Are you looking for Startup Business Credit Cards with EIN Only? If Yes, You are at the right place.

Using business credit cards to separate business expenses from personal expenses is becoming increasingly popular. Additionally, they allow you to take advantage of rewards and cashback offers.

The purpose of this article is to explain how to get startup business credit cards with EIN only.

This article explores the different options for applying for a startup business credit card with EIN only if you do not have a Social Security Number.

Startup Business Credit Cards with EIN Only

Contents

- 1 Startup Business Credit Cards with EIN Only

- 2 What is Business Credit Card?

- 3 What is an EIN card?

- 4 Can You Get Startup Business Credit Cards with EIN Only?

- 5 Types of Startup Business Credit Cards with EIN Only

- 6 Top 5 Startup Business Credit Cards with EIN Only

- 7 Requirements For Startup Business Credit Cards With EIN Only Options

- 8 How to Apply for Startup Business Credit Cards with EIN Only?

- 9 Benefits Of Startup Business Credit cards With EIN Only

- 10 FAQs

Some startup business credit cards can be applied for with only your EIN. Credit cards used by corporations or businesses are known as corporate credit cards. The creditworthiness of your business is often determined not by your credit rating but rather by your revenue, spending patterns, and cash balance. However, it’s important to know that corporate credit cards might be the wrong choice for some startups.

If you are looking for Startup Business Credit Cards with EIN Only, these are the best options:

| Credit Card | Details |

|---|---|

| Bank of America Business Advantage Customized Cash Rewards Credit Card | Learn More |

| Ink Business Unlimited Credit Card | Learn More |

| Business Platinum Card from American Express | Learn More |

| Ink Preferred Credit Card | Learn More |

| Shell Small Business Card | Learn More |

What is Business Credit Card?

Business credit cards are an extremely valuable tool for business owners. Your business expenses and personal finances can also be separated, allowing you to purchase essential items for the business. It is crucial for your tax records and financial records as a business owner.

A business credit card application often requires you to provide your SSN (Social Security Number) and EIN (Employer Identification Number).

What is an EIN card?

EIN stands for Employer Identification Number. It is sometimes called the Federal Employer Identification or Federal Tax Identification Number. A unique 9-digit code is assigned to each individual by the Internal Revenue Service in the US. It serves as a Taxpayer Identification Number when used for identification purposes only. People may confuse them with SSNs, also nine-digit codes assigned to American citizens and permanent residents, but the two codes are completely different.

EIN is more business-oriented than SSN. EIN is not treated in the same way as SSN, which is more of a secretive code. An SSN can be used to begin a sole proprietorship. However, an EIN can be used to hire employees or obtain business credit. In this case, EIN cards and other factors are important. Cards containing EINs may only be issued to businesses that provide a registered business number.

Can You Get Startup Business Credit Cards with EIN Only?

It is usually possible to get a corporate card without an individual SSN if you have a large, established company. A startup business credit cards with EIN only is also available, but more options are needed. Applicants for business credit cards must either have an SSN alone or an EIN along with an SSN if they own the business. The individual taxpayer identification number (ITIN), or tax ID, may be able to be used to apply for credit by immigrants who do not have an SSN.

If your business has established credit, there may need to be more than the EIN to qualify you for a card. There might be requirements such as paying a certain amount of revenue each month or having a certain amount of capital. However, If you have LLC business you can get some business credit cards for LLCs If you don’t have EIN.

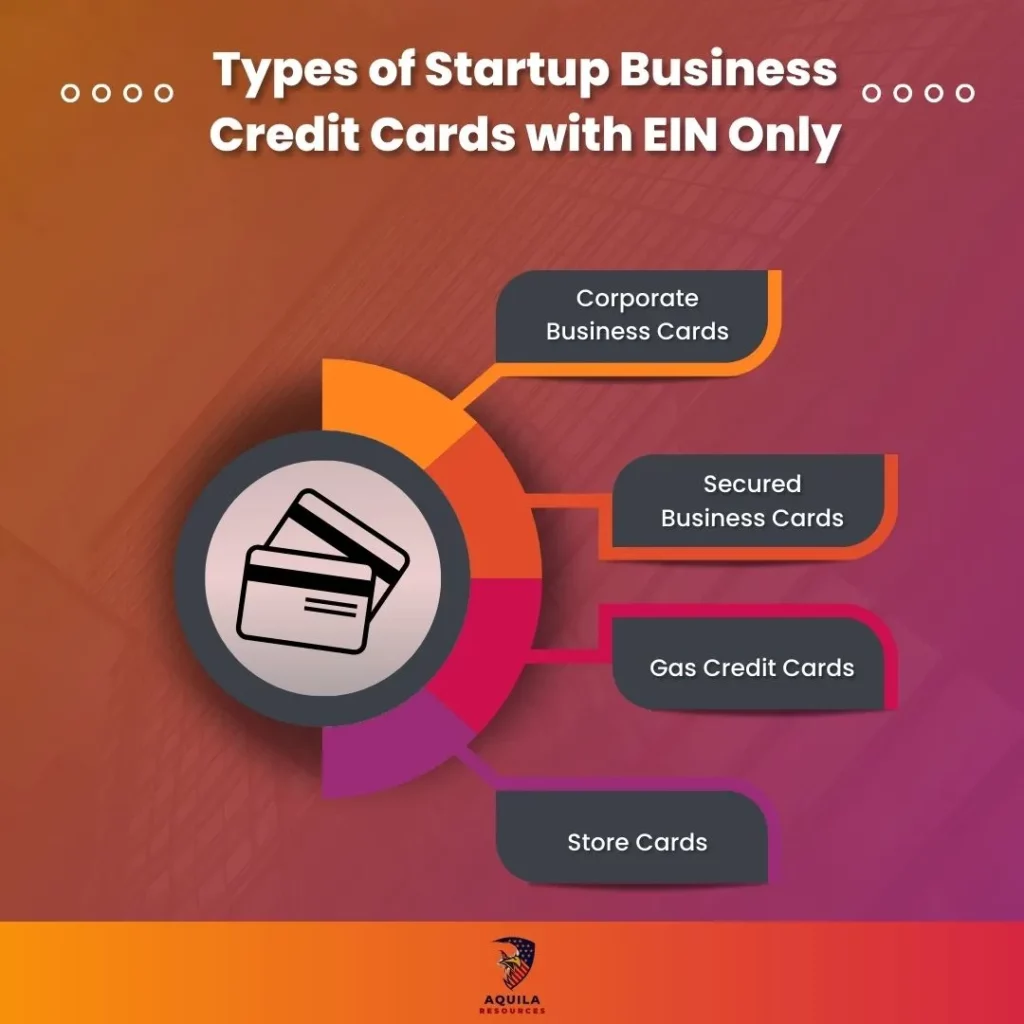

Types of Startup Business Credit Cards with EIN Only

Some credit cards are still available to applicants who only have an EIN instead of an SSN. You should know the following:

Corporate Business Cards

Most corporate business cards do not require a personal guarantee, so that you can apply only with your EIN. It is important to note that not all corporate business cards are in this category.

A corporate business card is usually issued directly to the company and not to an individual. Employees with access to company credit cards are fully liable for all purchases they make.

Secured Business Cards

If the business needs a credit history, card issuers often require applicants to provide their social security number. Because prepaid business cards don’t involve losses, lenders don’t need to check your credit history.

There are several types of secured business credit cards, including prepaid business cards. If your business can qualify for one, business cards are useful for building credit, but most businesses prefer unsecured credit cards.

Gas Credit Cards

The benefits of gas credit cards are similar to those of corporate store cards, such as discounts at the pump and money back on travel expenses. The corporate gas card has become a popular alternative to gas reimbursement programs at many companies.

The corporate gas credit cards work only at gas stations within a network, just like the corporate store cards. Put a corporate credit card for gas on your company’s account if gas represents a significant expense for your business.

Store Cards

The corporate store card is a credit card that can only be used in one store. However, if you buy most of your business supplies from a single vendor, they may make sense. An added benefit of corporate store cards is that no personal liability is attached.

There are many corporate store cards available that can benefit your business, but these rewards can only be redeemed at the store that issued the card.

Top 5 Startup Business Credit Cards with EIN Only

The business credit card is one of the EIN-only card options, but you have to be corporate in order to obtain one, and you cannot be a sole proprietor or small business owner. The following startup business credit cards with EIN only options will help you determine if you qualify for a startup business credit card with just an EIN.

Here are the list of Top 5 Startup Business Credit Cards with EIN Only –

Bank of America Business Advantage Customized Cash Rewards Credit Card

This is one of the best option for Startup Business Credit Cards with EIN Only as various categories are included in this credit card’s 3%, 2%, and 1% cashback. Additionally, this credit card offers a 300-dollar welcome bonus if you spend 3,000 dollars within your first 90 days. If you qualify for Bank of America’s highest Preferred Rewards for Business tier, you can earn up to 75% more cashback using this card. The card does not have an annual fee, and you will get a 0% introductory annual percentage rate for the first nine billing cycles.

Rates & Fee of Bank of America Business Advantage Customized Cash Rewards Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 16.49% - 27.49% variable |

| Introductory APR | 0% for the first 7 billing cycles on purchases |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 29.49% variable |

| Foreign transaction fee | 3% |

Ink Business Unlimited Credit Card

Ink Business Unlimited Credit Card from Chase are among a few bona fide business cards you can obtain with an EIN instead of a SSN. There is no better business credit card than the Ink Business Unlimited Credit Card, especially for those looking for a flat, unlimited rewards rate that works no matter where they make their purchases. The card comes with a good signup bonus, 0% intro APR promotion, and no annual fee. You can redeem your points in several ways, including cash, statement credits, and gift cards.

Rates & Fee of Ink Business Unlimited Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 18.49% - 24.49% variable |

| Introductory APR | 0% for 12 months on purchases |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 5% of the amount of the cash advance plus $10 |

| Foreign transaction fee | 3% |

Business Platinum Card from American Express

If you use this card within the first three months, you will earn 1,50,000 membership rewards points. With this card, you can earn 5× or 1.5× points on various purchases, and some purchases will also earn 1× points.

If your credit score is good, you can expect an APY between 17.24% and 25.24%. There is an annual fee of 695 dollars for the card. There are no foreign transaction fees associated with the card, which comes with a 200-dollar airline fee credit. This card also offers Dell Technologies, Indeed, Global Entry, and TSA Precheck benefits.

Rates & Fee of Business Platinum Card from American Express

| Fee | Amount |

|---|---|

| Annual fee | $695 |

| APR | 17.49% - 24.49% variable |

| Introductory APR | 0% for the first 12 months on purchases and balance transfers |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 5% of the amount of the cash advance, plus $25 |

| Foreign transaction fee | 3% |

Ink Preferred Credit Card

You will receive 100k points after spending 15,000 dollars within your first three months of using this card. If you are an Ultimate Chase rewards member, you can convert these points into 1,000 dollars in cash back or 1,250 dollars in travel rewards.

Since the rewards portal offers 25% more value, and the points do not expire while the account is open, you have more reasons to use the reward program. The card has a $95 annual fee, and it comes with an APY of 18.24% to 23.24%.

Rates & fees Ink Business Preferred Credit Card

| Fee | Amount |

|---|---|

| Annual fee | $95 |

| APR | 21.24% - 26.24% variable |

| Introductory APR | N/A |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 5% of the amount of the cash advance plus $10 |

| Foreign transaction fee | 3% |

Shell Small Business Card

Startup business credit cards with EIN only are available to small business owners, and one of them looks like this one. The card offers a 5-cent rebate every time you fill up, plus a discount when you use it at participating Jiffy Lube locations. There is no fee associated with the card, nor does it ask for your social security number. If you want to apply for this card, you must have a credit score between 580 and 739.

Rates & fees Shell Small Business Card

| Fee | Amount |

|---|---|

| Annual fee | $0 |

| APR | 15.99% - 24.99% variable |

| Introductory APR | 0% for the first 9 billing cycles on purchases |

| Balance transfer fee | 3% of the balance transferred |

| Cash advance fee | 2.75% of the amount advanced |

| Foreign transaction fee | None |

Requirements For Startup Business Credit Cards With EIN Only Options

Businesses need to meet a few basic requirements to qualify for a startup business credit cards with EIN only:

The issuer’s discretion will determine whether a business is approved for a credit card even if it meets these requirements.

How to Apply for Startup Business Credit Cards with EIN Only?

Here’s how you can apply for Startup Business Credit Cards with EIN Only.

Apply for your EIN

Your business must have an EIN before you can apply for a business credit card. If you don’t have an EIN, you can request one from the IRS using this online form if you still need to receive one when registering your business with the state.

Find Business credit cards with EIN only

You will need your EIN in order to apply for credit cards from issuers who will accept it. Business entities such as limited-liability corporations (LLCs), partnerships, and corporations must be registered according to local laws. To apply for a startup business credit card, follow the same steps as a personal credit card. Fill out the section requesting an EIN instead of the box asking for your SSN.

Apply for a business card with EIN Only

Additionally, you would need to provide additional information about your business, including its name and structure, contact information, the size of the business, its current and projected revenues, and the date on which the business was launched. You will hear from the card issuer once the application has been reviewed and verified. Depending on the card issuer, some verification processes will be completed instantly, while others might take a little longer.

Benefits Of Startup Business Credit cards With EIN Only

Here are a few benefits of Startup Business Credit cards With EIN Only:

- Boost your business credit and earn rewards and benefits with this card

- If your business cannot pay, you won’t be held liable.

- A business credit card won’t be affected by your credit score.

- Separating your personal and business finances is easier.

- There is no need for a Social Security Number to apply for a business credit card. Those who are not US citizens are particularly affected by this.

FAQs

Can you get startup business credit cards with EIN Only?

There are business credit cards that accept only an EIN, but the options are fewer than those that require a Social Security number. You may have to meet more stringent requirements related to your business assets or sales to qualify for startup business credit card with EIN only.

Can I build my startup business credit score with EIN only?

A credit card company uses your EIN to verify your business’s operations. A business EIN allows you to apply for business credit cards, but you need help to develop your business credit. your credit score will grow when you keep your credit utilization low and pay your bills on time, .

Can I get a business credit card with no business income?

Yes. You may be eligible for a business credit card even if you do not have any business income. It is necessary, however, for you to earn revenue in some other way.

Add Comment