Are you looking for Travel Credit Cards For Fair Credit? If Yes, You are at the right place.

In this article, We are sharing all the information about the Best Travel Credit Cards For Fair Credit.

Credit cards designed for travelers can be challenging to qualify for when building credit. Travel credit cards are typically reserved for people with FICO credit scores of 670 and above, and your credit score plays a big role in your ability to qualify.

There are few rewards programs on credit cards for people with bad or fair credit, and most are limited in features. Eventually, the goal is to build your credit score to be eligible for credit cards with the necessary features. Nevertheless, you can get some cards without waiting that long.

If your credit history is damaged or limited, getting a rewards credit card is still possible to make your next trip or vacation more affordable. Check out our picks for the best travel credit cards for bad to fair credit and our tips for maximizing your rewards.

What is a Travel Credit Card?

Contents

- 1 What is a Travel Credit Card?

- 2 How Do Travel Credit Cards Work?

- 3 Types of Travel Rewards Credit Cards

- 4 How To Get a Travel Credit Cards With Fair Credit

- 5 Best Travel Credit Cards For Fair Credit

- 6 What are the Eligibility Requirements for Travel Credit Cards for Fair Credit?

- 7 How do you apply for travel credit cards for fair credit?

- 8 What are the Benefits of Travel Credit Cards for Fair Credit?

- 9 How to Choose the Best Travel Card for Fair Credit?

- 10 How to Make the Most of a Travel Card for Fair Credit?

- 11 How to Compare Travel Credit Cards

- 12 Pros and Cons Travel Credit Cards For Fair Credit

- 13 How to Maximize Travel Rewards

- 14 What Are Some Alternatives to Getting a Travel Credit Card?

- 15 Why Should I Get a Travel Credit Card for Fair Credit?

- 16 FAQs

Credit cards that offer travel rewards and benefits are called travel credit cards. There are usually reward systems with travel redemption options and bonus points on travel spending. In addition to trip insurance, airport lounge access, and elite status, the best travel credit cards offer travel protections and perks.

A travel credit card is a card that can be used for anything related to travel. When you make travel purchases (flights, hotels, rental cars, etc.) with these cards, you can earn points in addition to trip insurance, priority boarding, and lounge access.

How Do Travel Credit Cards Work?

Credit cards for travel work just like regular credit cards, but they offer better rewards when used for travel (instead of grocery shopping). Imagine you’re planning a trip that includes a flight and a hotel stay.

Travel credit cards can reduce the cost of travel expenses like airfare, hotel stays, car rentals, and baggage fees. Travel rewards credit cards are an excellent way to earn rewards on travel and other monthly expenses. You will be surprised at how quickly your earnings accumulate. Each year, I earn thousands of dollars worth of rewards using travel rewards and Cash Back Credit Cards.

Depending on your credit card, you can redeem rewards for various things, such as airfare, statement credits, hotel stays, merchandise, and upgrades. These cards offer you the option of transferring miles and points to airlines and hotels that are partners.

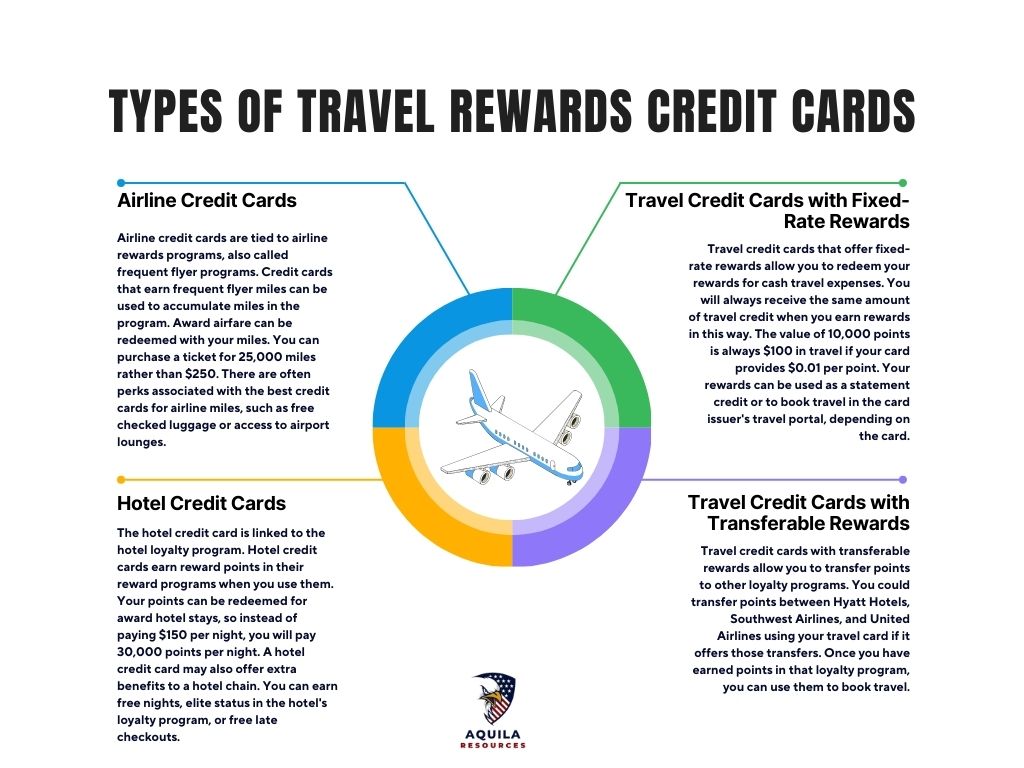

Types of Travel Rewards Credit Cards

You can choose from four types of travel rewards credit cards. Below, you’ll find descriptions of each type.

Airline Credit Cards

Airline credit cards are tied to airline rewards programs, also called frequent flyer programs. Credit cards that earn frequent flyer miles can be used to accumulate miles in the program. Award airfare can be redeemed with your miles. You can purchase a ticket for 25,000 miles rather than $250. There are often perks associated with the best credit cards for airline miles, such as free checked luggage or access to airport lounges.

Hotel Credit Cards

The hotel credit card is linked to the hotel loyalty program. Hotel credit cards earn reward points in their reward programs when you use them. Your points can be redeemed for award hotel stays, so instead of paying $150 per night, you will pay 30,000 points per night. A hotel credit card may also offer extra benefits to a hotel chain. You can earn free nights, elite status in the hotel’s loyalty program, or free late checkouts.

Travel Credit Cards with Fixed-Rate Rewards

Travel credit cards that offer fixed-rate rewards allow you to redeem your rewards for cash travel expenses. You will always receive the same amount of travel credit when you earn rewards in this way. The value of 10,000 points is always $100 in travel if your card provides $0.01 per point. Your rewards can be used as a statement credit or to book travel in the card issuer’s travel portal, depending on the card.

Travel Credit Cards with Transferable Rewards

Travel credit cards with transferable rewards allow you to transfer points to other loyalty programs. You could transfer points between Hyatt Hotels, Southwest Airlines, and United Airlines using your travel card if it offers those transfers. Once you have earned points in that loyalty program, you can use them to book travel.

How To Get a Travel Credit Cards With Fair Credit

The journey to building a good credit history starts somewhere. The main requirements for applying for a credit card are your Social Security number, address, contact information, and proof of income.

Your application will likely be approved if you have a history of timely payments. Your credit bureaus may also report late payments from utility companies and other companies to the credit bureaus that determine your credit score. The fact that you pay your bills on time indicates that you would also pay your credit card bills on time.

Best Travel Credit Cards For Fair Credit

Here is the list of Best Travel Credit Cards For Fair Credit.

Credit One Bank Wander Card

The Credit One Wander Card is an unsecured travel rewards card accessible to people with fair credit. There is an annual fee of $95, but frequent travelers can earn enough rewards to offset that fee. The card earns 10X points on hotel bookings and car rentals through the Credit One Bank Travel partner and 5X points on all other eligible travel (including airfare), dining, and gas purchases (Read: Best Gas Cards for Bad Credit) (followed by 1X points on all other purchases).

The bonus reward rates on this card are among the highest in the industry, and you are not restricted to specific airlines or hotels to earn them. The best prices can be found on flights, resorts, and travel booked through travel agencies using this tool. The Wander card easily ranks among the best travel credit cards at this credit level due to its flexibility, sign-up bonus, and no earning cap.

Feature & Fee of Credit One Bank Wander Card

| Category | Details |

| Annual Fee | $95 |

| Balance Transfer Fee | 3% of the amount transferred, minimum $10 |

| Cash Advance Fee | 5% of the amount advanced, minimum $10 |

| Foreign Transaction Fee | 3% |

| Late Payment Fee | $39 |

Capital One QuicksilverOne Cash Rewards Credit Card

Those with fair credit can earn 5 percent cash back on hotels and rental cars booked through Capital One Travel and 1.5 percent on general purchases with Capital One QuicksilverOne.

The above-average flat rate ensures you’ll get a decent amount of cashback with every purchase. As a Capital One cardholder, you’ll also have access to Capital One’s website, which contains useful travel tools for making booking travel easier and finding the best travel deals.

Feature & Fee of Capital One QuicksilverOne Cash Rewards Credit Card

| Feature | Capital One QuicksilverOne Cash Rewards Credit Card |

| Annual Fee | $39 |

| Balance Transfer Fee | 5% of the amount transferred, minimum $10 |

| Cash Advance Fee | 5% of the amount advanced, minimum $10 |

| Foreign Transaction Fee | 0% |

| Late Payment Fee | $39 |

Bank of America Travel Rewards Credit Card

Bank of America Travel Rewards credit card has one of the best flat rewards rates at 1.5 points per $1 spent on purchases, making it one of the best no-annual-fee travel cards. With the card, you’ll likely earn the welcome bonus when you book flights, hotels, and other lodging during the first few months and then use it to pay for your charges as a statement credit later.

You can also use this emergency card while traveling, as its introductory APR offers some security. When unexpected circumstances force you to return at the last minute, you’ll have time to pay for your flight.

Feature & Fee of Bank of America Travel Rewards credit card

| Feature | Bank of America Travel Rewards credit card |

| Annual Fee | $95 |

| Balance Transfer Fee | 3% of the amount transferred, minimum $10 |

| Cash Advance Fee | 5% of the amount advanced, minimum $10 |

| Foreign Transaction Fee | 0% |

| Late Payment Fee | $39 |

Capital One Quicksilver Secured Cash Rewards Credit Card

Many secured cards are available, but the Capital One Quicksilver Secured card offers a lot more value to people with fair credit. The Quicksilver Secured card for people with good or excellent credit offers the same cashback rates and benefits as Quicksilver cards without a security deposit.

Additionally, you’ll have access to the Capital One Travel portal, features like price drop protection and best price guarantee, and a high rewards rate on hotels and rental cars booked through Capital Travel.

Feature & Fee of Capital One Quicksilver Secured Cash Rewards Credit Card

| Feature | Fee |

| Annual Fee | $39 |

| Balance Transfer Fee | 5% of the amount transferred, minimum $10 |

| Cash Advance Fee | 5% of the amount advanced, minimum $10 |

| Foreign Transaction Fee | 0% |

| Late Payment Fee | $39 |

Upgrade Cash Rewards Visa

The Upgrade Cash Rewards Visa has an interest rate ranging from 14.99 percent to 29.99 percent. It might be useful to have this card if you need to take a sudden vacation and can’t afford to pay it off immediately if you qualify for an APR on the low end of that range.

Money can be transferred directly to your bank account whenever you like. You can even use the card to cover emergency travel costs. As a result, you are charged a fixed interest rate and pay it back monthly, which means you pay less interest over time. A bonus is that the card enables you to earn 1.5 percent cash back on all purchases after you’ve paid them off.

Feature & Fee of Upgrade Cash Rewards Visa

| Feature | Fee |

| Annual Fee | $0 |

| Balance Transfer Fee | Up to 5% of the amount transferred, minimum $10 |

| Cash Advance Fee | Up to 5% of the amount advanced, minimum $10 |

| Foreign Transaction Fee | Up to 1% |

| Late Payment Fee | $30 |

What are the Eligibility Requirements for Travel Credit Cards for Fair Credit?

Travel credit cards have different eligibility requirements depending on the issuer and the card. The following are some of the most common eligibility requirements that credit card companies consider:

- Credit Score: Most travel credit cards require a good or excellent credit score to qualify. It is generally considered good when the score is 700 or higher, while excellent when it is 750 or higher.

- Income: To qualify for a travel credit card, an applicant must earn a certain amount of income. The minimum income requirement can vary between $30,000 and $50,000, depending on the card.

- Employment Status: Many credit card companies require applicants to have a steady income or to be employed.

- Age: You must be 18 to apply for a credit card.

- Citizenship or Residency: Citizens or residents of certain countries or regions may not be eligible for some travel credit cards.

- Existing Credit Accounts: If an applicant applies for a travel credit card, issuers may consider their existing credit accounts and utilization.

- Card issuer’s Policies: Lastly, credit card issuers can have internal policies or criteria for evaluating applications. Depending on the issuer, an individual may be limited to a certain number of credit cards or must have a specified credit history.

It is important to remember that meeting the eligibility requirements does not guarantee approval. Additionally, credit card issuers consider an applicant’s overall creditworthiness and ability to repay debts.

How do you apply for travel credit cards for fair credit?

The following steps can be followed to apply for a travel credit card:

- Research Different Travel Credit Cards: Choose a travel credit card with rewards and benefits that match your travel goals.

- Check Your Eligibility: Ensure you meet the eligibility requirements, such as age, income, and credit score, before applying.

- Gather Required Documents: You must provide proof of identity, address, and income.

- Apply Online or in Person: Most credit card issuers offer online applications through their websites. For more information, visit a bank branch or contact customer service.

- Submit Documents and Complete Verification: A verification process will follow your application submission if you have provided the required documentation.

- Wait for Approval: Once you have completed the application and verification process, your credit card issuer will review your application and decide whether it should be approved or rejected.

- Activate the Card and Start Using It: Your credit card will be mailed to you within a few days if your application is approved. The card issuer’s terms and conditions will dictate when and how you can use the card.

Travel credit cards should be used responsibly and paid on time, and you should avoid carrying a balance to avoid high-interest charges.

What are the Benefits of Travel Credit Cards for Fair Credit?

There are a few purposes for which travel rewards cards can be used. Travel rewards programs can help you earn points or miles to redeem for travel expenses, insure your trip from unexpected mishaps, or upgrade your accommodations. There are even some that let you earn a companion pass. Travel cards have annual fees ranging from zero to hundreds of dollars, so it’s crucial to know what you’re getting before signing up.

Benefits of Travel Cards Include:

- Boosted Travel Rewards: Most travel credit cards offer higher rewards for purchases such as flights and hotels.

- Travel Booking Portals: Several major credit card issuers offer flight booking, hotel booking, rental car booking, and much more through their travel portals. You can reduce your travel expenses by using your points rather than cash.

- Trip Insurance: Various travel credit cards provide baggage insurance, trip delay coverage, trip cancellation coverage, trip interruption coverage, and car rental collision coverage. There will be specific details in the benefit guide for the card.

- TSA PreCheck or Global Entry: Some credit cards offer the TSA PreCheck or Global Entry credit. The TSA PreCheck program speeds up security lines at airports, while Global Entry streamlines immigration.

- Lounge Access: The airport lounge access benefit is a common perk many premium travel credit cards offer. There are private work areas and refreshments to keep you comfortable while you wait for your flight.

- Annual Travel Credits: Many travel cards offer some annual travel credit, whether it be for hotel bills, flights, or just general travel purchases. Travel cards with an annual fee can offer credits ranging from $50 to hundreds of dollars.

Choosing a credit card with the most benefits and rewards should be weighed against the annual fee.

How to Choose the Best Travel Card for Fair Credit?

Travel cards with fair credit often offer features that make traveling and everyday purchases more rewarding, which can lower the cost of your next trip. You will need to consider several factors besides how you like to travel to choose the right one. Here are some tips to help you compare travel cards for fair credit.

- Get Your Credit Score. A credit score is one factor affecting your chances of getting approved for a credit card. A secured credit card might be the best option for those with bad credit (FICO score under 580), but with fair credit (FICO score between 580 and 669), you’ll have more options, including unsecured cards.

- Know Your Spending Habits: The best travel cards reward you for as much of your travel or everyday spending as possible. The Capital One Walmart Rewards card offers bonus rewards on groceries and household items, making it a better fit for Walmart shoppers than a card that only rewards hotels and rentals.

- Secured vs. Unsecured Cards: You may choose between unsecured or secured cards based on your creditworthiness. Secured cards, however, require you to deposit a cash deposit as collateral, which normally acts as your credit limit, before you can use them. Check the minimum and maximum security deposit amount and ensure you can afford them.

- Watch Out for Fees: Ensure you know the fees associated with each credit card you are considering. Consider some fees, such as an annual fee card offering a high rewards rate, which gives you enough cash back to offset the fee and still cover travel expenses. Consider a card that does not charge foreign transaction fees if you plan to travel abroad or shop online with overseas merchants. Consider cards with penalty APRs if you habitually make late payments, which can hurt your credit score and make it more difficult to pay your credit card bills.

- Know the Value of Your Rewards: The best travel credit cards for bad or fair credit usually earn 1 cent per point. A travel portal will give you 10,000 points for $10 when you redeem them for statement credits or gift cards. The situation is sometimes different, however. The value of points may be 1 cent on some cards when redeemed for statement credits but 0.8 cents when redeemed for gift cards. Hence, before you choose a rewards card, you should know what your points are worth.

How to Make the Most of a Travel Card for Fair Credit?

Once you choose the right card, you should prepare a strategy for building credit and maximizing rewards. The best way to get the most value from your travel card is to follow these steps.

- Take advantage of the perks. You can earn more rewards using your credit card rather than cash or a debit card. You can use the travel portal your credit card issuer offers to book the best flight based on your travel plans by utilizing features like price-drop prediction. Check prices on third-party websites for the best value before making your final travel arrangements.

- Have a Budget: When you don’t pay attention to how you spend your money, you may overuse your credit card or need more money when needed. Maintaining a budget can help you avoid most missteps derailing your travel or financial plans.

- Pay Off Your Balance Quickly: Travel plans you cannot afford should be avoided without an emergency. You can avoid most rewards cards’ high annual percentage rates or APR when you pay your balance in full each month before the grace period ends. Having a balance, however, will require you to pay interest, making it harder to repay your travel purchases and possibly causing you to incur debt.

- Ask for a Credit Limit Increase: It might be a good idea to ask for a credit limit increase after six months if you do not already have one. Your credit score could be lowered if you had to pay down your balance before the last day of your billing cycle if you had a higher credit limit and used the least amount of credit possible.

- Don’t Lose Track of Building Credit: The risk of focusing too much on rewards will slow down the process of building your credit. To prevent negative marks on your credit report and a drop in your credit score, pay your credit card bill on time and keep your debt to a minimum. This will make you less likely to access credit cards and loans with better features.

How to Compare Travel Credit Cards

Travel credit cards are unlikely to be perfect, but if you compare several cards, you’ll likely find one that meets most of your needs.

- Credit Score: Choosing a rewards credit card requires a good credit score, so know your score beforehand. Doing this will save time looking at cards you won’t qualify for. You can also protect your score if you concentrate on cards that might get approved. Your credit score can be affected by up to five points each time you apply for a credit card.

- Annual Fees: Many travel reward cards have annual fees. A higher annual fee is charged for rewards and perks, which are more generous. It is important to ensure that the rewards you expect to earn will outweigh the annual fee.

- Sign-Up Bonus: There are a lot of travel rewards cards that offer enticing sign-up bonuses. Most credit cards require you to spend a minimum amount within the first three months. The terms of each travel card differ, so read them carefully.

- Foreign Transaction Fees: Businesses may charge you a foreign transaction fee if you purchase overseas. There is usually a 3% fee added to your bill. A credit card with no annual fee will save you money.

- Purchase APR: As mentioned, there is a higher interest rate on rewards cards. Even though comparing APRs among credit cards is always a good idea, you should never carry a balance with a rewards card. A high rate of interest and compound interest can quickly lead to debt.

- Rewards Programs: Ensure you are familiar with the card’s programs before deciding. The programs of some cards are simple, while those of others are more complex. Seeing which cards offer rewards that match your spending habits is a great way to compare rewards programs.

- Benefits and Perks: Travel credit cards offer generous rewards and excellent benefits, including waived baggage fees, access to airport lounges, insurance for lost luggage, airline fee credits, and travel cancellation insurance, among others. Choose a credit card that offers the most important benefits, and then determine which card will provide the best value.

Travel cards won’t become your soulmate, but if you compare them, you’ll find the one that gives you the most pleasure.

Pros and Cons Travel Credit Cards For Fair Credit

Travel credit cards can benefit the right consumer, but it’s important to understand the pros and cons.

Pros

- Higher Earning Rates and Redemption Value for Travel: Travel credit cards can earn points and miles faster than other rewards cards. Cardholders can get a better return on their rewards when they redeem them for travel, so they get more value from them than if they redeem them for cash back, statement credits, or gift cards.

- Foreign Transaction Fees are Not Charged: Foreign transaction fees are surcharges on purchases made using credit cards in foreign countries or currencies. Every purchase is typically subject to a 3% fee. Travel rewards credit cards with no foreign transaction fees are especially beneficial if you plan an international trip you are planning for a road trip then you can also get Road Trips Credit Cards.

- Sign-up Bonuses: Travel credit cards tend to offer lucrative sign-up bonuses to new cardholders who spend more than the minimum within the first few months.

Cons

- Potentially High Annual Fees: Most travel rewards credit cards charge an annual fee. There are a range of fees from $39 to over $500. The annual fees of premium travel cards reflect their premium benefits. A travel card might be worth the annual fee if you are a good match.

- Possible Complexity and Restrictions: Using travel credit cards can also be time-consuming. The terms and conditions of some travel cards require you to work with customer service to navigate unclear terms and conditions, blackout dates, or limitations in seat availability. Additionally, travel cards may have expiration dates and caps on points or miles. Also, bonus points may only be redeemable with certain brands or qualifying partners if they come from airline or hotel credit cards.

- Low Value for Infrequent Travelers: The card is for someone other than those who travel frequently, so ensure you receive enough rewards and benefits to justify the annual fee.

How to Maximize Travel Rewards

- Pick the Right Travel Card: Choose a travel card that allows you to earn rewards for all spending and redeem them for rewards from most brands when you’re starting. The best way to get started is only with a co-branded credit cards such as airline or hotel card if you travel with that brand.

- Combine a General Travel Card with a Co-Branded Card: Co-branded airline or hotel cards are ideal for frequent travelers who can commit to one brand and use them with their general travel cards. As a result, you can earn bonus points for purchases made with your preferred brand using the co-branded card and earn bonus points for purchases made with the general travel card in other categories by using the general travel card.

- Get Your Sign-Up Bonus Before a Large Purchase: A new travel rewards card is the best way to be sure you get your sign-up bonus if you activate it before you make any purchases (a family vacation, for instance).

- Pick up the Tab with Your Travel Credit Card: Do you get extra points for dining with your credit card? The next time you go out with friends, you can offer to pick up the tab. If you get more reward points, it’s worth it as long as you get paid back.

What Are Some Alternatives to Getting a Travel Credit Card?

- Use a Cash Back Rewards Credit Card: Several cash-back rewards cards offer significant cash back on everyday purchases. Some offer travel benefits such as rental car protection and travel insurance.

- Join a Frequent Flyer Program: Many major airlines reward customers for booking flights, spending with their travel partners, and shopping at select retailers. There may be no limits on these points; you can redeem them for flights, exclusive vacations, premium drinks, and cabin upgrades.

- Sign up for a Hotel Loyalty Program: The loyalty programs offered by hotels offer a variety of incentives for keeping your overnight stays at their properties, such as prime rates, late checkouts, and bonus points. You can earn bonus points by booking directly with hotels and not using third-party services, and then redeem them for free drinks, spa treatments, and free nights.

Why Should I Get a Travel Credit Card for Fair Credit?

Some travelers could have better credit. You can still build or rebuild your credit while enjoying travel-related benefits to make your adventures more convenient, safer, and often more affordable if you apply for a travel credit card for fair credit.

A travel credit card for fair credit may come with high-end travel benefits such as collision damage waivers for rental cars, luggage cancellation, interruption coverage, and lost or delayed luggage coverage. Those who enjoy travel should also look for rewards programs that do not charge foreign transaction fees.

Many credit cards are listed here that allow you to redeem your travel rewards. Moreover, they can help you build good credit, which can benefit you in multiple ways.

FAQs

What is the Easiest Airline Credit Card to Get with Bad Credit?

Secured credit cards will be the easiest way to get credit with poor credit. As a result, you will likely have to put down a cash deposit in advance before you can borrow money with the card. The issuer of a secured card is naturally taking on more risk to offer you fewer benefits and earnings potential than the issuer of an unsecured card.

What Are the Best Travel Credit Card Perks?

It would help if you determined which travel credit card has the best perks based on your travel priorities. A frequent flyer might want an airline lounge access card that covers the TSA PreCheck fee. Hotel stays can be prioritized by looking for perks like late checkouts.

How Do I Maximize My Travel Rewards Credit Card?

You should maximize your benefits as much as possible. Take advantage of all the features of your travel card, and remember to use any. You should find out whether it offers access to airport lounges and if a registration process is required. Discover how your travel protections work if you ever need to use them or if you have a card offering these features.

Can You Get Travel Rewards for Business Travel?

Travel to the card issuer means travel. There is no difference between work and pleasure. Using your travel rewards card can help you maximize your points if your employer allows you to expense travel costs.

Small-business owners, entrepreneurs, and side hustlers have more options than others. Consolidating your points can be achieved by keeping all your spending on one travel rewards credit card. You may also apply for a separate business credit card. There are typically different reward categories if you are looking for a business card.

What Credit Cards Can I Get with a 600 Credit Score?

Secured credit cards, credit-building cards, or student cards may make sense if you’re looking for credit cards with a 600 credit score. Check with online lenders and credit unions if you need a credit card with these features.

Add Comment