Are you curious to know about Best Cheapest Cars To Lease With No Money Down? You’re on the right page.

The advantage of Cars To Lease With No Money Down is that you don’t need to write a huge check at the time of pick-up of your lease car. This money can be saved instead. It’s common to hear of zero-down lease agreements, but can you lease a car without money down?

The process of obtaining Cars To Lease With No Money Down requires just as much research as that of acquiring a traditional lease. You should consider the following factors when trying to find a zero-down lease, regardless of the vehicle type you’re searching for. Certain caveats to zero-down leases may make them cost-prohibitive. A few avenues you can explore can help you drive off the lot in a leased vehicle without breaking the bank, though finding the Best Cheapest Cars To Lease With No Money Down can be tricky.

Let’s begin.

What Is Car Leasing?

Contents

- 1 What Is Car Leasing?

- 2 How Cars To Lease With No Money Down Programs Work?

- 3 Types of Cars To Lease With No Money Down

- 4 Best Cheapest Cars To Lease With No Money Down

- 5 How To Qualify For Best Cheapest Cars To Lease With No Money Down?

- 6 How To Lease A Car With No Money Down?

- 7 Advantages and Disadvantages of Best Cheapest Cars To Lease With No Money Down

- 8 Is It A Good Idea To Lease A Car With No Money Down?

- 9 Car Leasing vs. Car Buying: Which is Cheaper?

- 10 FAQs

- 11 Conclusion

There is often a misunderstanding about leasing, even among car enthusiasts. Leases are temporary ownership arrangements in which you do not have to purchase the vehicle outright. A lease agreement with a dealership stipulates that you will be responsible for covering the car’s depreciation costs during the leasing period, which is usually two or three years.

In addition, you’re responsible for any additional fees or costs incurred during the lease period. The down payment required for purchasing a vehicle is usually much higher than that needed for leasing it. But when you sign the lease agreement, you must put some money down.

There are limits or specific requirements for the following in many lease arrangements:

- The mileage

- Models of vehicles

- The location

- Employment history

- The credit score

Additionally, the dealership’s inventory may be limited since a lease may be available only on certain trims. It’s, therefore, a good idea to inquire about new leasing offers as soon as they’re advertised before the dealer’s supplies run out.

How Cars To Lease With No Money Down Programs Work?

You can get Cars To Lease With No Money Down deal, but that doesn’t mean you can drive away with a new car if you have no money. You still have to pay fees, sales tax, and your first month’s payment.

The process of putting together lease deals that don’t require a down payment starts with an understanding of how leasing works. If you finance a car, you will have to pay interest on top of the borrowed amount if it is financed. You pay the entire negotiated price for the car when you purchase it.

Letting a car is only about paying the depreciation over the life of the lease, plus a few fees and interest (called the money factor). A depreciation estimate is based on how much the car is expected to be worth at the end of the contract. They come up with a number called residual value.

Types of Cars To Lease With No Money Down

There are several advantages to leasing a car for no money down, but you should know how leasing works to understand whether the deal is right for you or not.

Capital Cost Reduction Zero-Down Lease

While you won’t pay a down payment for this kind of lease, you’ll still have to pay the first month’s rent at signing, as well as any applicable fees.

No Down Payment, and Dealer Makes the First Payment

You can lease a Honda or Acura vehicle with no money down if the manufacturer pays the first month’s payment. You will only be responsible for the initial fees since the company waives the payment.

Capitalized Reduction Costs and No First Month’s Payment

As an incentive to sign, some dealers will let you skip your first month’s lease payment, rolling it into your lease and only requiring you to pay your state’s fees. With this option, you will be able to eliminate both the capitalized reduction cost and the first month’s payment; however, you will pay more for future monthly payments.

Sign and Drive/Zero Due at Signing

There are several lease options available, but “sign and drive” might be the most appealing. Fees and payments are automatically rolled into the lease contract by the dealer.

You shouldn’t assume that no-money-down leases are good deals just because a dealer offers them. It’s not uncommon for lease agreements to cost more in the long run as a result of added fees, interest, and increased monthly payments.

Best Cheapest Cars To Lease With No Money Down

Ford Fusion

Fusion replaced the Mondeo for the Latin American market – except in Argentina and Canada. Fusion replaced the former mid-size Taurus and the compact Contour in the US and Canada (where it replaced the then mid-size Taurus and compact Contour). This model is sold alongside the Mondeo in the Middle East and sits between the compact Ford Focus and the full-size Ford Taurus. There is no more affordable sedan than the 2017 Ford Fusion SE, which costs just $139 a month for 24 months, with $2,179 due at signing. Over the lease term, the total cost of driving 21,000 miles is $5,515 without any fees included.

Honda Civic

The Civic has been a faithful servant for 11 generations. There’s plenty of drive in this economy car thanks to its eager chassis and rev-happy engines. There is a $100 price difference at signing and $10 per month between the base LX sedan and the base Accord LX sedan. A $200 signing payment discount and $10 less per month are available to Honda owners and lessees of 2014 or newer models. There are certain markets where the Civic Hatchback LX is available at a similar price. There are a lot of body styles and sizes available from Honda at these minor price differences. Civics have been faithful servants for 11 generations. It is an economy car with an eager chassis that runs continuously and an engine that revs happily. There is a $100 difference in cost at signing and a $10 difference in monthly payments between a base LX sedan and a base Accord LX. There are a variety of body styles and sizes available from Honda at these minor price differences.

Mazda CX-30

Mazda offers a lease deal for the CX-30 starting with a “1” for just three grand down. Only Southern California is offering this deal for the base CX-30 2.5 S, which comes standard with all-wheel drive and looks like a mini Ferrari Purosangue. A pretty good car for a great price is still a great deal if you live in the Midwest and Southeast. There is little interior space, but the seats are very comfortable. You might not find deals like this in other parts of the country due to Mazda’s leases being regionally different. Mazda owners receive a $500 loyalty discount on top of the price based on 10,000 miles a year. In addition, Mazda offers a $500 conquest bonus for customers coming from competing brands.

Toyota Prius Prime

As well as the Prius Prime in North America, South Korea, and New Zealand, Toyota sells the Prius Plug-in Hybrid (often abbreviated as the Prius PHV). Everything about the Prius Prime goes up except the lease price. The Toyota Prime has 99 more horsepower (220 total) and 19 more miles more battery life (up to 44) than the previous generation. But while the price has gone up, it’s being discounted by $4500 in select markets. With the smallest wheels, the SE delivers the best fuel economy (52 mpg combined and 127 mpg in electric mode, which is better than many EVs). It costs a lot to sign, but then it’s cheap after that.

Chevrolet Trax

The new Chevy Trax offers more space and more value than ever before. A once dreary subcompact gets a dazzling redesign and advanced safety features. Front-wheel drive is standard on all Trax models. A turbocharged three-cylinder engine produces 137 horsepower and is paired with a six-speed automatic transmission. Despite being thousands cheaper than other subcompact SUVs, it looks, feels, and drives like a premium vehicle. Also, it’s surprisingly spacious. This lease includes an 11-inch touchscreen and a turbo inline-three, even in the base LT. It is only available to current lessees of vehicles purchased in 2019 or later.

Jeep Wrangler

A head-turning $259 lease deal makes it easy to go green in the Northeast with the 2024 Jeep Wrangler 4xe. This deal brings the effective lease cost of the Wrangler 4xe Willys Edition down to $389 a month through April 1st. Considering its MSRP is nearly $60,000.

A plug-in hybrid Wrangler can get as much as $11,000 per year in lease cash, unlike the gas-powered model. Unfortunately, there are some catches to be aware of. This deal is based on an annual mileage allowance of just 7,500 miles. Additionally, it comes with a loyalty discount that is only available to current FCA lessees.

Hyundai IONIQ 6 Sedan

Leasing an EV doesn’t need to cost an arm and a leg. Hyundai is offering a $249/month lease deal on the 2024 IONIQ 6 SE Long Range through April 1st. These killer deals will continue into March for the Hyundai IONIQ 6. The offer includes a 10,000-mile allowance per year.

Volkswagen Taos

We tested the Taos on the highway and found it to have a spacious interior and 40 mpg, but its drab styling and soft handling weren’t up to the Golf’s standard. The Taos continues to be our preferred subcompact SUV over the Kia Niro and Subaru Crosstrek. The base Taos S is equipped with a turbo 1.5-liter four-cylinder engine and includes two years of maintenance. The additional monthly payment for all-wheel drive is just $10.

How To Qualify For Best Cheapest Cars To Lease With No Money Down?

There are some people who will not be eligible for Cars To Lease With No Money Down. The dealership or leasing company may allow you to pay nothing down on your lease in the following ways:

- Most zero-down leases are offered only to lessees with excellent credit scores, which increases their chances of qualifying for this type of lease.

- The right lease deal might allow you to score a zero-down lease with a little persuasion. The first step in negotiating a zero-down lease is to agree on a price before you mention leasing.

- Some cars sell more quickly than others. If you express an interest in making a deal, you might be able to negotiate a better price on a low-demand car.

- A leasing company may offer Cars To Lease With No Money Down to clear out inventory before new items arrive.

- If your co-signer has a higher credit score, you will be more likely to qualify for Cars to Lease With No Money Down.

A zero-down lease is more likely to be approved if your credit score is at least 680. Take the time to shop around for leasing companies and dealerships that offer the best deals. You can also improve your credit score in order to qualify for a zero-down lease. Keep your credit card balances low, pay your bills on time, and pay off debt to improve your credit score.

How To Lease A Car With No Money Down?

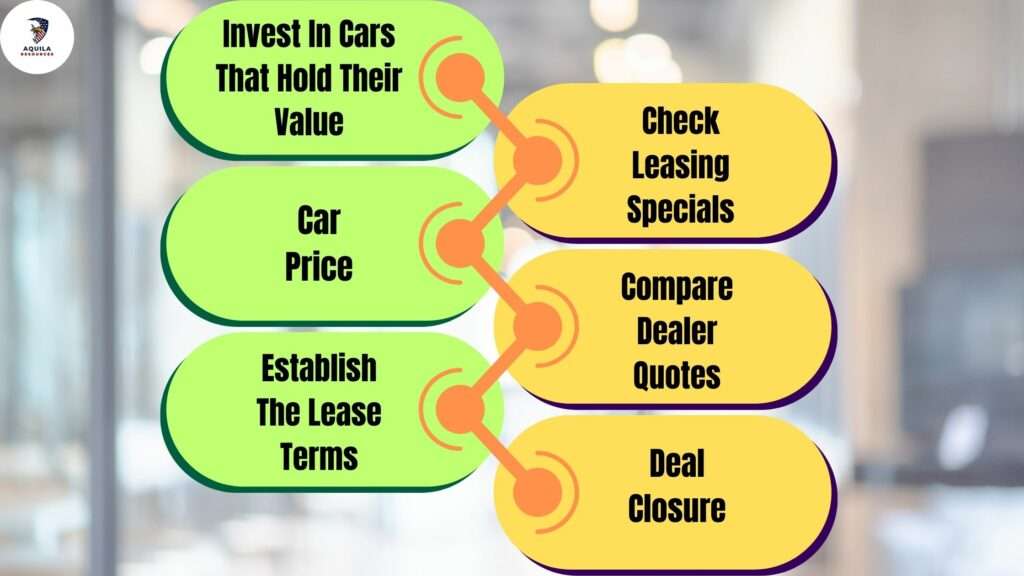

Here are some tips you can use to simplify the Cars To Lease With No Money Down process if you decide it’s right for you.

Invest In Cars That Hold Their Value

Those who lease a vehicle are responsible for depreciation, interest, tax, and some fees. You will pay less for a lease on a car that holds its value or depreciates less. The residual – the amount you’re left with – is still high when your lease term ends for a car with good resale value. As a result, a lease with a higher residual value will generally result in lower monthly payments.

Check Leasing Specials

It is common for manufacturers to advertise special leasing offers, such as lower monthly payments or lower interest rates. Despite the fact that such incentives can reduce lease costs, it is important to check for any hidden fees before accepting any offer. For example, some manufacturer leases may include drive-off fees, which are similar to down payments and are paid upfront.

Car Price

To determine the fair market price of the Cars To Lease With No Money Down, use pricing guides such as Kelley Blue Book, Edmunds.com, or the National Automobile Dealers Association. You’ll then have a better idea of what you’re likely to pay when you lease and be able to negotiate more effectively.

Compare Dealer Quotes

Contact multiple dealers to request and compare car price quotes once you have a target sales price. It is easier to compare quotes by contacting dealers by phone or via email rather than visiting a car lot in person, and it relieves some of the stress involved in negotiating.

To determine which option is best for you, compare your price quotes with the estimates you received from pricing guides. Additionally, you can shop around to see if other dealers can beat your lowest offer.

Establish The Lease Terms

After deciding what vehicle to lease and who to lease it from, the next step is to negotiate and understand the lease terms. It is always possible to negotiate the lease terms. Your monthly payment will be affected by the interest rate you pay. Lease factors or money factors are terms used to describe interest rates in leasing. It is different from interest rates to display money factors.

Deal Closure

Ensure the lease contract matches the price and terms you agreed on (lease term and mileage) and that there are no hidden fees. Ensure the lease contract includes gap insurance, which covers the difference between the cost of damages and what your insurance will reimburse you if your car is stolen or damaged.

There are some lease contracts that do not automatically include gap coverage. If you’re seeking cheap full coverage auto insurance with no payment, it’s crucial to review the terms of your lease agreement carefully to ensure you’re adequately protected.

Advantages and Disadvantages of Best Cheapest Cars To Lease With No Money Down

Advantages

- Cars To Lease With No Money Down offer attracts so much attention for obvious reasons. Your upfront costs will be much lower without a down payment. You may not have to borrow a large sum of money to start your lease if you can just file monthly payments. It is much simpler and easier to start a lease this way.

- In addition, you will pay taxes much slower if you don’t put down a down payment. Instead of adding a large tax to your upfront expenses, you’ll be taxed a small amount on each monthly payment. Of course, your monthly payments will eventually cover the down payment, just as the taxes will eventually add up. It makes tax payments easier to manage.

- As a result, you’re at less financial risk in the event of an accident. In the event that the car is totaled or stolen, any insurance payments go to the leasing company. Regardless of whether the accident happened on the way home from the dealership, your down payment would be lost forever. The only thing you lose if the car is totaled with a zero-down contract is the registration and documentation fees. It’s possible to start over from scratch.

Disadvantages

- The upfront payment on one side, the payments over the lease period on the other. A reduction in weight on one side results in a reduction in weight on the other side. The difference will have to be made up somehow. A down payment can also be referred to as a reduction in cap costs. It usually offsets the total cap cost you are paying every month. If there is no down payment, you must pay more every month.

- The money factor (or interest) is part of your monthly payment. A higher monthly payment rate means a higher interest rate. If you raise the monthly payment enough, you may end up paying substantially more than you would have had you made a down payment. Of course, it depends a great deal on your rate of interest, which is determined by your credit score. It is up to you to do the calculations.

- It can also be difficult to get approved for Cars To Lease With No Money Down. A customer with a “Tier 1” credit score is usually eligible for these offers. The zero-down lease offer is often used as a marketing tool in this way. In the short term, they’re an easy way to get people through the door, but in the long run, they’re not available to the customers who’ve already shown interest in the car. Even if you don’t have Tier 1 credit, you still have a chance of getting a no-down-payment loan. The lease requires a cosigner with good credit. Essentially, this person will be your financial backup if you cannot make your monthly payments.

Is It A Good Idea To Lease A Car With No Money Down?

Leasing a car instead of buying one can avoid the price of vehicle depreciation. You also save money by avoiding car payments and routine maintenance. The newest model vehicles are also available without incurring all the ownership costs.

In the long run, leasing vehicles typically cost more than buying them. The dealership still owns the vehicle, so you’re not really free to do anything with it. You may want to consider another option if you prefer to own a vehicle.

Car Leasing vs. Car Buying: Which is Cheaper?

The short-term cost of leasing a car is generally lower due to less stringent down payments, lower monthly payments, and minimal maintenance.

Over time, you may save more by buying a car since you’ll keep all the equity you build as you pay off the loan. You won’t have a monthly payment if you keep the car after you pay off the debt.

You must consider how often you will swap cars to find out which option is the most cost-effective for you. A leasing vs. buying calculator can help you determine what the costs will be for your situation.

FAQs

Is It Better To Lease A Car With No Money Down?

The fact is that putting down money upfront might be a good idea if you’re leasing a car with a high selling price and a high money factor. However, if you are leasing a car with special incentives and low rates, you might be able to begin the lease without putting down any money.

Are Leasing Cars Cheaper?

Leases typically cost less in the long run because they require less down payment, lower monthly payments, and little maintenance and repair. As you pay down your loan, you will retain all the equity you build, so you may be able to save more.

Conclusion

You may not be able to obtain Cars To Lease With No Money Down unless you have a near-perfect credit score. There are some zero-down lease deals that are not cost-effective, especially if those fees appear elsewhere in your lease contract. It can be worthwhile to find zero-down lease agreements if they are properly structured, but they are as rare as they are few.

Add Comment