Are you looking for Illinois First Time Home Buyer Programs? If Yes, You are at the right place.

In this article, we are sharing all the information about Illinois First Time Home Buyer Programs.

Those buying their first home in Illinois can utilize generous down payment assistance. Here, we’re going to examine some of the statewide homebuyer assistance programs available in the Prairie State and what the qualification requirements are. Most programs require at least a 640 credit score and income limits – however, Illinois allows repeat buyers, unlike some other states, to apply for assistance.

The average home price in Illinois is almost 40% lower than the national average, making homeownership more affordable outside the Chicago area. The federal government and the state of Illinois have created mortgage programs to help first-time homeowners, such as Florida First Time Home Buyer Programs. There is something for everyone in these programs, regardless of your financial situation. Having a financial advisor assist you in analyzing your financial situation and answering your questions may be helpful to you when buying a home.

What is a Homebuyers Program?

Contents

- 1 What is a Homebuyers Program?

- 2 What Is a First Time Homebuyer Program & How Can It Help?

- 3 Illinois First Time Home Buyer Programs

- 4 Illinois First Time Home Buyer Programs Qualifications

- 5 Illinois First Time Home Buyer Programs Application Process

- 6 Federal Programs for First-Time Homebuyers

- 6.1 Federal Housing Administration (FHA) Loans

- 6.2 Freddie Mac Home Possible Mortgages

- 6.3 Fannie Mae HomeReady Mortgages

- 6.4 Fannie Mae Standard 97 LTV Loan

- 6.5 Department of Veterans Affairs (VA) Loans

- 6.6 Native American Veteran Direct Loans (NADLs)

- 6.7 U.S. Department of Agriculture (USDA) Loans

- 6.8 HUD Good Neighbor Next Door Program

- 7 Video Guide for Illinois First Time Home Buyer Programs

- 8 What are Today’s Mortgage Rates in Illinois?

- 9 What to Know When Buying a Home in Illinois

- 10 Stats on First-Time Homebuyers in 2022

- 11 FAQs

The goal of all homeownership programs is to make homeownership more accessible to more people. A homebuyer program may benefit those with financial obstacles to obtaining conventional loans. The types of applicants who would be suitable for the program include first-time buyers, veterans, or families with low incomes.

Everyone can’t obtain enough credit to purchase a home. Programs offered by states and private lenders can help bridge the gap by providing mortgage benefits to people with lower incomes. The federal government guarantees some homebuyer programs, which enable participating lenders to offer you better interest rates than you would get with conventional mortgages.

What Is a First Time Homebuyer Program & How Can It Help?

Homeownership is hampered largely by the financial burden of a down payment, which is a percentage of your home’s cost. A first-time homebuyer should note that down payments vary according to the amount and type of mortgage. Your monthly mortgage payment will be less expensive if you make a larger down payment.

Fortunately, there are initiatives in place to support aspiring homeowners, such as the $25,000 First Time Home Buyer Grant Application, which can significantly alleviate the financial challenges associated with buying a home.

Through homebuyer assistance programs, down payments and other purchase-related expenses are covered, easing the financial burden of owning a home. A homebuyer program may be offered by the federal government in Illinois or by the state itself. There are different requirements for each program, with some having stricter guidelines than others.

Illinois First Time Home Buyer Programs

The Illinois Housing Development Authority (IHDA) offers fixed-rate loans through its Access Mortgage program through a network of mortgage lenders. A variety of down payment and closing cost assistance is also available with these loans.

The IHDA mortgage does not require a down payment, however, a contribution of $1,000 or 1 percent of the purchase price is required. If you are able to make a down payment, you should do so. Purchasing a home with at least 20 percent down will remove the need for private mortgage insurance.

Here are the Illinois First Time Home Buyer Programs –

IHDA Access Forgivable Mortgage

The Access Forgivable Mortgage program from IHDA provides a fixed-rate 30-year mortgage – a conventional, FHA, VA, or USDA loan – with as much as $6,000 in closing costs and down payment assistance. If you live in the house for at least 10 years, you won’t need to repay the loan.

You will need a credit score of at least 640 to qualify. The amount of your income and the price of your purchase also have to meet certain limitations, depending on your county and household size.

IHDA Access Deferred Mortgage

The Access Deferred Mortgage program from IHDA also offers a 30-year fixed-rate mortgage and down payment assistance of up to $7,500. Your loan is interest-free, and you will only have to repay it on the maturity date of your loan or when you sell your house or refinance it.

A credit score of at least 640 is required to qualify for a deferred mortgage with IHDA Access. There are income and purchase price limits with the IHDA Access Forgivable Mortgage.

IHDA Access Repayable Mortgage

An Access Repayable Mortgage from IHDA includes a 30-year fixed-rate mortgage and a loan for up to $10,000 of the purchase price. This loan is designed to help with down payment and closing costs. It is repaid in monthly installments over a 10-year term. There are similar credit requirements, income limits, and purchase price limits for the Repayable program as for the other Access programs.

It is important to note that the IHDA does not offer mortgages directly; IHDA-approved mortgage lenders offer these programs. Visit the IHDA website for more information and to take the next steps if you believe you qualify for a first-time homebuyer program.

Illinois First Time Home Buyer Programs Qualifications

Illinois first-time homebuyer programs require the following qualifications:

- It is required that your credit score is at least 640

- You cannot exceed 45% in your DTI ratio

- The program must approve your lender

- It is mandatory to take a homebuyer education course

- IHDA can help you get a first mortgage

- You cannot exceed the program’s income limits

Illinois First Time Home Buyer Programs Application Process

Here are the steps you need to take to apply for an Illinois First Time Home Buyer Programs:

Step 1: Find a Lender Approved by IHDA: The Illinois Housing Development Authority only approves lenders to originate IHDA loans that qualify for down payment assistance. You can find IHDA lenders by visiting the IHDA mortgage website.

Step 2: Become Prequalified: You can determine how much money you can borrow by getting prequalified with an approved loan officer. Furthermore, it will display the interest rate and fees associated with the loan. Then, you’ll have to provide your loan officer with financial documentation. To find the right lender for you, meet with different lenders.

Step 3: Attend Homebuyer Education Classes: A homeowner education course that meets the National Industry Standards for Homeownership Education and Counseling or the Department of Housing and Urban Development (HUD) requirements is required for IHDA loan closings. On the IHDA website, you can search for courses.

Step 4: Find an Agent to Help You Find a Home: Prequalified buyers can find a home within their price range with a knowledgeable agent to guide them through the home-buying process. Getting the house inspected and setting up an appraisal if your offer is accepted are all services that an agent offers if you find the home of your dreams.

Step 5: Apply for The Right Mortgage Type and Down Payment Assistance: IHDA provides mortgage assistance under several programs with slightly different repayment criteria. A mortgage underwriter will review your financial information to determine if you qualify. A down payment assistance program may be available when approved for a first mortgage.

Step 6: Complete the Loan Process: You will get the keys to your new home after closing on your mortgage. The home is yours once you have signed and approved all the paperwork.

Federal Programs for First-Time Homebuyers

There are several federal government programs designed to help people with low credit scores or limited down payments. Unlike state programs, most of these programs are available to repeat homeowners, but they are especially helpful to first-time homebuyers and those who last owned a home some time ago.

Most mortgages are for single-family homes, two- to four-unit residential properties that their owners will occupy, as well as approved condos, townhomes, and planned unit developments. The Illinois Housing Development Authority also offers some of these loan programs but without the state’s perks, such as the $5,000 First Time Home Buyer Grant. This grant is available to first-time homebuyers who purchase a home in Illinois with a mortgage from an approved lender. The grant can be used for down payment assistance, closing costs, or other home-buying expenses.

Here are some of the First Time Home Buyer Grants and Programs–

Federal Housing Administration (FHA) Loans

A mortgage insured by the FHA is one of many products offered by the U.S. Department of Housing and Urban Development (HUD). Homebuyers can choose from a list of lenders who have been approved. If you have a FICO® score of 580 or higher, you will qualify for a loan with competitive interest rates and a 3.5% down payment. If your score is below 500, you must put down at least 10%.

There is a provision which allows gift money for the down payment to be used by certain donors, and this will be documented in the gift letter for the mortgage.

The FHA requires mortgage insurance with each loan, which costs 1.75% upfront and annual premiums for the life of the loan. However, if you make a down payment of at least 10%, the mortgage insurance can be removed after 11 years. FHA mortgage limits by state and county can be found on the FHA website.

Freddie Mac Home Possible Mortgages

A Home Possible mortgage requires a 3% down payment from low- and low-income borrowers. The down payment sources for these loans include co-borrowers, family gifts, employer assistance, secondary financing, and sweat equity.

The Home Possible mortgage is available to buyers with a credit score of 660 or higher. Your mortgage payments will be lowered once you pay 20% of your loan.

Fannie Mae HomeReady Mortgages

Freddie Mae HomeReady® Mortgages are available to low-income borrowers for as little as 3% down. It is usually necessary for applicants to have a credit score of at least 620; pricing may be better for those with a score of at least 680. The HomeReady program allows down payment financing, such as gifts and grants, just like Freddie Mac. You can find income limits, a FHA loan comparison, and more information on this Fannie Mae site.

Fannie Mae Standard 97 LTV Loan

First-time homebuyers with a credit score of at least 620 and debt-to-income ratios between 40% and 45% can apply for the conventional 97 LTV loan. There is a 3% down payment requirement on the 97% loan-to-value mortgage. There are third-party sources that will assist borrowers with down payments and closing costs.

Department of Veterans Affairs (VA) Loans

The Department of Veterans Affairs offers loans to active-duty military members, veterans, and their surviving spouses. V.A. loans offer low interest rates and don’t require a down payment on purchases, construction, or home improvements. There is typically a one-time funding fee that is rolled into the mortgage.

Native American Veteran Direct Loans (NADLs)

This no-down-payment loan program is available to eligible Native American veterans and their spouses who want to build or improve a home on federal trust land. A funding fee is charged by the V.A., which is the direct lender.

U.S. Department of Agriculture (USDA) Loans

Those USDA-guaranteed loans for moderate-income borrowers are not subject to a down payment requirement as part of the USDA’s direct lending program; low- and very-low-income people pay an upfront guarantee fee and an annual mortgage insurance fee. They also receive direct loans from the USDA for home improvement.

HUD Good Neighbor Next Door Program

The program helps police officers, firefighters, emergency medical technicians, and teachers obtain mortgages in their service areas. A homeowner who lives in a “revitalization area” for three years can receive 50% off a home.

Video Guide for Illinois First Time Home Buyer Programs

What are Today’s Mortgage Rates in Illinois?

If you’re ready to purchase a home, use a mortgage calculator to determine how a down payment and interest rate will affect your monthly mortgage payment. Make sure to get personalized mortgage quotes from three to five lenders.

Make sure you rely on something other than online rates. Check out the interest rates and fees offered to you when you apply for pre-approval. Your new home loan must be financed in the best way possible if you want to save money.

What to Know When Buying a Home in Illinois

It is important to note that Illinois’ housing market is quite active, with a $50,000 increase in home prices on average. The good news is that Illinois’ home price inflation is lower than the average for other states.

The real estate market in other states increased by 14.9% on average, while Illinois only increased by 8.4%. It’s a win for homebuyers!

In addition, it is important to keep in mind the support provided by each city. There is city-specific assistance for first-time homebuyers in Chicago, Joliet, and Aurora.

Stats on First-Time Homebuyers in 2022

Have you ever wondered where you fit among first-time homebuyers? According to the National Association of Realtors (NAR) Profile of Home Buyers and Sellers for 2021, here are some national stats:

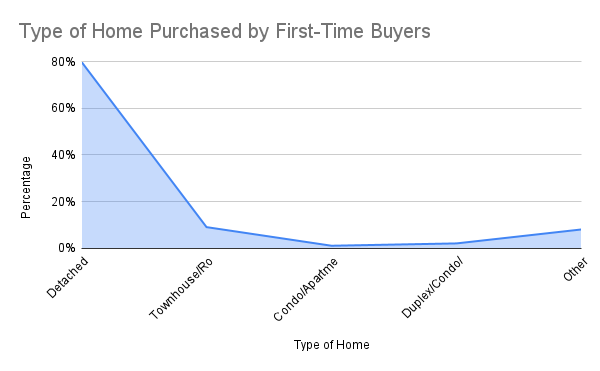

Type of Home Purchased by First-Time Buyers

| Type of Home | Percentage |

| Detached Single-Family Home | 80% |

| Townhouse/Rowhouse | 9% |

| Condo/Apartment (5 or more units) | 1% |

| Duplex/Condo/Apartment (2 to 4 units) | 2% |

| Other | 8% |

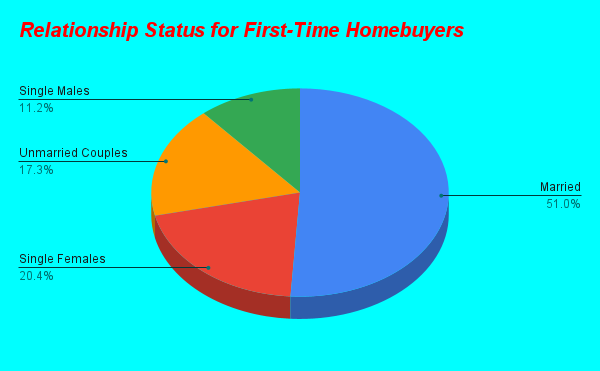

Relationship Status for First-Time Homebuyers

| Relationship Status | Percentage |

| Married | 50% |

| Single Females | 20% |

| Unmarried Couples | 17% |

| Single Males | 11% |

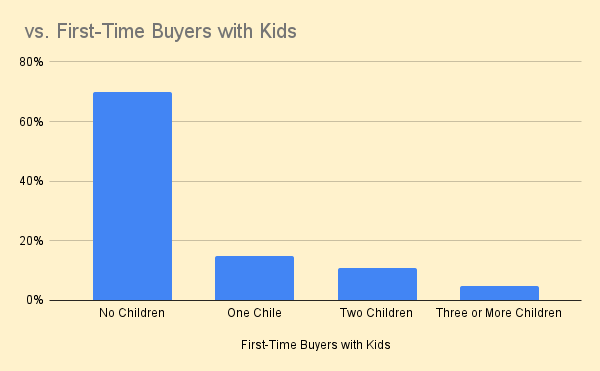

First-Time Buyers with Kids

| First-Time Buyers with Kids | Percentage |

| No Children | 70% |

| One Chile | 15% |

| Two Children | 11% |

| Three or More Children | 5% |

FAQs

Do First-Time Homebuyers with Bad Credit Qualify for Homeownership Assistance?

Yes. There are many homeowner assistance programs available to people with low credit scores through government and nonprofit organizations. In addition, interest rates and terms for loans available to borrowers with higher credit scores are often competitive. Before you go house hunting, take all possible steps to improve your credit score since almost every lending program has credit qualifications.

Is There a First-Time Homebuyer Tax Credit in Illinois?

Currently, no. A portion of the mortgage interest can be claimed as a federal credit every year through mortgage credit certificate programs administered by state and local agencies. A suspension has been imposed on the housing development programs of the Illinois Housing Development Authority and the city of Chicago.

Can I Qualify for Down Payment Assistance in Illinois?

The credit score you need to qualify for Illinois down payment assistance will likely be 640 or higher. Then, you must complete a homebuyer education course, obtain a first mortgage through IHDA, meet your county’s income limits, and maintain a debt-to-income ratio of less than 45%. There are no down payment assistance programs for repeat buyers in Illinois, unlike many other states.

What Are the Best First-Time Homebuyer Loans?

It is impossible to find a home loan that fits every need. You will have to consider your financial situation and other factors when choosing one. The HUD housing counsellors (800-569-4287) can provide you with free or low-cost advice on home purchases. They can also provide information if you find yourself homeless or facing foreclosure.

Add Comment