Are you looking for the Best Travel Credit Cards for Travelers? If Yes, You are at the right place.

In this article, We are sharing all the information about the Best Travel Credit Cards for Travelers.

If you travel frequently or occasionally, having a travel rewards credit card is helpful. You can collect points or miles from every purchase using a good travel card and redeem them for flights, hotels, or other travel arrangements.

Several travel rewards cards offer extra benefits, including free entry into airport lounges and statement credits toward TSA PreCheck and other airport security programs. A Best Travel Credit Cards For Fair Credit can help you save money when you travel, whether on business or for pleasure.

A travel card has various benefits, including a signup bonus and a rewards program. A general travel card may be a good option if you are looking for flexibility. However, airline-branded cards are available if you have a favourite airline.

What are Travel Credit Cards?

Contents

- 1 What are Travel Credit Cards?

- 2 How Does Travel Credit Cards Work?

- 3 Types of Travel Credit Cards

- 4 5 Best Travel Credit Cards

- 5 How to Apply for Travel Credit Cards?

- 6 How Do You Choose the Best Travel Credit Cards?

- 7 Pros and Cons of Travel Credit Cards

- 8 What are the Benefits of Travel Credit Cards?

- 9 How to Maximize Your Travel Credit Cards?

- 10 What are Travel Points and Miles Worth?

- 11 FAQs

Travel credit cards offer rewards and benefits related to travel. Bonus points are often available on travel spending, and a rewards system allows you to redeem points for travel. Travel credit cards offer benefits like trip insurance, airport lounges, and elite status.

Travel credit cards are rewards credit cards same as business credit cards that let you earn points, miles, or other travel rewards when you use them. The rewards-earning travel cards may also offer specific benefits, such as elite membership with airline or hotel loyalty programs, annual travel credits, tier-qualifying miles, airport security benefits, and access to airport lounges.

How Does Travel Credit Cards Work?

Travel rewards from a credit card work differently based on the type of points or miles you’ve accumulated. The best way to spend your earnings is to redeem them for travel.

Types of Travel Credit Cards

Travel credit cards come in various types, and they all work differently. Ensure you understand the different types of travel cards and how they work before choosing one.

Credit Cards with Transferable Rewards

Credit cards that offer flexible travel rewards typically allow users to redeem their rewards in various ways. A travel portal or fixed-value travel statement credit may be a way for you to use your points. Several airline and hotel partners can also accept flexible travel credit cards.

Credit Cards with Fixed Values

Some credit cards allow you to earn points/miles or cash back as rewards. The value of these cards can vary depending on the redemption type, but most have a fixed value when redeemed. The same point may be redeemed for 1.5 cents if it is used for travel but just 1 cent if it is redeemed for cash back.

Airline-Specific Credit Cards

Airline-branded credit cards offer frequent flyer programs that allow users to earn airline miles. Additionally, some cardholders are entitled to airline perks, including early boarding, free checked bags, discounts on inflight purchases, and even access to airline lounges.

Hotel-Specific Credit Cards

There are credit cards that offer exclusive benefits for hotels, such as elite hotel status or annual hotel credits. You can earn hotel loyalty points when you use a hotel-co-branded credit card for spending, which can be redeemed for free hotel stays, room upgrades, etc.

Business Travel Credit Cards

A business travel rewards card can be useful when travelling for work and keeping business and personal expenses separate. Credit cards for travel businesses have earning categories, annual fees, and perks similar to consumer cards.

5 Best Travel Credit Cards

There’s no way to believe that summer is coming to an end. Your travel plans should be fine as a result. Travel can become expensive if you’re already planning for 2023. Travelling is expensive, whether for hotels, airfare, or rental cars. With their rewards, perks, and welcome offers, travel credit cards can lower some of the costs.

A travel credit card, usually with an annual fee, offers perks that can expedite certain aspects of your trip while making it more pleasant. They’ll sometimes offer you vacation credits, travel insurance, and annual credits for your travel expenses. If you plan to use the card for travel, make sure the budget matches yours.

The following are some of the best travel credit cards–

Capital One Venture X Rewards Credit Card

Capital One Venture X Rewards Credit Card is an excellent choice for those seeking a travel credit card that pays for itself with rewards, benefits, lounge access, a rewarding earning structure, and flexibility in redeeming rewards.

The Venture X cardholder program at Capital One is going all in on travel, offering perks at hundreds of top hotels worldwide, a Premier Collection offering special perks at hundreds of top hotels, and a Lifestyle Collection offering global benefits at boutique hotels globally to its cardholders. Capital One Venture X Rewards Credit Card members can earn 75,000 bonus miles after making $4,000 purchases within three months of account opening.

- Annual Fee: $395.

- Rewards: Capital One Travel offers 2 miles per dollar on purchases, 5 miles per dollar on flights, and 10 miles on hotels and rental cars.

- Welcome Bonus: Once you spend $4,000 on purchases within the first three months of your account opening, you will receive 75,000 miles.

- Foreign Transaction Fee: None.

Wells Fargo Autograph Card

Wells Fargo Autograph Card rewards are available in many categories and can be redeemed as statement credits, travel booking credits or gift cards.

There is also a cell phone protection plan included with the card, along with travel and purchase protections and 24/7 roadside assistance. There are no foreign currency conversion fees with this Visa Signature card, and it offers access to the Visa Signature Luxury Hotel Collection benefits and perks, even though it does not offer the travel rewards of a premium travel rewards credit card.

- Annual Fee: $0.

- Rewards: Receive 3 points per $1 when you shop at restaurants, travel, gas stations, transit, and popular streaming services. You will also receive 1 point per $1 when you buy other items.

- Welcome Bonus: Earn 30,000 points after you spend $1,500 in purchases within three months of opening your account.

- Foreign Transaction Fee: None.

Chase Sapphire Preferred Card

There are generous rewards on travel and dining with the Chase Sapphire Preferred Card and a straightforward redemption program. This is an excellent choice for frequent travellers and those who are interested in maximizing their everyday spending.

Besides an annual 10% points bonus, cardholders can transfer points 1:1 to Chase’s travel loyalty partners and get a long list of purchase and travel protections, including primary auto rental coverage. As an added bonus, rewards earned on this card can be redeemed for travel at 25% more value when redeeming through Chase Ultimate Rewards. There are few travel cards that offer so much value at such an affordable price.

- Annual Fee: $95.

- Reward: Chase Ultimate Rewards members earn 5 points for every $1 they spend on travel, 3 points for every $1 spent on dining, streaming services, and online grocery purchases, excluding Walmart, Target, and wholesale clubs, and 2 points for every $1 spent on travel.

- Welcome Bonus: You will earn 60,000 points after spending $4,000 within the first 3 months of opening your account.

- Foreign Transaction Fee: $0.

Wyndham Rewards Earner Plus Card

Many Wyndham hotels throughout the country offer value-priced accommodations along major highways and in small towns. This card offers high rewards on Wyndham-branded hotels and gas stations, making it perfectly suited for travellers.

The card comes with complimentary Platinum status in Wyndham Rewards, the second-highest level in the loyalty program. The status level provides flexible check-in and check-out times and the ability to choose a preferred room type. Those interested in owning a Wyndham timeshare can take advantage of an intro offer with this card.

- Annual Fee: $75.

- Rewards: You get 6 points per $1 spent on Hotels By Wyndham and gas, 4 points per $1 spent on restaurants and grocery purchases (excluding Target and Walmart), and 1 point per $1 spent on everything else.

- Welcome Bonus: A first-time customer can earn up to 45,000 points after spending $1,000 on purchases in the first 90 days, entitling them to six free nights at participating properties. The free nights are subject to availability at participating properties and may require up to 30,000 points per bedroom. There may be resort fees that cannot be paid with points.

- Foreign Transaction Fee: 0% of all U.S. dollar transactions.

The Platinum Card from American Express

Platinum Card from American Express offers more lounge access benefits than any other credit card. Potential statement credits have more than $1,000, so the high price point may be reasonable for some.

You will receive up to $200 in Uber Cash each year, an airline incidental fee statement credit of up to $200 (applicable to one qualifying airline of your choice) and a digital entertainment statement credit of up to $240 that can be applied toward certain streaming services. These benefits can only be accessed by enrolling.

- Annual Fee: $695.

- Rewards: You can earn 5 Membership Rewards points per $1 for flights booked directly with airlines or through American Express Travel. You can earn 5 points per $1 for prepaid hotel reservations made through American Express Travel.

- Welcome Bonus: Spend $8,000 on purchases in your first six months and earn 80,000 Membership Rewards Points.

- Foreign Transaction Fee: None.

How to Apply for Travel Credit Cards?

You can apply for a travel rewards card by following these steps:

- Choose a card based on your travel habits.

- Visit the issuer’s website to complete the secure application.

- Make sure you fill out all the required financial and personal information.

- Keep your card in good working order and pay the bill on time.

If you are using travel rewards, ensure they are redeemed in the most beneficial manner and take advantage of their perks whenever possible.

How Do You Choose the Best Travel Credit Cards?

Travel cards offer a variety of features you should consider when picking the right one for you, such as fees, rewards, redemption options, and additional benefits.

Foreign Transaction Fees: The card you’re eyeing should not charge you foreign transaction fees if you intend to travel overseas. Travel credit cards usually don’t have foreign transaction fees, but many credit cards do when you’re travelling abroad. These fees add up to about 3% of your transaction.

Annual Fees: If you plan on spending normal amounts on the card, ensure the rewards and benefits are enough to cover the annual Fee. The card’s benefits can be used to cover the Fee if you spend enough money and travel enough to use all of the card’s benefits. Travel cards without annual fees are better for travellers who don’t travel often throughout the year, but their perks may not be as impressive as annual statement credits.

Rewards: There are many factors to consider when choosing a travel credit card, but rewards are among the most important. You must choose travel rewards cards that match your spending, and you’ll be able to redeem them for something when you return. The best credit card is one that helps you manage your daily spending habits without the need to change them to fit the card.

Rewards Redemption: Some credit cards offer redemption bonuses for certain redemptions, and several credit cards offer point transfers to hotel or airline partners, which may give you a higher value per point than standard redemptions. The more options you have, the better your chance of maximizing your rewards.

Travel Perks. Finally, consider the card’s additional benefits. What are the benefits of the annual statement credits? Does it offer airport amenities such as access to lounges or a credit for Global Entry or TSA PreCheck application fees? It’s important to ensure you can utilize your premium travel card’s benefits to offset your annual fees.

Pros and Cons of Travel Credit Cards

Pros

- Travel costs can be offset with rewards

- Provides additional benefits and discounts for travel

- They are often bundled with travel insurance and protections

- When used outside the U.S., it may not charge foreign transaction fees.

Cons

- The cost of a more robust benefit package is typically higher

- The process of redeeming rewards can be confusing

- There may be a high spending requirement attached to large signup bonuses

- A good credit score is usually required

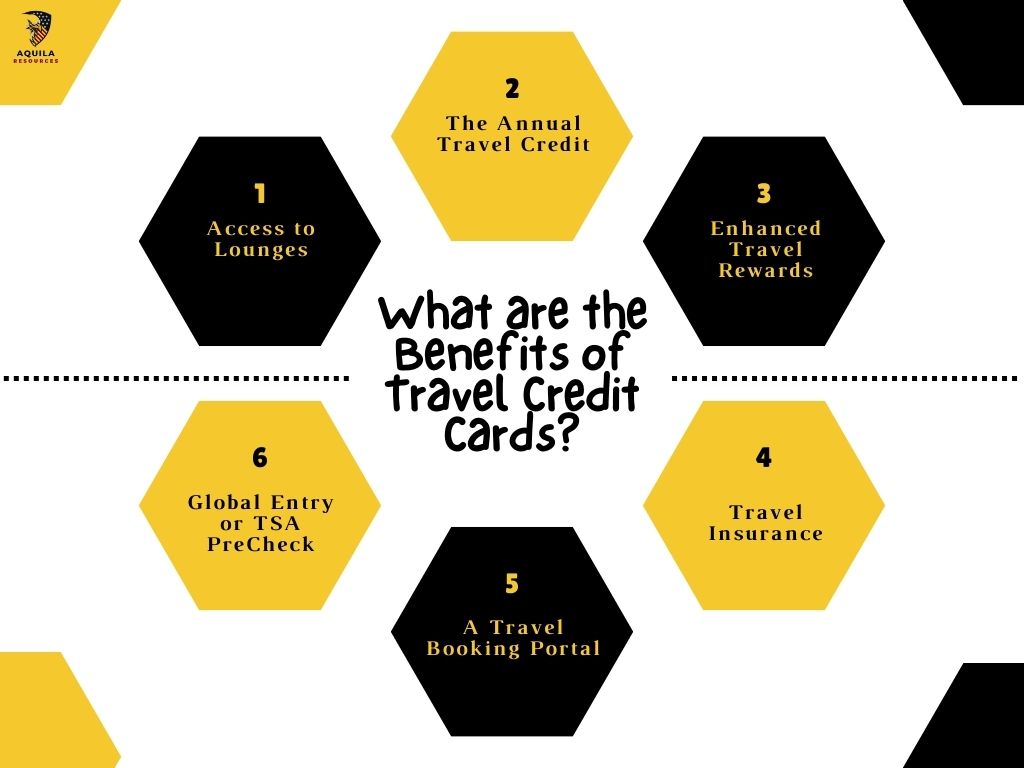

What are the Benefits of Travel Credit Cards?

There are a few purposes for which travel rewards cards are designed. Travel rewards programs can help you earn points or miles to redeem toward travel expenses, provide insurance against unexpected mishaps or upgrade your accommodations. Understanding what you’ll get before signing up for a travel card is important, as annual fees can range from zero to hundreds of dollars.

Among the benefits of a travel card are:

Access to Lounges

Credit cards offering access to airport lounges are common among premium travel credit cards. You can enjoy refreshments, lounges, and work areas while waiting for your flight.

The Annual Travel Credit

Most travel credit cards offer some form of annual travel credit, whether for hotels, flights or general travel purchases. Several types of travel cards offer these credits but typically come with annual fee-based cards.

Enhanced Travel Rewards

Travel credit cards offer higher rewards rates on travel purchases like flights and hotels.

Travel Insurance

Most travel credit cards offer various types of coverage, such as baggage insurance, trip delay insurance, trip cancellation insurance, trip interruption insurance, or collision coverage on a car rental. The details of each card will be found in the fine print.

A Travel Booking Portal

Several major credit card companies offer travel portals where you can book flights, hotels, rental cars, etc. Finding better deals using these portals is possible if you use your points or miles.

Global Entry or TSA PreCheck

The credit card issuer may offer the user a credit for TSA PreCheck or Global Entry. You can benefit from these programs if you frequently fly and want to get through security lines faster.

If you’re selecting a travel credit card, consider the combination of these travel perks and rewards rates.

How to Maximize Your Travel Credit Cards?

Please maximize your travel credit card’s rewards program and benefits to get the most out of it.

Organize Your Next Few Cards: You can keep a timeline of when you apply for different credit cards. Some issuers may have restrictions determining whether you will be approved for a card. Chase says you may be denied a credit card if you have opened five or more credit cards in the past 24 months. Furthermore, Wells Fargo prohibits new card applications if you’ve already applied for a Wells Fargo card in the last six months.

Time Your Applications for Bonus Offers: A credit card bonus can significantly impact your finances. A signup bonus can help you save on flights or hotels before you book your trip.

Manage Multiple Cards at Once: You may have to put in additional effort and planning to use multiple cards, but the effort may be worth it. You can earn points more quickly when you strategically use specific credit cards for specific earning categories. In addition, this can also save you money by allowing you to get the same points for less money.

Consider How You Can Redeem Your Points: You can redeem your points in various ways depending on your travel card. You can transfer to an airline or hotel loyalty program or use your issuer’s travel portal. The value of your points can vary depending on how you redeem them.

Shop Through the Issuer’s Website: The issuer may offer an online shopping portal allowing you to shop at popular retailers while earning points. It makes sense to shop where you can earn more rewards since you’ll already do it anyway.

Utilize the Benefits of Your Card: Ensure you understand the benefits and protections offered by your card. Then, you’ll be prepared to use them to their full potential.

What are Travel Points and Miles Worth?

There is a difference in value between points and miles depending on the card and how you redeem them. Most travel credit cards allow you to redeem rewards for past travel expenses and transfer them to partner hotels and airlines.

Point transfers could offer a higher value per point than standard redemption methods, depending on the credit card you’re using and the brand you’re transferring the points. You can generally redeem travel cards for airfare, hotels, or rental cars when you redeem them for travel.

You may also get a better value for your points and miles when redeeming for airfare or hotels based on how many people travel and book. Travel rewards will always be worth more than statement credits or other redemption options when points and miles are used for travel.

FAQs

Are Travel Credit Cards Worth It?

A travel reward credit card is worth it, even if you only take a few trips. The annual Fee of a premium credit card may be worth it if you get enough value out of it. Think about your spending habits before selecting a card.

Should You Get a Travel Rewards Card?

You should be able to travel if you do it a few times a year. Credit cards can reduce travel stress and make your trip more affordable. The type of travel card you need depends on how often you travel.

Do I Only Earn Travel Rewards on Travel-Specific Purchases?

There are often bonus miles offered with travel credit cards for purchases on travel and other types of spending. However, the rest of your purchases will earn you points or miles at a base rate.

What Credit Score Do I Need To Get a Travel Rewards Credit Card?

The credit score you need for a travel rewards credit card will vary according to the card you apply for. A good credit score or higher is generally recommended for the best chance of approval. It is recommended that you have a FICO Score of at least 670. You can apply for a more rewarding travel card when you have a good credit score.

Add Comment