Are you searching for Home Depot Credit Card Pre-Approval Application Process? If Yes, you are at the right place.

In this article, We are providing all the information related to Home Depot Credit Card Pre-Approval Application Process.

It is possible to pre-qualify for the Home Depot Credit Card online or through a mail-in pre-approval offer from the issuer. It is important to remember that getting pre-qualified for the card means you have a high chance of being approved, almost 90%, should you apply. There is no guarantee that your application will be approved.

You can also make your Home Depot credit card payments online through a convenient online portal, plus you can return items hassle-free for one year on certain promotions. The Home Depot Credit Card Pre-Approval Application Process is explained here.

What is Home Depot Consumer Credit Card?

Contents

- 1 What is Home Depot Consumer Credit Card?

- 1.1 Is It Hard To Get a Home Depot Credit Card?

- 1.2 Who qualifies for a Home Depot credit card?

- 1.3 Home Depot Credit Card Application Process

- 1.4 Home Depot Credit Card Pre-Approval Application Process

- 1.5 Does Pre-Qualification Affects on Your Credit Score?

- 1.6 Apply Online for a Home Depot Credit Card

- 1.7 Apply in Person for a Home Depot Credit Card

- 1.8 What Credit Limit Does Home Depot Start at?

- 1.9 Benefits of Home Depot Credit Card

- 1.10 How To Improve Your Chances of Getting a Home Depot Card?

- 1.11 What bank does the Home Depot credit card use?

- 1.12 Reasons Why Your Home Depot Credit Card application was Denied?

- 1.13 Home Depot Credit Card customer service

- 1.14 FAQs

The Home Depot Consumer Credit Card is a store card, so you cannot use it elsewhere. You’ll receive special financing for six months if you spend $299 or more on the card.

A purchase paid off within the special financing period will not be charged interest, but deferred interest will be charged if the purchase is not paid off in full. There are also occasional special promotions with longer financing periods of up to 24 months.

There is also zero liability protection for unauthorized charges to the account, and cardmembers can make returns for one year-four times what Home Depot normally allows.

Is It Hard To Get a Home Depot Credit Card?

Citibank will perform a hard inquiry on your account to determine your creditworthiness. To determine your credit limit and whether you meet Citi’s criteria, Citi will collect information from your employer and bank as well as information from credit bureaus.

The FICO Score is major in getting approved for a credit card, just like most credit cards. It is generally considered a good score between 670-739. Home Depot consumer cards allow you to pre-approve if you’re still determining whether you’ll be approved. A pre-approval does not, however, guarantee approval.

You can get No Credit Check Credit Cards Instant Approval No Deposit if you have a low credit score. Also, a few credit cards offer guaranteed approval with a $5,000 limit or Credit Cards with $2000 Limit Guaranteed Approval. These cards are typically secured credit cards, which means that you need to make a security deposit to get the card. The security deposit will be your credit limit, so if you max out your card, you will only borrow money from yourself.

Who qualifies for a Home Depot credit card?

It is necessary for applicants to fulfill the following requirements in order to qualify for a Home Depot credit card:

- Minimum age requirement. The applicant must be at least 18 years old. It ensures that applicants are legally entitled to enter into financial contracts.

- The Social Security Number or (ITIN). You must have an Individual Taxpayer Identification Number (ITIN) or a valid Social Security number. The purpose of this is to verify and identify you.

- United States Address. There must be a physical address within the United States for applicants. It is necessary to establish residency and to ensure that the applicant can receive the credit card.

- An income. It is important for applicants to have an income that allows them to meet the monthly minimum payment requirements. This requirement is in place to ensure that applicants can make regular credit card payments.

- Your credit history. A fair credit score is usually required for Home Depot approval. Fair credit indicates a moderate level of creditworthiness based on a credit score within a certain range. The chances of Home Depot approving your application are increased if you have at least fair credit.

A Home Depot credit card application only guarantees approval if you meet these requirements. Credit card companies assess applicants’ overall creditworthiness before making a final decision.

Home Depot Credit Card Application Process

You must be a United States resident to qualify for Home Depot’s credit card offer. The application process usually takes place on the spot, and your card will be delivered within 14 days after you apply. Home Depot will notify you of the status of your application within 30 days by U.S. mail if an instant credit decision is not possible.

It is possible to determine your chances of approval based on your credit report and credit score, but there is a simpler way. You can check your Home Depot consumer credit card eligibility using the company’s pre-qualification tool. This credit check is quick and won’t affect your credit score.

Home Depot Credit Card Pre-Approval Application Process

- Check out Home Depot’s pre-qualification page.

- You must enter your name, email address, phone number, and social security number last four digits.

- Click on Continue and see if you are pre-qualified.

You can respond to a pre-approved offer by visiting the issuer’s pre-approval page and entering the invitation code included with your offer. This way, the issuer can flag the application as pre-approved.

Does Pre-Qualification Affects on Your Credit Score?

Home Depot Credit Card pre-qualification involves only a soft pull of your credit history so that it won’t impact your credit score. But your credit score will be temporarily affected if you apply for the Home Depot® Credit Card, which involves a hard pull by the issuer.

Apply Online for a Home Depot Credit Card

- You can find the Home Depot consumer credit card offer on the Home Depot’s online credit center.

- Applicants can apply for credit cards online by clicking the Apply Now button.

- You can fill out the application online. If you can, please supply your full name, email address, street address, phone number, and financial information, as well as your Social Security number and date of birth.

- Read the account terms and details before checking the agreement box.

- To submit your application, click the Submit Application button.

- Once approved, an online confirmation indicating your credit limit will be sent to you.

- Upon presenting your confirmation at your nearest Home Depot store, you’ve your temporary card information and a $25 Home Depot coupon upon preparing, valid for 30 days.

Apply in Person for a Home Depot Credit Card

- Visit the Special Services desk at your local Home Depot store.

- Please tell the associate you want to apply for a consumer credit card at Home Depot.

- To complete the application, you must enter your full name, email address, street address, phone number, financial information, Social Security number, and date of birth.

- Upon signing up for the temporary credit card account, the associate will also issue you a $25 coupon. Your account will be charged as soon as you make a purchase. For questions about your Home Depot credit card account, call 866-875-5488.

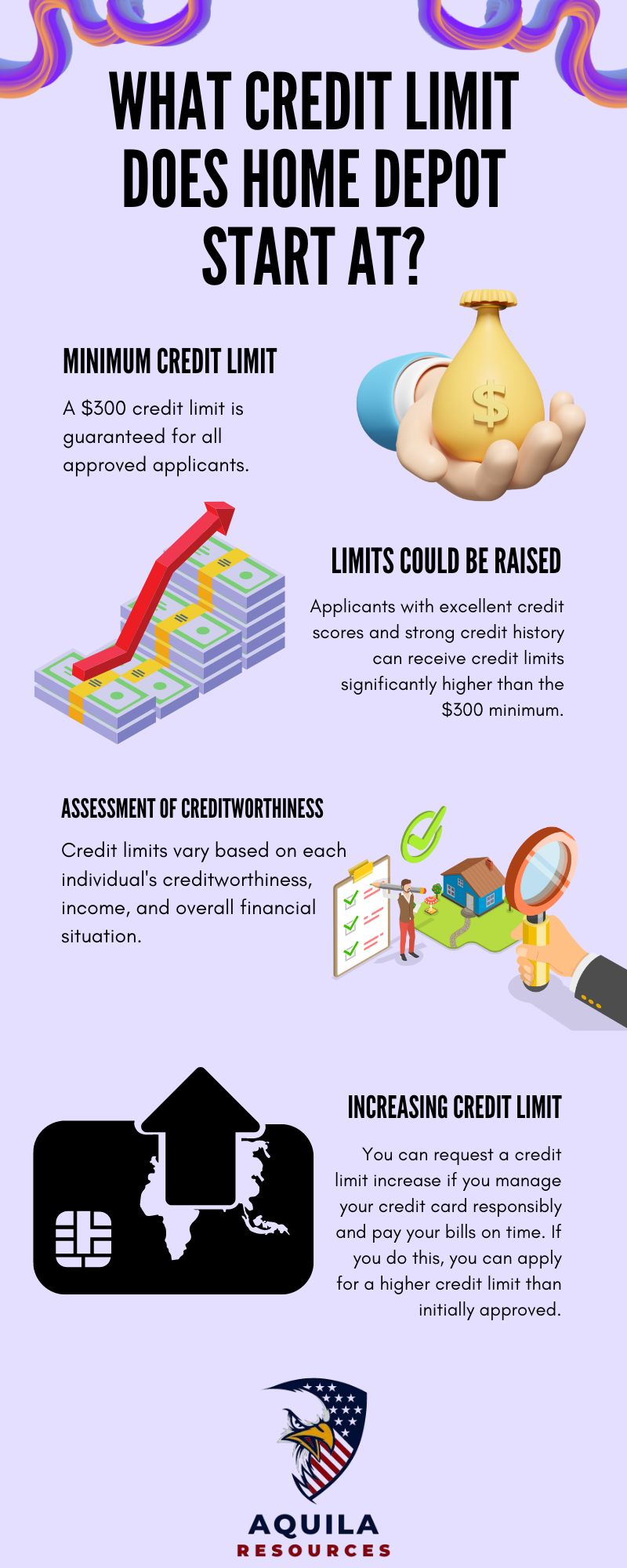

What Credit Limit Does Home Depot Start at?

There is typically a $300 credit limit on the Home Depot Credit Card. In addition, note that all approved applicants are guaranteed a minimum credit line. It is possible to obtain higher credit limits if you have an excellent credit history and are considered creditworthy.

The following are some key details regarding the Home Depot Visa Credit Card credit limits:

Individual credit limits will vary depending on their unique credit profile and financial circumstances.

Benefits of Home Depot Credit Card

If you are considering home improvement credit cards from Home Depot, consider your reasons for wanting or needing them.

This Home Depot Consumer Credit Card offers special financing options to help fund everyday household needs for new homeowners, those with multiple projects to complete, or those who shop at Home Depot often.

A commercial account or Pro Xtra Credit Card is more useful if you’re a business owner planning to load up on supplies for a specific building project.

How To Improve Your Chances of Getting a Home Depot Card?

You are not guaranteed to be approved for any credit card, even if you have been pre-qualified. In addition to evaluating your income, lenders must consider other factors before finalizing the loan. If you’re determined to get a Home Depot card, here are a few steps you can take:

- Make sure your credit report is error-free by getting a copy.

- Check your credit report again before reapplying, and dispute any errors with the credit bureau.

- The secured credit card will require you to deposit so that you can build a positive credit history.

- Your Home Depot card application should be reapplied once your credit report indicates positive credit history.

You will only be approved for a credit card if you are rejected. You should instead determine what’s blocking the approval and take steps to resolve it, so you can get the credit card you want.

What bank does the Home Depot credit card use?

Citibank issues Home Depot Consumer Credit Cards. The following are some more details about the credit card:

| Feature | Details |

| Utilization |

Can only be used at Home Depot stores or the company’s website.

|

| Financing options |

Offers different financing plans based on the price of a large purchase. May include special financing offers such as 0% interest or a fixed monthly payment with a reduced APR.

|

| Other benefits |

May offer Home Depot discounts, promotional offers, or special events. Specific benefits vary and should be reviewed with Home Depot or Citibank.

|

| Issuance |

Issued and managed by Citibank. Citibank processes credit card applications, customer service, and billing.

|

Reasons Why Your Home Depot Credit Card application was Denied?

There are several reasons why your Home Depot Credit Card application may have been denied:

- The credit score is low

- An insufficient income

- High existing debt

- Multiple credit cards or recent inquiries

- Negative credit history

If you want to increase your chances of getting approved for a credit card, you should consider these tips:

- Reduce your debt and pay your bills on time to improve your credit score.

- Find a cosigner with good credit.

- Reduce your credit limit on a credit card.

- Obtain a secured credit card first.

If you want to improve your chances of receiving credit card approval, review your credit report, address any problems, and maintain healthy financial habits.

Home Depot Credit Card customer service

You can contact Home depot credit card customer service if you were denied a Home Depot Credit Card application:

You can inquire why the denial was made by calling Home Depot Credit Card customer service at (800) 695-5171. Their decision may be reconsidered if more specific information is provided.

FAQs

Where Can I Use My Home Depot Credit Card?

No other retailers or vendors accept Home Depot credit cards or credit accounts. These cards are “closed-loop” and can only be used at Home Depot stores or on HomeDepot.com.

Does the Home Depot Credit Card Worth It?

You can save money with exclusive financing promotions with the Home Depot Consumer Credit Card if you are a new homeowner or have a variety of home improvement projects to complete. This card can be used only at Home Depot and does not offer rewards. The rewards or cash back offered by credit cards might also be more beneficial to professionals.

Is There Any Difference Between Pre-Approved and Pre-Qualified Credit Cards?

Pre-approved and pre-qualified credit card offers are similar but used in slightly different situations. You are pre-approved if you receive an offer from the issuer, whereas you are pre-qualified if you check your approval odds on the issuer’s website. Both terms are commonly used interchangeably.

Add Comment