small percentage of cash back won’t make it worth spending more than you normally would.

What Are the Pros and Cons of Cash Back Credit Cards?

Pros of Cash Back Credit Cards

| Pros | Details |

| Earnings Can be Easily Understood | Keeping track of how much cash back rewards you have earned and what the rewards are worth is easy. A cent back means you will get one cent for every dollar spent. |

| Cashback Rewards Can be Redeemed Easily | It is possible that you must have a certain amount of rewards – for example, $25 – to redeem them. |

| You can Earn Rewards in Many Different Bonus Categories | Cashback rates are higher on some cards when you make certain purchases. A certain card offers bonus categories that change throughout the year so that you can earn rewards at different times. |

| Getting a Bonus for Referring Friends is Possible | It is easy to keep track of how much cash back rewards you have earned and what the rewards are worth. A cent back means you will get one cent for every dollar spent. |

| It Adds Value to Use Cardholder Benefits | Additionally, they may offer access to special events, zero fraud liability, extended warranty coverage, purchase protection, rental car insurance, roadside assistance, and reimbursement for lost luggage. |

Cons of Cash Back Credit Cards

| Cons | Details |

| Excellent or Good Credit Requirements | It is usually necessary to have a credit score of at least 670 to qualify for a cash back credit card. It is possible, however, to need a higher credit score for some credit cards. A student credit card may be a good option if you are new to credit and in college. The best credit cards for building credit if you aren’t a student and you’re building credit for the first time. |

| Requirements for the Sign-Up Bonus | You have to meet a spending requirement if you want to earn a sign-up bonus. Spending requirements vary from card to card but usually fall between $500 and a few thousand dollars and must be met within three months of account opening. |

| Tracking Bonus Categories | Using a card that offers rotating categories will allow you to earn the most CCashback, but you will need to keep track of the categories and the percentage of CCashback they offer. |

| Rewards may be Less Valuable | You may not be able to get more value from your cash back card because its point value is locked in. Different from co-branded hotel or airline cards, points can sometimes be redeemed at different rates. |

| Rewards Credit Cards have Fewer Perks | A travel credit card may be better if you like free checked bags and travel deals. |

| Fees | Your annual fees might exceed the cashback rewards you receive, depending on how you use a credit card. It’s better to get a low-interest credit card if you are going to carry a balance. Credit card debt can arise from carrying a balance. |

Factors to Consider When Choosing a Cash back Credit Cards

When choosing a cash back credit cards, you should consider the following:

1. Will you carry a balance

A cashback card usually earns between 1% and 6%. The issue with these cards is that they usually charge double-digit interest rates, so when you carry a balance, you’ll pay more than you earn back.

2. What does the reward structure look like

If you rarely use your kitchen, getting a card with high rewards on grocery purchases is pointless. You should choose a card based on your spending habits.

3. Are there any overlaps in features between similar cards

Card rewards may be the same, but one may offer extra perks like cell phone insurance or extended warranty protections if you pay with it.

Can I Get Cash Back Credit Cards With Bad Credit?

Getting approved for rewards credit cards usually takes a lot of work. If you’re rebuilding credit, you might boost your credit score with a secured credit card. Your security deposit usually determines your credit limit. You’ll improve your credit score; some secured credit cards even offer rewards.

Meanwhile, pay off your bills on time and keep a low balance if you get a credit card. Your payment history determines your FICO score, which is 65%.

FAQs

Do Cash Back Credit Cards Give You Cash?

The rewards on cashback cards can be redeemed as statement credits, checks, or direct deposits into your bank account. Cash back rewards you receive as checks or bank deposits are Cash.

Are Cash Back Credit Cards Worth It?

Cash back credit cards may be useful if you pay your balance in full each month. Check out annual fees and bonus category rates before signing up. Make sure you know the rewards program before you spend so you can take advantage of cash back opportunities.

Don’t carry a balance on these cards. The interest rates are higher, and carrying a balance can lead to debt. If you pay interest on a balance, you lose your rewards.

What’s the Highest Cash back Rewards Rate?

Cashback rates are generally 10%, but special promotions increase them. Most cards earn at least 1% across purchases, with a maximum of 5%.

Does Cash Back Expire?

Ensure your account terms and conditions tell you when cash back rewards can expire or how you might lose them. Your rewards are usually yours so long as your account is active. Some rewards require you to use them within a certain timeframe, so check the fine print. Make sure you redeem CCashbackoften to avoid inflation.

Add Comment