Are you looking for Free Cash Advance With No Credit Check? If Yes then you are at the right place.

In this article, We are sharing all the information about Free Cash Advance With No Credit Check.

A cash advance can help you get cash fast if you are in a tight spot with money at the moment. Cash advances are calculated based on your income or credit limit. Depending on where you get it, you may not need a credit check to qualify for a cash advance.

The cash advance apps are just one example of where you can get a cash advance without a credit check today. This article discusses a few options.

An emergency cash advance can be a useful financial tool for those needing funds immediately. People with poor or no credit histories have difficulty obtaining a cash advance because traditional options often require a credit check. A free cash advance can be obtained through alternative methods without undergoing a credit check.

Here, you will find answers to frequently asked questions concerning this topic and a walkthrough of the process.

What Are Free Cash Advance With No Credit Check and How Do They Work?

Contents

- 1 What Are Free Cash Advance With No Credit Check and How Do They Work?

- 2 Why Are Instant Cash Advance with No Credit Check Required?

- 3 5 Best Instant Cash Advance Loans No Credit Check

- 4 Benefits and Limitations of No Credit Check Cash Advances

- 5 Alternative Options for Free Cash Advances With No Credit Check

- 6 Why it’s Hard to Get Free Cash Advance With No Credit Check?

- 7 FAQs

The purpose of a cash advance is to let individuals borrow money against their next paycheck as a short-term loan. A bridge loan can help cover urgent expenses between paydays. Getting a cash advance through a payday lender, an online lender, or a credit union is usually possible.

Typically, the borrower returns the borrowed amount plus associated fees and interest on the next payday, along with any associated interest. There is a No Denial Payday Loans Direct Lenders Only that you can get, which means you will not be denied a loan based on your credit score.

A cash advance can be obtained relatively easily. The lender examines the borrower’s financial information after they apply, including the borrower’s income and employment status. If the lender determines that the borrower is eligible for a loan based on the evaluation, the maximum loan amount will be determined.

A short period, usually one business day, is typically required for funds to be disbursed once approved. Some lenders even offer instant approval credit cards with cash advance, which means you can get the money you need right away.

Why Are Instant Cash Advance with No Credit Check Required?

It may be possible for you to obtain instant cash advance loans without a credit check if you find yourself facing unexpected financial difficulties. Cash advance loans are short-term loans with higher APRs than traditional bank loans. They can be taken out for a fraction of the cost of typical bank loans and credit union loans.

You are not required to pay back instant cash advance loans with your credit scores because you are assessed based on your employment record, income, debt-to-income ratio, and ability to repay.

It is important to note that these loans carry higher interest rates than the average due to the speed of their process and their availability to people with limited to no credit histories (those with scores in the 300 to 580 range).

5 Best Instant Cash Advance Loans No Credit Check

MoneyMutual

MoneyMutual is a great place to begin if you want to solve your financial problems quickly. Many online payday loan marketplaces offer instant cash advances without a credit check. It features hundreds of direct lenders offering loans ranging from $200 to $5,000 with APRs up to 35.99%, a better deal than payday loans, auto title loans, and pawnshop loans. Comparing multiple loan offers simultaneously will save you several hours searching for each direct lender separately.

The MoneyMutual website adheres to the https protocol and uses 256-bit SSL encryption to protect your data. It’s easy to borrow money from MoneyMutual whether you need $100, $255, $500, $1,000, $2,000, or even more.

How to Apply for MoneyMutual

MoneyMutual makes it easy to take out an instant cash advance loan.

- The application process starts when you click the homepage’s orange “Get Started” button.

- Upon meeting all eligibility requirements, you will receive an instant approval and be matched to at least three competitive rates within an hour.

- Please submit your loan application during business hours Monday through Thursday to receive funds the next business day.

Eligibility for MoneyMutual

- A minimum age of 18 is required

- U.S. legal residency

- An income of at least $800 per month is required

- A valid checking or savings account

- Self-employed individuals, pensioners, gig workers, and part-timers are welcome

- Not a resident of New York or Connecticut

Pros & Cons of MoneyMutual

| Pros | Cons |

|---|---|

| APRs as low as 35.99% on loans up to $5,000 | Interest rates that are higher than average |

| 60-month repayment terms are available | Loan amounts may not be granted to all borrowers |

| Requirements for eligibility are loose | New York and Connecticut are not licensed |

| Same-day approval with no credit checks | There are almost no options for cosigners, co-borrowers, or secured loans |

| Easy and quick application process | There are no added features, such as financial hardship resources or credit monitoring |

LifeLoans

A legit network of direct lenders offering up to $40,000 makes LifeLoans one of our favorite sources of emergency cash.

There are various types to choose from, including loans for people with bad credit and cash advances online. There are competitive interest rates up to 35.99% and repayment terms up to five years or sometimes longer. The monthly payments can be reduced for five years with a customized repayment schedule. If you take out a longer loan, you should expect to pay more interest.

You can also apply for a LifeLoan online, which is quick and easy. It should take you up to five minutes to complete, provided all necessary supporting documents are available before you begin. If you qualify, the loan proceeds will be deposited directly into your bank account the following business day.

How to Apply for LifeLoans

- On the LifeLoan homepage, click the large neon green “Start Now” button.

- Follow all instructions on the screen, including the amount you wish to borrow, where you reside, and other relevant information.

- Reviewing all eligibility requirements to increase your chances of receiving a competitive loan offer and guaranteed approval is important.

Eligibility for LifeLoans

- You must be at least 18 years old

- Permanent resident or U.S. citizen

- An income of at least $800 per month is required

- Savings or checking account for valet

- A resident of a state other than Connecticut, New Hampshire, Washington, or Vermont

Pros & Cons of LifeLoans

| Pros | Cons |

|---|---|

| You can borrow up to $40,000. | Limited options for customer support |

| Up to $35.99% APR with some exceptions | A short-term, unsecured loan source |

| Terms of repayment that are flexible | Tribal lenders are exempt from state usury laws |

| Near-guaranteed approval and no credit check | Vermont, Connecticut, New Hampshire, and Washington residents do not qualify |

| The funds will be available by the next business day | Credit bureaus may report on-time payments by some lenders |

NextDayPersonalLoan

NextDayPersonalLoan is a trusted online marketplace that offers cash advance loans with virtually no employment verification or credit checks.

There are many short-term lending options available at NextDayPersonalLoan for bad credit borrowers in the 300 to 580 credit score range, with loans ranging from $100 to $40,000 at interest rates between 35.99% and 35.99%. Small business loans, relocation loans, and automotive repairs can all be financed with these loans.

There is nothing better than NextDayPersonalLoan’s transparency. A 256-bit SSL encrypted online form, well-written disclaimers, and representative loan examples all help to inspire confidence.

How to Apply for NextDayPersonalLoan

It’s easy to apply for a NextDayPersonalLoan.

- Click the “Start Now” button on the homepage.

- You will then need to complete the multi-page guided questionnaire with information about the loan amount you desire, your employment status, and your monthly income.

- At least three competitive loan offers will match your application for instant approval. Some exceptions exist, but you can expect funds within one business day if you sign up with anyone.

Eligibility for NextDayPersonalLoan

- A minimum age of 18 is required

- Legal U.S. resident required

- Minimum income of $800 a month with a valid bank account

- Residents of Vermont, Washington, Connecticut, and New Hampshire are not eligible

Pros & Cons of NextDayPersonalLoan

| Pros | Cons |

|---|---|

| Up to $40,000 in loans | It depends on the lender how funds are transferred |

| Up to 35.99% APR | BBB accreditation is not available |

| It is available in almost all states | There is no dedicated customer support line |

| A network of reputable direct lenders for bad credit | The following states are not licensed: Connecticut, New Hampshire, Washington, and Vermont |

| Approval same day, funding next business day |

VivaLoan

What is the best cash advance for financing a large-scale bathroom renovation? Can unexpected expenses such as a $7,000 hospital bill be covered? Your next source of instant cash could be VivaLoan if you are on the hook for these expenses.

Direct lenders on the VivaLoan platform offer loans from $100 to $15,000, most of which have rates as low as 35.99% and repayment terms as long as 60 months, which offer greater budgeting flexibility. On-time payments are also reported by many of its lenders to Equifax, TransUnion, and Experian, which gives bad credit borrowers a head start on improving 35% of their FICO score.

A useful feature of VivaLoan is its easy-to-use online application. It only takes a few minutes to complete it. VivaLoan offers a safe, reliable way to apply for a legit cash advance loan even if you have bad credit, with 256-bit bank-level encryption and the Online Lenders Alliance (OLA) seal of approval.

How to Apply for VivaLoan

It is easy to get started with VivaLoan today.

- Click the orange “Get Started” button and fill out the two-page form.

- beginning with the Introduction & Income panel and ending with the Contact & Deposit panel.

- Depending on the state laws and the direct lender, loan requests of up to $15,000 may not be approved.

Eligibility for VivaLoan

- You must be at least 18 years old.

- Applicants must be U.S. citizens or permanent residents

- Valid checking and savings accounts

- Minimum income of $1,000 per month

- An acceptable debt-to-income ratio and a payment-to-income ratio

- Not a resident of N.Y., WV, OR, or D.C.

Pros & Cons of VivaLoan

| Pros | Cons |

|---|---|

| You can borrow up to $40,000. | APRs under 35.99% |

| A 100% secure online form for the protection of your personal information | Residents of N.Y., WV, OR, and D.C. are not eligible |

| Easily apply online in two minutes | Loan offers are not guaranteed to all applicants |

| Compared to NextDayPersonalLoan and LifeLoan, the maximum loan limit is low ($15,000) |

Benefits and Limitations of No Credit Check Cash Advances

The following advantages and limitations should be taken into account before applying for a no-credit-check cash advance:

| Benefits | Limitations |

|---|---|

| Accessibility | Fees and interest rates |

| Funds are disbursed within a short period | Loan amounts are limited |

| Easy application process | Term of repayment |

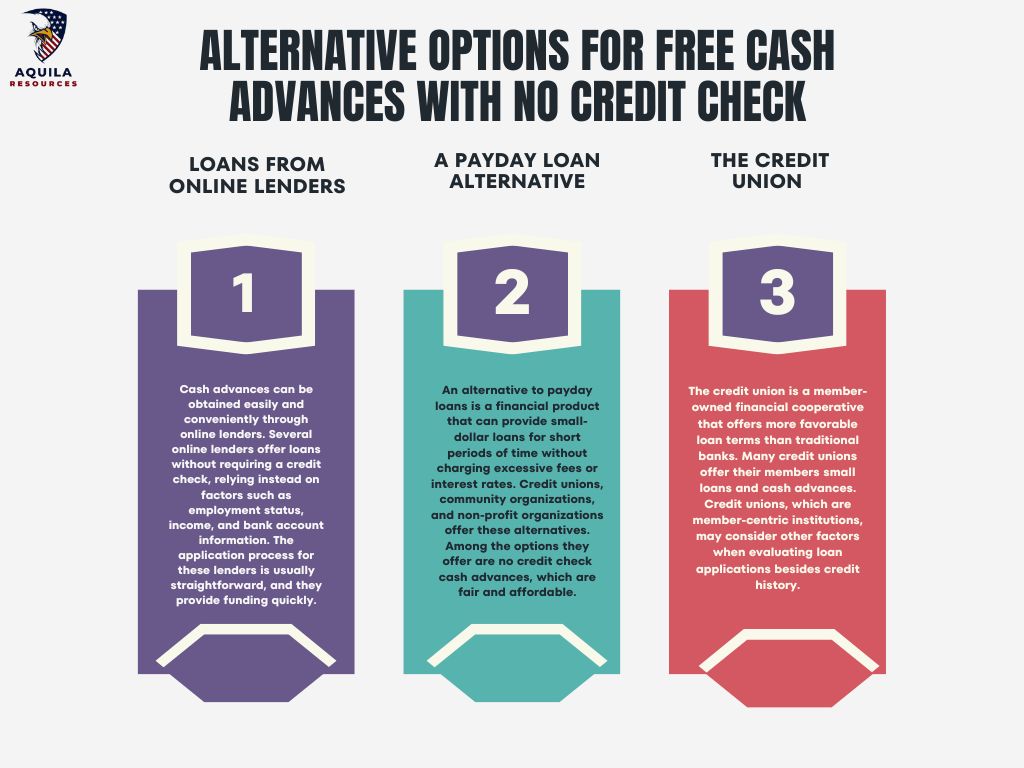

Alternative Options for Free Cash Advances With No Credit Check

If you are looking for Free Cash Advances With No Credit Check, you have several options available to you. Many of these alternatives require the borrower to deal with non-traditional lenders who may offer free cash advances without looking at the borrower’s credit score.

Credit unions, payday loan alternatives, and online lenders are some available options.

Why it’s Hard to Get Free Cash Advance With No Credit Check?

As we said earlier, it’s okay to have a credit check to obtain a cash advance. Find out how by scrolling down. A payday loan (Read: Instant Payday Loans Online Guaranteed Approval), on the other hand, can require a credit check. Our article on the difference between a payday loan and a cash advance can help you understand.

The following explanation will help you understand why you have been rejected from places requiring a credit check.

There can be a vicious cycle here, where people struggle financially, decreasing their credit scores. Due to this, they are less likely to qualify for quick loans during a crisis, so they take on debt from sketchy lenders who might impose high-interest rates.

There is no need to worry if this sounds a little too Black Mirror. No credit checks and 0% interest are available for cash advances.

FAQs

Can I Get a No Credit Check Cash Advance with Bad Credit?

There is still a possibility of receiving a cash advance with no credit check, even if you have bad credit. You are more likely to be approved for a loan based on your income and employment status than your credit score with these lenders. However, bad credit may affect the interest rate and fees associated with the loan.

What is an Instant Cash Advance to a Debit Card?

Cash advances on debit cards can be deposited directly into your checking account. You can do this by submitting a loan request form through one of our recommended online marketplaces, receiving instant approval, and promptly receiving funds, if available, the following business day.

Does a Cash Advance Work?

Yes, getting an emergency instant cash advance fast and instantly is possible. Your bank account can receive funds within minutes with 0% interest cash advance apps. As soon as the loan is approved, the money can be deposited as early as the next business day at most online marketplaces.

How Much Can I With a No Credit Check Cash Advance?

Based on the lender’s policy, a no-credit check cash advance can be obtained for a maximum amount. The amount depends on several factors: income, employment status, and repayment capacity. Avoid unnecessary debt by borrowing only what you need.

Add Comment