Are you looking for Instant Approval Credit Cards With Cash Advance? If yes, you are at the right place.

In this article, we are sharing all the information regarding Instant Approval Credit Cards With Cash Advance, How you can get, apply, and the benefits of these cards.

Instant Approval Credit Cards With Cash Advance

Contents

- 1 Instant Approval Credit Cards With Cash Advance

- 1.1 What is a cash advance?

- 1.2 What are Instant Approval Credit Cards With Cash Advance?

- 1.3 How to Apply for an Instant Approval Credit Cards With Cash Advance?

- 1.4 Top 5 Best Instant Approval Credit Cards With Cash Advance

- 1.5 What are the Benefits of Using a Instant Approval Credit Card with Cash Advance?

- 1.6 What to Look Out for When Comparing Instant Approval Credit Cards With Cash Advance?

- 1.7 Tips for Using an Instant Approval Credit Cards With Cash Advance Safely

- 1.8 FAQs

You can withdraw cash with most credit cards. However, you must pay back the withdrawn funds along with any applicable interest charges. Quick access to funds during an emergency can be made possible by this method. There are additional costs to consider, including the higher interest rate charged when withdrawing cash than usual.

To find the best credit card with a cash advance facility for your needs, compare credit cards that offer cash advances and those that don’t.

What is a cash advance?

You can use your credit card to access cash through a cash advance feature. Credit cards with cash advance capabilities allow you to withdraw cash at ATMs or bank branches. This may be a convenient solution when you need more funds in your transaction account but urgent cash. Using your card to withdraw cash is usually much more expensive than using it to make purchases because cash advances typically have high-interest rates.

When you take out a cash advance, money is taken from the credit limit you have been approved for, not your bank account. A cash advance facility is a loan, which means you borrow money and may have to pay interest and other fees.

Your credit card may charge you a cash advance fee and higher interest rates. Cash advances generally begin accruing interest as soon as the transaction is completed, unlike credit card purchases, which may offer a grace period for interest-free purchases.

What are Instant Approval Credit Cards With Cash Advance?

A Instant Approval Credit Cards With Cash Advance enables you to access funds quickly and easily. An application for such a card can be submitted online, and you will receive a response within minutes.

It takes just a few minutes to apply – you have to fill out an application form with basic personal details, such as your address and financial standing. You will receive an automatically generated credit card that you can use to make purchases and withdraw cash once approved.

The ability to borrow more, sometimes at higher rates, can make managing large purchases easier. There are many benefits to instant approval credit cards with cash advances, but you should carefully consider the interest rates and other terms involved before signing up.

There are some credit cards that offer guaranteed approval with no deposit as well. These cards are usually designed for people with poor or limited credit histories. It is important to use them responsibly, though they often have high-interest rates and fees.

How to Apply for an Instant Approval Credit Cards With Cash Advance?

A credit card with instant approval and a cash advance can be applied quickly and easily. Choose a credit card with the best interest rates or rewards programs for your needs.

You must fill out all the necessary forms accurately and promptly and provide information about your current debt obligations and personal financial history.

If your application is approved, you’ll usually be informed within minutes. The card can be used immediately for purchases, saving time and money.

Top 5 Best Instant Approval Credit Cards With Cash Advance

It can be difficult to find credit cards with high cash advance limits. You may have a cap on cash advances based on how much money you have available in your account.

Cash advance cards with the highest limits also offer generous cash advances. The process is easier if you have good to excellent credit.

Here are some cards with hefty cash advance offers if your credit score falls within this range –

Capital One Venture Rewards Credit Card

A Capital One Venture card is designed for frequent travelers. With Capital One Travel, you earn 5 miles for each dollar spent on hotel and rental car bookings and a generous 75,000 bonus miles after spending at least $4,000 in the first three months.

According to Capital One, cash advances can be limited to anywhere from 30% to 50% of your total limit, depending on your credit history. There may also be a daily ATM withdrawal limit.

There is a cash advance fee of 3% or $3, whichever is greater than a variable 28.74% APR. Applicants have reported approvals up to $50,000, but the average limit is between $5,000 and $10,000.

Capital One Platinum Credit Card

This Capital One Platinum card comes with no annual fee and is designed for users with fair credit. Additionally, you can see if you’re preapproved without affecting your credit score.

The Capital One credit card provides cash advances of up to 30 – 50% of your remaining balance, but you should check your account to verify your cash advance limit. Depending on your credit history, your limits may vary.

The variable cash advance APR of 30.49% is also included in the fee for each cash advance, which is 3% or $3 whichever is greater.

Pen Fed Platinum Rewards Visa Signature Card

There are many ways to join Pen Fed, but it is based in Virginia, and members come from all over the world. They also offer Pen Fed Platinum Rewards Visa Signature Cards, which offer variable cash advance interest rates as low as 17.99% without additional transaction fees.

This card has no annual fees, and it offers an introductory APR of 0%, then a variable APR of 17.99%. With this card, you can also earn bonus points for shopping at supermarkets, restaurants, gas stations, and more.

Bank of America Premium Rewards

Bank of America Premium Rewards cards offer travel perks and 50,000 bonus points after spending $3,000 within the first three months. Every time you spend $1 on travel and dining, you’ll earn 2 points; for every $1 you spend on everything else, you’ll earn 1.5 points.

Just note that if you take advantage of the cash advance option, you’ll pay a fee of $10 or 3 – 5% and a variable cash advance APR of 23.24% – 31.24%.

The Platinum Card from American Express

There are several reports about the Amex Platinum Card having one of the highest cash advance limits of $8,000. You’ll also have to pay a 29.99% cash advance APR, which can vary depending on market conditions.

The Platinum card from American Express is renowned for its generous travel benefits. For those who travel often, AmexTravel.com may be worth looking into, where you can earn 5x points when you book flights and hotels with your card, up to $500,000 each calendar year. The high annual fee and APR may only be worth it if you meet the terms.

Here is the Table-

| Card | Cash Advance APR | Cash Advance Fee | Other Details |

| Capital One Venture Rewards Credit Card | 28.74% | 3% or $3, whichever is greater |

Earn 5 miles per dollar spent on hotel and rental car bookings and 75,000 bonus miles after spending at least $4,000 in the first three months.

|

| Capital One Platinum Credit Card | 30.49% | 3% or $3, whichever is greater |

Cash advances limited to 30-50% of your credit limit. No annual fee.

|

| PenFed Platinum Rewards Visa Signature Card | 17.99% | None |

No annual fee. Introductory APR of 0% for 12 months, then a variable APR of 17.99%. Earn 5x points at gas stations and supermarkets, and 2x points on restaurants and other travel.

|

| Bank of America Premium Rewards | 23.24%-31.24% | $10 or 3-5% |

Earn 2 points per dollar spent on travel and dining, and 1.5 points per dollar spent on everything else. 50,000 bonus points after spending $3,000 within the first three months.

|

| The Platinum Card from American Express | 29.99% | Varies |

Cash advance limit of up to $8,000. Earn 5x points on flights and prepaid hotels booked directly with airlines or through AmexTravel.com.

|

What are the Benefits of Using a Instant Approval Credit Card with Cash Advance?

It is convenient and fast to access money with credit cards that can be used for cash advances. The benefits of these loans are especially beneficial during times of financial hardship or emergency, as they generally offer approval instantly and quick access to funds.

This type of credit card offers the advantage of low-interest rates, which makes them an attractive choice for managing cash flow. Some even offer special discounts for making purchases and reward programs. The benefits available make credit cards with a cash advance an efficient and smart way to manage people’s finances.

What to Look Out for When Comparing Instant Approval Credit Cards With Cash Advance?

| Factor | Description |

| Interest rate |

The interest rate is the percentage of interest you will pay on your outstanding balance each month. Cash advances typically come with higher interest rates than regular purchases.

|

| Additional fees |

There are often additional fees associated with cash advances, such as an upfront fee or a daily interest charge. Be sure to read the fine print to understand all of the fees involved.

|

| Limits on cash withdrawals |

Cash advance limits are not always the same as credit limits. Some cards may have a lower cash advance limit than your overall credit limit.

|

| Benefits and rewards |

Some cash advance credit cards offer rewards, such as cash back or points, on cash advances. Be sure to compare the rewards offered by different cards before you choose one.

|

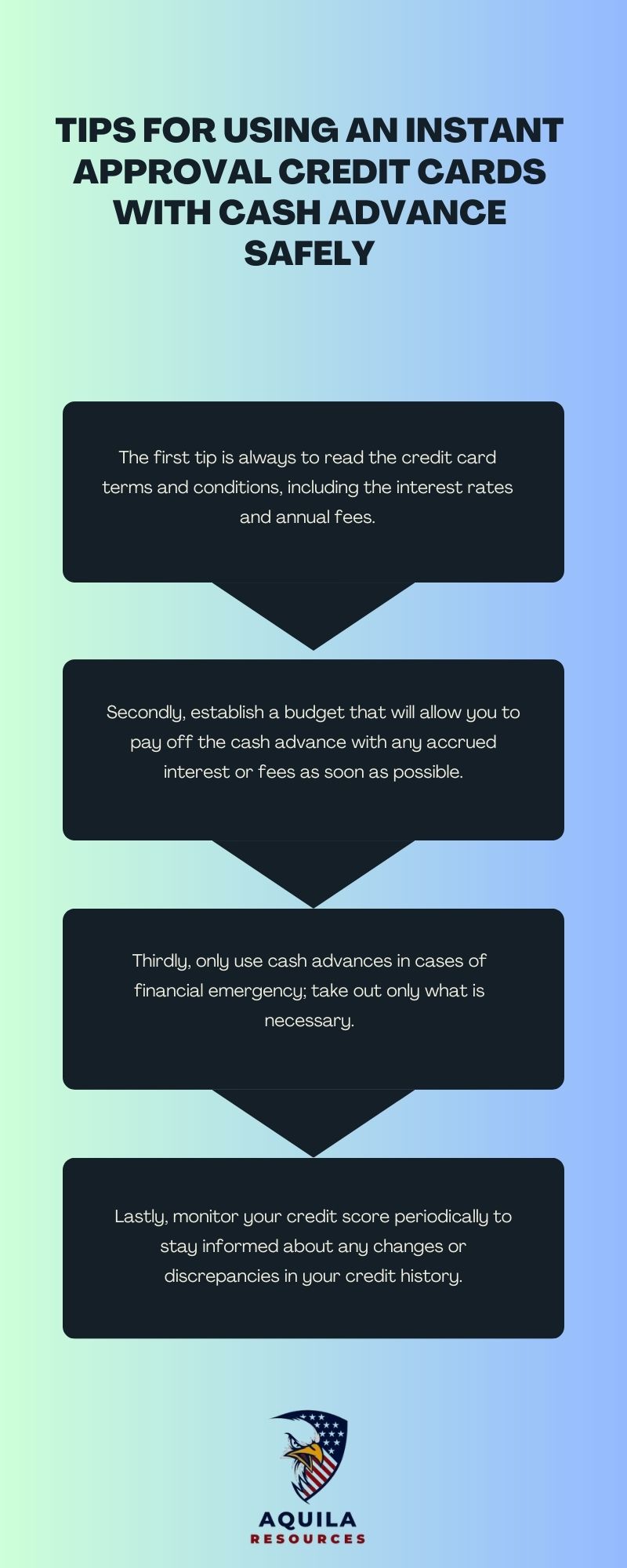

Tips for Using an Instant Approval Credit Cards With Cash Advance Safely

You need to keep several tips in mind when considering an instant approval credit card with a cash advance to ensure that you use it responsibly and safely.

Following these tips, you can successfully use an instant approval credit card with a cash advance.

FAQs

How much does a cash advance cost?

Credit cards that offer cash advances usually have higher interest rates than other types of credit cards. Some can reach as high as 27%. It is also possible to charge a fee for taking out cash with these cards.

There are usually fees associated with cash advances between $2 and $10. However, the fees charged by some lenders are not based on dollar amounts but rather on a percentage of your withdrawal, ranging from 1-10%. If you use your credit card to withdraw cash overseas, like a transaction account, you may also have to pay an extra fee for using an ATM not affiliated with your card network.

Does a cash advance affect your credit score?

Cash advance transactions do not directly affect credit scores because they are not separately recorded on your credit report.

Cash advance costs, however, can add up quickly and create debt if you need to be more careful. Your credit score can be negatively affected by this accrual of debt. It is also possible to suffer a credit score drop if you miss a credit card repayment.

Can I Increase My Cash Advance Limit? How?

Your cash advance limit will depend on how your issuer calculates it. Banks sometimes calculate cash advance limits based on your available balance.

You can increase your cash advance limit if your total available balance increases. You should approach your issuer directly when increasing your overall or cash advance limit because it can vary based on the provider.

Add Comment